The Form 8863 Credit Limit Worksheet is a crucial component of the Education Credits claimed on tax returns. It's essential for taxpayers to accurately complete this worksheet to ensure they receive the maximum credit allowed. Mastering the Form 8863 Credit Limit Worksheet requires a clear understanding of the calculations involved and the qualifying criteria for education credits.

Understanding the Purpose of Form 8863

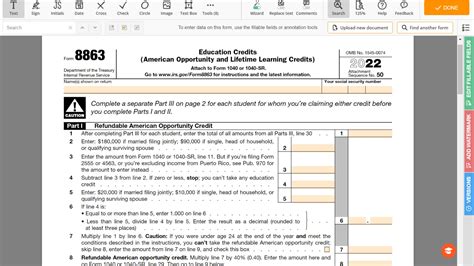

The Form 8863 Credit Limit Worksheet is used to calculate the credit limit for the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). These credits are designed to help offset the costs of higher education expenses, such as tuition and fees, for eligible students. The AOTC is a refundable credit, while the LLC is a non-refundable credit.

Breaking Down the Form 8863 Credit Limit Worksheet

To master the Form 8863 Credit Limit Worksheet, taxpayers need to understand the different components of the form. The worksheet consists of several sections, including:

- Part I: Student's Qualified Education Expenses

- Part II: Student's Scholarships, Grants, and Tax-Free Education Benefits

- Part III: Student's Adjusted Qualified Education Expenses

- Part IV: Credit Limit

Each section requires taxpayers to input specific information, such as the student's qualified education expenses, scholarships, and grants received. The taxpayer must also calculate the adjusted qualified education expenses and credit limit.

Tips for Mastering the Form 8863 Credit Limit Worksheet

Here are five tips for mastering the Form 8863 Credit Limit Worksheet:

- Gather all necessary documents: Before starting the worksheet, gather all necessary documents, such as Form 1098-T (Tuition Statement) and receipts for qualified education expenses. This will ensure accuracy and efficiency when completing the form.

- Understand qualified education expenses: It's essential to understand what constitutes qualified education expenses, which include tuition and fees required for the student's enrollment or attendance at an eligible educational institution.

- Calculate scholarships and grants correctly: Taxpayers must accurately calculate scholarships and grants received by the student. This includes tax-free education benefits, such as the Pell Grant.

- Use the correct credit limit: The credit limit is based on the student's adjusted qualified education expenses. Taxpayers must use the correct credit limit to avoid errors.

- Double-check calculations: Finally, taxpayers should double-check their calculations to ensure accuracy. This will prevent errors and ensure the maximum credit is claimed.

Some common challenges taxpayers face when completing the Form 8863 Credit Limit Worksheet include:

- Calculating adjusted qualified education expenses: Taxpayers often struggle with calculating the adjusted qualified education expenses, which requires subtracting scholarships and grants from the total qualified education expenses.

- Determining credit limit: The credit limit calculation can be complex, especially when dealing with multiple students or education institutions.

- Missing required documents: Taxpayers may forget to gather all necessary documents, leading to errors or delays in processing the tax return.

Best Practices for Avoiding Errors

To avoid errors when completing the Form 8863 Credit Limit Worksheet, taxpayers should:

- Read instructions carefully: Take the time to read the instructions carefully and understand the calculations involved.

- Use tax preparation software: Consider using tax preparation software, such as TurboTax or H&R Block, to help with calculations and ensure accuracy.

- Seek professional help: If unsure about any aspect of the form, consider seeking help from a tax professional.

CONCLUSION

Mastering the Form 8863 Credit Limit Worksheet requires a clear understanding of the calculations involved and the qualifying criteria for education credits. By following the tips outlined above and avoiding common challenges, taxpayers can ensure accuracy and claim the maximum credit allowed. Remember to stay organized, read instructions carefully, and seek professional help when needed.

What is the purpose of the Form 8863 Credit Limit Worksheet?

+The Form 8863 Credit Limit Worksheet is used to calculate the credit limit for the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC).

What are qualified education expenses?

+Qualified education expenses include tuition and fees required for the student's enrollment or attendance at an eligible educational institution.

How do I calculate the credit limit?

+The credit limit is based on the student's adjusted qualified education expenses. Taxpayers must use the correct credit limit to avoid errors.