Investing in the stock market can be a complex and nuanced process, especially when it comes to understanding the various forms and documents that are involved. One such document that can be particularly confusing is the ProShares K-1 form. If you're an investor who has received a K-1 form from ProShares, you may be wondering what it is, why you need it, and what you're supposed to do with it. In this article, we'll break down five key things you need to know about ProShares K-1 forms.

What is a ProShares K-1 Form?

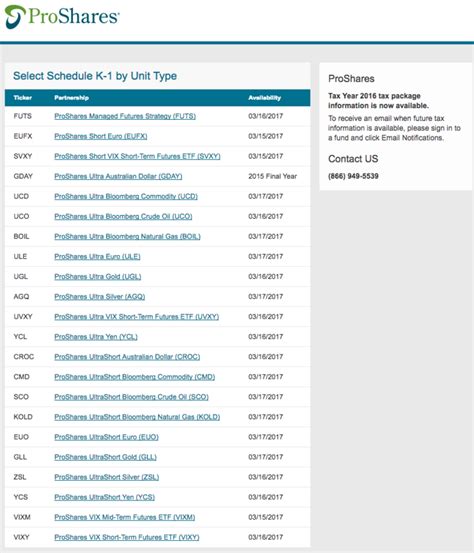

A ProShares K-1 form is a tax document that is issued by ProShares, a leading provider of exchange-traded funds (ETFs) and other investment products. The K-1 form is used to report the tax information for investors who have invested in certain ProShares funds, such as the ProShares Ultra S&P 500 or the ProShares Short S&P 500. The form is typically issued in March or April of each year, and it provides investors with the information they need to complete their tax returns.

Why Do I Need a K-1 Form?

You need a K-1 form because it provides you with the information you need to report your investment income and expenses on your tax return. The form will show you the amount of income you earned from your investment, as well as any deductions or credits you may be eligible for. Without the K-1 form, you won't be able to accurately complete your tax return, and you may be subject to penalties and fines.

How Do I Complete My Tax Return with a K-1 Form?

Completing your tax return with a K-1 form can be a bit complex, but it's essential to get it right. Here are the steps you need to follow:

- Review the K-1 form carefully and make sure you understand the information it provides.

- Use the information on the K-1 form to complete Schedule K-1 (Form 1065) and attach it to your tax return.

- Report the income and deductions shown on the K-1 form on your tax return, using the correct schedules and forms.

- Claim any credits or deductions you're eligible for, using the information on the K-1 form.

Common Mistakes to Avoid with K-1 Forms

There are several common mistakes that investors make when dealing with K-1 forms. Here are a few things to watch out for:

- Failing to report income or deductions: Make sure you accurately report all the income and deductions shown on the K-1 form.

- Missing deadlines: Make sure you file your tax return on time, and that you attach the K-1 form to your return.

- Not claiming credits or deductions: Make sure you claim any credits or deductions you're eligible for, using the information on the K-1 form.

What Happens if I Don't Receive a K-1 Form?

If you don't receive a K-1 form, you should contact ProShares directly to request one. You can do this by calling their customer service number or by emailing them through their website. Make sure you have your account information and tax identification number handy, as you'll need this to request a replacement K-1 form.

Conclusion

Receiving a ProShares K-1 form can be confusing, especially if you're not familiar with tax documents. However, by understanding what the form is, why you need it, and how to complete your tax return with it, you can avoid common mistakes and ensure you're in compliance with tax laws. Remember to review the form carefully, report all income and deductions accurately, and claim any credits or deductions you're eligible for.

Frequently Asked Questions

What is the deadline for filing my tax return with a K-1 form?

+The deadline for filing your tax return with a K-1 form is typically April 15th of each year. However, you may need to file an extension if you don't receive your K-1 form on time.

Can I file my tax return electronically with a K-1 form?

+What happens if I make a mistake on my tax return with a K-1 form?

+If you make a mistake on your tax return with a K-1 form, you may be subject to penalties and fines. You should correct the mistake as soon as possible and file an amended return.