As the tax season approaches, individuals and businesses are required to file their income tax returns with the Internal Revenue Service (IRS). One of the most common tax forms used for this purpose is the Form IT-201, also known as the Resident Income Tax Return. In this article, we will provide a step-by-step guide on how to file Form IT-201, highlighting the necessary information, deductions, and credits that you need to know.

Understanding Form IT-201

Form IT-201 is a tax form used by New York State residents to report their income and pay any taxes owed to the state. The form is used to calculate the taxpayer's total income, deductions, and credits, and to determine the amount of tax owed. It is essential to accurately complete Form IT-201 to avoid any penalties or delays in processing your tax return.

Who Needs to File Form IT-201?

You need to file Form IT-201 if you are a New York State resident and you meet any of the following conditions:

- You have a gross income of $8,500 or more ($17,000 or more if married filing jointly)

- You have a dependent care credit

- You have a household credit

- You have a mortgage interest or real estate tax credit

- You have a credit for other state or local taxes withheld

Step 1: Gather Required Documents

Before starting to file Form IT-201, make sure you have the following documents:

- Your social security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's social security number or ITIN (if married filing jointly)

- Your dependents' social security numbers or ITINs (if applicable)

- W-2 forms from your employer(s)

- 1099 forms for freelance work or self-employment income

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Capital gains and losses statements (1099-B)

- Charitable donation receipts

- Medical expense receipts

- Mortgage interest and real estate tax statements

Step 2: Complete Form IT-201

Form IT-201 consists of several sections, including:

- Section 1: Income

- Section 2: Deductions

- Section 3: Credits

- Section 4: Tax Calculation

Start by completing Section 1, where you report your income from various sources, such as W-2 forms, 1099 forms, and interest statements. Make sure to report all income earned during the tax year.

Next, complete Section 2, where you claim deductions for expenses such as charitable donations, medical expenses, and mortgage interest. You can also claim a standard deduction, which is a fixed amount that you can deduct from your income without needing to itemize.

Step 3: Claim Credits

In Section 3, you can claim credits for various expenses, such as:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Dependent Care Credit

- Household Credit

- Mortgage Interest and Real Estate Tax Credit

Credits can significantly reduce your tax liability, so make sure to review the instructions carefully and claim all eligible credits.

Step 4: Calculate Your Tax Liability

In Section 4, you will calculate your tax liability based on your income, deductions, and credits. You can use the tax tables provided in the instructions or use tax software to calculate your tax liability.

Step 5: File Your Tax Return

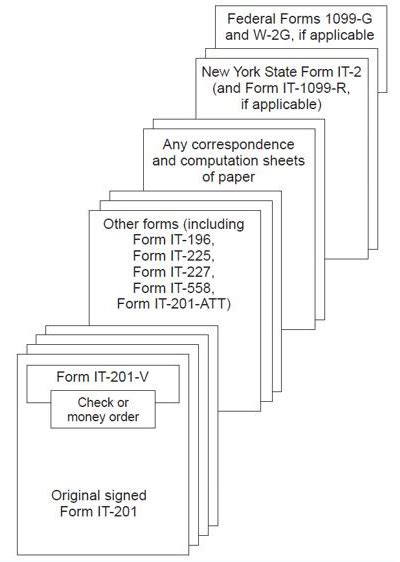

Once you have completed Form IT-201, you can file your tax return electronically or by mail. If you file electronically, you will need to create an account with the New York State Tax Department and submit your return through their website. If you file by mail, make sure to sign and date your return and include all required documentation.

What Happens After Filing?

After filing your tax return, you can expect the following:

- If you owe taxes, you will need to pay the amount due by the tax deadline to avoid penalties and interest.

- If you are due a refund, you can expect to receive it within 6-8 weeks after filing.

- If you have any errors or discrepancies on your return, you may receive a notice from the New York State Tax Department requesting additional information or corrections.

Common Mistakes to Avoid

When filing Form IT-201, avoid the following common mistakes:

- Failure to report all income

- Inaccurate or incomplete documentation

- Failure to claim eligible credits

- Failure to sign and date the return

- Failure to file on time

Conclusion

Filing Form IT-201 can be a complex and time-consuming process, but by following the steps outlined in this guide, you can ensure that you accurately complete your tax return and avoid any penalties or delays. Remember to gather all required documents, complete the form carefully, claim all eligible credits, and file on time. If you have any questions or concerns, you can contact the New York State Tax Department for assistance.

What is Form IT-201?

+Form IT-201 is a tax form used by New York State residents to report their income and pay any taxes owed to the state.

Who needs to file Form IT-201?

+You need to file Form IT-201 if you are a New York State resident and you meet certain conditions, such as having a gross income of $8,500 or more.

What is the deadline for filing Form IT-201?

+The deadline for filing Form IT-201 is typically April 15th of each year.