Filling out a direct deposit form is a straightforward process that can help you receive payments, such as your salary or benefits, quickly and securely. By providing your banking information, you can ensure that funds are deposited directly into your account, eliminating the need for paper checks and reducing the risk of lost or stolen payments. Here are six ways to fill wisely a direct deposit form:

Understanding the Direct Deposit Form

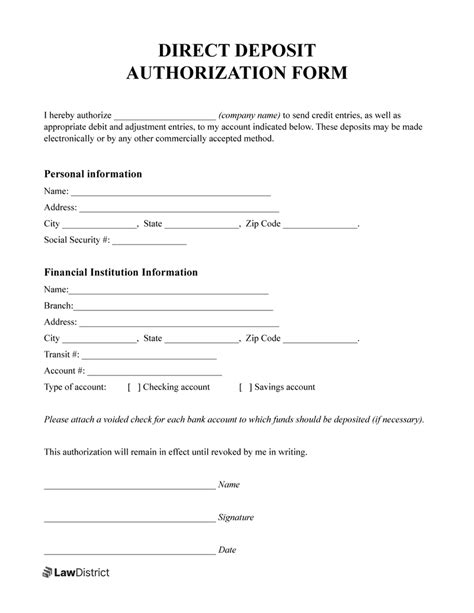

Before filling out the direct deposit form, take a moment to review the document and understand what information is required. Typically, the form will ask for your:

- Name and address

- Bank account number

- Bank routing number

- Type of account (checking or savings)

Gathering Required Information

To fill out the form accurately, you'll need to gather the required information from your bank account documents. Make sure you have:

- Your bank account number: This can be found on your checks, bank statements, or online banking profile.

- Your bank routing number: This is a 9-digit number that identifies your bank and is usually found on the bottom left corner of your checks or on your bank's website.

Filling Out the Form Accurately

When filling out the form, make sure to:

- Use a black or blue pen to ensure your writing is legible.

- Print clearly and avoid using abbreviations or nicknames.

- Double-check your bank account and routing numbers for accuracy.

- Sign the form in the presence of a notary public, if required.

Verifying Account Information

Before submitting the form, verify that your account information is correct. You can do this by:

- Calling your bank to confirm your account number and routing number.

- Checking your online banking profile to ensure the information matches.

- Reviewing your bank statements to verify the accuracy of your account information.

Submitting the Form Securely

Once you've completed the form, submit it securely to the designated recipient. You can:

- Hand-deliver the form to the person or department requesting it.

- Mail the form via certified mail or with a tracking number.

- Submit the form electronically, if an online option is available.

Confirming Receipt of the Form

After submitting the form, confirm that it has been received by the recipient. You can:

- Call or email the recipient to confirm receipt.

- Ask for a confirmation number or receipt.

- Follow up with the recipient if you don't receive a response.

Updating Account Information

If your account information changes, update the direct deposit form promptly. You can:

- Notify the recipient of the changes and request a new form.

- Complete a new form with the updated information.

- Submit the updated form securely to the recipient.

Benefits of Direct Deposit

By filling out the direct deposit form wisely, you can enjoy the benefits of:

- Faster payment processing

- Reduced risk of lost or stolen payments

- Convenience and flexibility

- Improved financial security

By following these six ways to fill wisely a direct deposit form, you can ensure that your payments are processed quickly and securely. Remember to gather the required information, fill out the form accurately, and submit it securely to enjoy the benefits of direct deposit.

We'd love to hear from you! Have you ever had to fill out a direct deposit form? Share your experiences or tips in the comments below.

What is a direct deposit form?

+A direct deposit form is a document that allows you to provide your banking information to receive payments, such as your salary or benefits, directly into your account.

What information is required on a direct deposit form?

+The form typically requires your name and address, bank account number, bank routing number, and type of account (checking or savings).

How do I verify my account information?

+You can verify your account information by calling your bank, checking your online banking profile, or reviewing your bank statements.