Filing taxes can be a daunting task, especially for those who are new to the process. One of the most important forms you'll need to complete is the POS-030 form, which is used to report income and claim deductions. In this article, we'll break down the process of completing the POS-030 form into 5 easy steps.

What is the POS-030 Form?

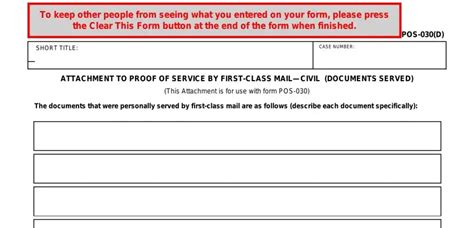

Before we dive into the steps, let's quickly discuss what the POS-030 form is. The POS-030 form is a tax form used to report income and claim deductions. It's typically used by individuals who are self-employed or have income that isn't reported on a W-2 form. The form is used to calculate your tax liability and determine how much you owe in taxes.

Step 1: Gather Required Documents

Before you start filling out the POS-030 form, you'll need to gather some required documents. These include:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your business records, including income statements and expense reports

- Your W-2 forms, if applicable

- Your 1099 forms, if applicable

- Your business license or registration documents

Step 2: Determine Your Filing Status

Your filing status will determine which tax rates and deductions you're eligible for. Your filing status can be single, married filing jointly, married filing separately, head of household, or qualifying widow(er). You'll need to choose the correct filing status on the POS-030 form.

Filing Status Options:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Step 3: Report Your Income

On the POS-030 form, you'll need to report all of your income, including:

- Business income

- W-2 income

- 1099 income

- Interest and dividend income

- Capital gains and losses

You'll need to calculate your total income and report it on the form.

Types of Income:

- Business income

- W-2 income

- 1099 income

- Interest and dividend income

- Capital gains and losses

Step 4: Claim Deductions and Credits

On the POS-030 form, you'll also need to claim any deductions and credits you're eligible for. This can include:

- Business expenses

- Charitable donations

- Mortgage interest and property taxes

- Education credits

You'll need to calculate the total amount of your deductions and credits and report it on the form.

Types of Deductions and Credits:

- Business expenses

- Charitable donations

- Mortgage interest and property taxes

- Education credits

Step 5: Sign and Date the Form

Finally, you'll need to sign and date the POS-030 form. Make sure to review the form carefully to ensure all of the information is accurate and complete.

Signing and Dating the Form:

- Sign your name in the designated area

- Date the form with the current date

Conclusion

Completing the POS-030 form can seem like a daunting task, but by following these 5 easy steps, you'll be able to report your income and claim deductions with confidence. Remember to gather all of the required documents, determine your filing status, report your income, claim deductions and credits, and sign and date the form. If you're still unsure, consider consulting a tax professional or using tax software to help guide you through the process.

What is the POS-030 form used for?

+The POS-030 form is used to report income and claim deductions.

What documents do I need to complete the POS-030 form?

+You'll need to gather your Social Security number or ITIN, business records, W-2 forms, 1099 forms, and business license or registration documents.

How do I determine my filing status?

+Your filing status can be single, married filing jointly, married filing separately, head of household, or qualifying widow(er). You'll need to choose the correct filing status on the POS-030 form.