As a business owner in California, it's essential to stay on top of your company's annual reporting requirements to maintain compliance with the state's regulations. The California Secretary of State requires all corporations to file an annual report, also known as a Statement of Information, to update the state's records on your company's current information. In this article, we'll guide you through the 5 easy steps to complete California corporations' annual report.

Why is the Annual Report Important?

The annual report is a critical filing that helps the state keep track of your company's current information, such as its name, address, and management structure. Failure to file the report can result in penalties, fines, and even suspension or dissolution of your corporation. Moreover, the annual report is a public record, and it's often used by banks, creditors, and other businesses to verify the status of your company.

Step 1: Determine Your Filing Deadline

The filing deadline for California corporations' annual report is typically within 6 months of the close of your corporation's fiscal year. For example, if your fiscal year ends on December 31st, your annual report is due by June 30th of the following year. You can check the California Secretary of State's website to determine your specific filing deadline.

Step 2: Gather Required Information

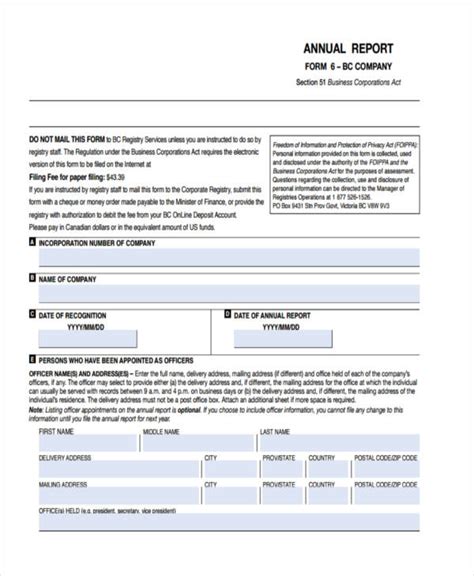

To complete the annual report, you'll need to gather the following information:

- Your corporation's name and address

- The names and addresses of your corporation's officers and directors

- The name and address of your corporation's agent for service of process

- A brief description of your corporation's business activities

- Your corporation's fiscal year-end date

Step 3: Choose Your Filing Method

You can file your annual report online or by mail. The California Secretary of State's website offers an online filing system that's convenient and easy to use. Alternatively, you can download the Statement of Information form from the Secretary of State's website and mail it to the address listed on the form.

Step 4: Complete and File the Report

Once you've gathered all the required information and chosen your filing method, you can complete and file the report. Make sure to review the report carefully for accuracy and completeness before submitting it. If you're filing online, you'll need to pay the filing fee by credit card or electronic check. If you're filing by mail, you'll need to include a check payable to the California Secretary of State.

Step 5: Verify Your Filing Status

After you've filed your annual report, you can verify your filing status by searching the California Secretary of State's database. You can search by your corporation's name or filing number to confirm that your report has been processed and accepted.

By following these 5 easy steps, you can complete your California corporation's annual report and maintain compliance with the state's regulations. Remember to file your report on time to avoid penalties and fines.

What is the penalty for not filing the annual report in California?

+The penalty for not filing the annual report in California can range from $250 to $1,000, depending on the circumstances. Additionally, the corporation may be suspended or dissolved for failure to file the report.

Can I file my annual report electronically in California?

+Yes, you can file your annual report electronically in California through the Secretary of State's online filing system.

How often do I need to file the annual report in California?

+You need to file the annual report every year, typically within 6 months of the close of your corporation's fiscal year.

We hope this article has provided you with a comprehensive guide to completing your California corporation's annual report. If you have any further questions or need assistance with the filing process, please don't hesitate to reach out to us.