Employers in the United States are required to file a quarterly tax return with the Internal Revenue Service (IRS) to report their employment taxes. This is done by completing and submitting Form 941, also known as the Employer's Quarterly Federal Tax Return. Filing Form 941 can be a daunting task, but with the right guidance, it can be done with ease. In this article, we will explore five ways to complete Form 941 with ease.

Understanding the Purpose of Form 941

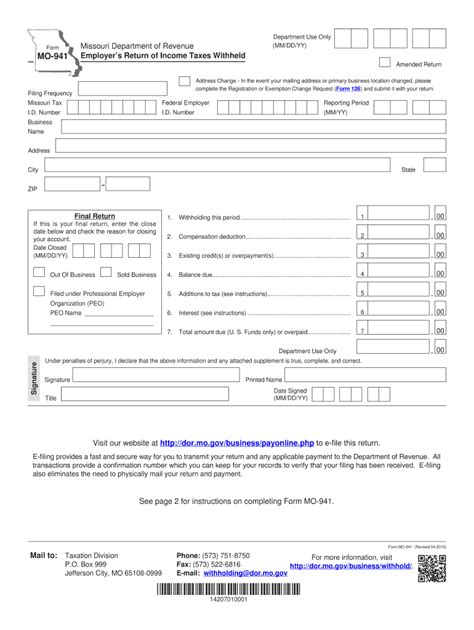

Form 941 is used to report employment taxes, including income taxes withheld from employees, Social Security taxes, and Medicare taxes. Employers must file Form 941 on a quarterly basis, and the due dates are as follows:

- April 30th for the first quarter (January 1 - March 31)

- July 31st for the second quarter (April 1 - June 30)

- October 31st for the third quarter (July 1 - September 30)

- January 31st for the fourth quarter (October 1 - December 31)

Important Information to Report on Form 941

Before we dive into the five ways to complete Form 941 with ease, it's essential to understand what information is required to be reported on the form. This includes:

- The employer's identification number (EIN)

- The quarter and year being reported

- The total amount of wages paid to employees

- The amount of income taxes withheld from employees

- The amount of Social Security taxes withheld from employees

- The amount of Medicare taxes withheld from employees

- The total amount of employment taxes owed

Method 1: E-File Form 941

One of the easiest ways to complete Form 941 is to e-file it through the IRS website. The IRS offers an electronic filing option for Form 941, which can be accessed through their website. To e-file Form 941, you will need to:

- Create an account on the IRS website

- Fill out the required information, including the employer's EIN, quarter and year being reported, and employment tax information

- Submit the form electronically

E-filing Form 941 is a convenient and efficient way to file your quarterly tax return. It also reduces the risk of errors and ensures that your form is received by the IRS in a timely manner.

Benefits of E-Filing Form 941

E-filing Form 941 offers several benefits, including:

- Convenience: E-filing allows you to file your quarterly tax return from the comfort of your own home or office.

- Efficiency: E-filing reduces the risk of errors and ensures that your form is received by the IRS in a timely manner.

- Speed: E-filing allows you to receive a confirmation of receipt from the IRS immediately.

Method 2: Use Tax Preparation Software

Another way to complete Form 941 with ease is to use tax preparation software. There are several tax preparation software programs available, including QuickBooks, TurboTax, and H&R Block. These programs can guide you through the process of completing Form 941 and ensure that you are reporting the correct information.

To use tax preparation software to complete Form 941, you will need to:

- Purchase and download the software

- Enter the required information, including the employer's EIN, quarter and year being reported, and employment tax information

- Follow the software's instructions to complete the form

- Print or e-file the form

Benefits of Using Tax Preparation Software

Using tax preparation software to complete Form 941 offers several benefits, including:

- Accuracy: Tax preparation software can ensure that you are reporting the correct information and reduce the risk of errors.

- Efficiency: Tax preparation software can guide you through the process of completing Form 941 quickly and efficiently.

- Convenience: Tax preparation software allows you to complete Form 941 from the comfort of your own home or office.

Method 3: Hire a Tax Professional

If you are not comfortable completing Form 941 on your own, you can hire a tax professional to do it for you. Tax professionals, such as accountants and bookkeepers, have the expertise and knowledge to ensure that your Form 941 is completed accurately and efficiently.

To hire a tax professional to complete Form 941, you will need to:

- Research and find a reputable tax professional in your area

- Provide the tax professional with the required information, including the employer's EIN, quarter and year being reported, and employment tax information

- Allow the tax professional to complete the form and submit it to the IRS on your behalf

Benefits of Hiring a Tax Professional

Hiring a tax professional to complete Form 941 offers several benefits, including:

- Accuracy: Tax professionals have the expertise and knowledge to ensure that your Form 941 is completed accurately.

- Efficiency: Tax professionals can complete Form 941 quickly and efficiently.

- Convenience: Hiring a tax professional allows you to focus on other aspects of your business while the tax professional handles your quarterly tax return.

Method 4: Use the IRS Website to File Form 941

The IRS website offers a range of resources and tools to help employers complete and file Form 941. You can use the IRS website to file Form 941 electronically or to print out a paper copy of the form.

To use the IRS website to file Form 941, you will need to:

- Visit the IRS website and navigate to the Form 941 page

- Follow the instructions to complete the form electronically or print out a paper copy

- Submit the form electronically or mail it to the IRS

Benefits of Using the IRS Website to File Form 941

Using the IRS website to file Form 941 offers several benefits, including:

- Convenience: The IRS website is available 24/7, allowing you to file Form 941 at a time that is convenient for you.

- Efficiency: The IRS website can guide you through the process of completing Form 941 quickly and efficiently.

- Accuracy: The IRS website can help ensure that your Form 941 is completed accurately.

Method 5: Use a Payroll Service Provider

Finally, you can use a payroll service provider to complete and file Form 941 on your behalf. Payroll service providers, such as ADP and Paychex, offer a range of services, including payroll processing, tax compliance, and benefits administration.

To use a payroll service provider to complete Form 941, you will need to:

- Research and find a reputable payroll service provider

- Provide the payroll service provider with the required information, including the employer's EIN, quarter and year being reported, and employment tax information

- Allow the payroll service provider to complete the form and submit it to the IRS on your behalf

Benefits of Using a Payroll Service Provider

Using a payroll service provider to complete Form 941 offers several benefits, including:

- Accuracy: Payroll service providers have the expertise and knowledge to ensure that your Form 941 is completed accurately.

- Efficiency: Payroll service providers can complete Form 941 quickly and efficiently.

- Convenience: Using a payroll service provider allows you to focus on other aspects of your business while the payroll service provider handles your quarterly tax return.

In conclusion, completing Form 941 can be a daunting task, but with the right guidance, it can be done with ease. By using one of the five methods outlined above, you can ensure that your quarterly tax return is completed accurately and efficiently. Remember to always double-check your information and follow the instructions carefully to avoid errors.

We hope this article has been helpful in guiding you through the process of completing Form 941. If you have any further questions or concerns, please don't hesitate to reach out to us.