Understanding the Importance of IRS Form 8915-F

Completing IRS Form 8915-F is a crucial step for individuals who qualify for the Employee Retention Credit (ERC) due to the COVID-19 pandemic. This form is used to calculate the credit, which can provide significant financial relief to eligible employers. However, filling out the form can be daunting, especially for those who are not familiar with tax laws and regulations.

In this article, we will provide a comprehensive guide on how to complete IRS Form 8915-F, highlighting five essential steps to help you navigate the process. Whether you're a business owner, accountant, or tax professional, this guide will equip you with the knowledge and confidence to accurately complete the form and claim the ERC.

What is IRS Form 8915-F?

Before we dive into the completion process, it's essential to understand what IRS Form 8915-F is and its purpose. The form is used to calculate the Employee Retention Credit (ERC), which is a refundable tax credit designed to encourage businesses to keep employees on their payroll during the COVID-19 pandemic. The credit is available to eligible employers who experienced a significant decline in gross receipts or were forced to suspend operations due to government orders related to the pandemic.

Step 1: Determine Eligibility

The first step in completing IRS Form 8915-F is to determine if you are eligible for the Employee Retention Credit. To qualify, you must meet one of the following conditions:

- Your business experienced a significant decline in gross receipts during a calendar quarter compared to the same quarter in the previous year.

- Your business was forced to suspend operations due to a government order related to the COVID-19 pandemic.

You can use the IRS's eligibility tool to determine if you qualify for the credit.

Gross Receipts Test

To qualify under the gross receipts test, you must demonstrate a significant decline in gross receipts during a calendar quarter compared to the same quarter in the previous year. The decline must be at least 50% for 2020 and 20% for 2021.

Government Orders Test

To qualify under the government orders test, you must demonstrate that your business was forced to suspend operations due to a government order related to the COVID-19 pandemic. This includes orders to limit commerce, travel, or group meetings.

Step 2: Gather Required Documents

Once you've determined your eligibility, the next step is to gather the required documents to complete IRS Form 8915-F. These documents include:

- Form 941, Employer's Quarterly Federal Tax Return, for the quarters you're claiming the credit

- Form W-2, Wage and Tax Statement, for the employees included in the calculation

- Form 1099-MISC, Miscellaneous Income, for any independent contractors included in the calculation

- Records of gross receipts and qualified wages

Step 3: Calculate Qualified Wages

Qualified wages are the wages paid to employees during the eligible period. To calculate qualified wages, you'll need to determine the wages paid to each employee during the eligible period. You can use the following steps:

- Identify the eligible period, which is the quarter(s) you're claiming the credit

- Determine the wages paid to each employee during the eligible period

- Calculate the qualified wages by multiplying the wages paid to each employee by the credit percentage (50% for 2020 and 70% for 2021)

Step 4: Calculate the Credit

Once you've calculated the qualified wages, the next step is to calculate the credit. The credit is calculated by multiplying the qualified wages by the credit percentage (50% for 2020 and 70% for 2021).

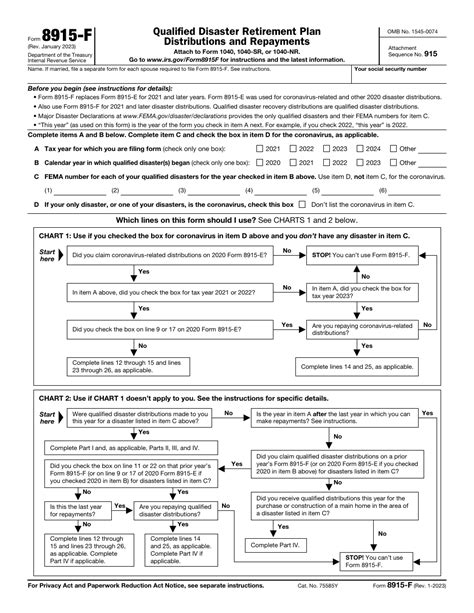

Step 5: Complete IRS Form 8915-F

The final step is to complete IRS Form 8915-F. You'll need to provide the following information:

- Business name and address

- Employer Identification Number (EIN)

- Eligible period(s)

- Qualified wages

- Credit calculation

- Signature and date

Make sure to review the form carefully and ensure you've completed all the necessary fields.

Conclusion and Next Steps

Completing IRS Form 8915-F can be a complex process, but by following these five essential steps, you'll be able to accurately calculate the Employee Retention Credit and claim the credit. If you're still unsure about the process, consider consulting with a tax professional or accountant to ensure you're taking advantage of this valuable credit.

What is the Employee Retention Credit (ERC)?

+The Employee Retention Credit (ERC) is a refundable tax credit designed to encourage businesses to keep employees on their payroll during the COVID-19 pandemic.

Who is eligible for the ERC?

+Eligible employers are those who experienced a significant decline in gross receipts or were forced to suspend operations due to government orders related to the COVID-19 pandemic.

What is the credit percentage for the ERC?

+The credit percentage is 50% for 2020 and 70% for 2021.