Understanding tax forms can be a daunting task, especially for those who are new to the world of taxation. The Rut 25 tax form is one such document that can seem overwhelming at first glance. However, with a clear understanding of its purpose, components, and instructions, you'll be well on your way to mastering this essential tax form.

As a taxpayer, it's crucial to familiarize yourself with the Rut 25 tax form, as it plays a significant role in your tax compliance. In this article, we'll delve into the world of the Rut 25 tax form, exploring its importance, components, and instructions. By the end of this comprehensive guide, you'll have a solid grasp of this tax form and be better equipped to navigate the tax filing process.

What is the Rut 25 Tax Form?

The Rut 25 tax form is a document used by taxpayers to report their income and claim deductions and credits. It's a crucial part of the tax filing process, as it helps the government determine your tax liability. The form is typically used by individuals who have income from various sources, such as employment, self-employment, investments, and more.

Importance of the Rut 25 Tax Form

The Rut 25 tax form serves several purposes, making it an essential document for taxpayers. Some of its key importance includes:

- Income Reporting: The form allows taxpayers to report their income from various sources, ensuring that they are meeting their tax obligations.

- Deductions and Credits: Taxpayers can claim deductions and credits on the form, which can help reduce their tax liability.

- Tax Compliance: The Rut 25 tax form is a critical component of tax compliance, as it helps the government verify a taxpayer's income and tax payments.

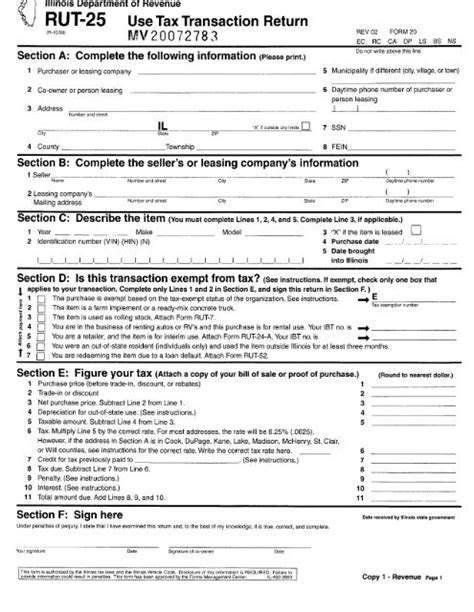

Components of the Rut 25 Tax Form

The Rut 25 tax form consists of several sections and schedules, each serving a specific purpose. Some of the key components include:

- Identification Section: This section requires taxpayers to provide their personal and contact information.

- Income Section: Taxpayers report their income from various sources, including employment, self-employment, investments, and more.

- Deductions Section: Taxpayers can claim deductions for expenses related to their income, such as business expenses, charitable donations, and more.

- Credits Section: Taxpayers can claim credits for taxes paid, education expenses, and other eligible expenses.

Instructions for Completing the Rut 25 Tax Form

Completing the Rut 25 tax form requires attention to detail and accuracy. Here are some step-by-step instructions to help you navigate the form:

- Gather Required Documents: Collect all necessary documents, including W-2 forms, 1099 forms, receipts for deductions, and more.

- Complete the Identification Section: Provide your personal and contact information, including your name, address, and Social Security number.

- Report Your Income: Complete the income section, reporting your income from various sources.

- Claim Deductions: Complete the deductions section, claiming deductions for eligible expenses.

- Claim Credits: Complete the credits section, claiming credits for taxes paid, education expenses, and other eligible expenses.

- Calculate Your Tax Liability: Use the tax tables or tax calculator to determine your tax liability.

- Sign and Date the Form: Sign and date the form, ensuring that you've completed it accurately and truthfully.

Tips for Completing the Rut 25 Tax Form

- Use Tax Software: Consider using tax software to help you complete the form accurately and efficiently.

- Seek Professional Help: If you're unsure about completing the form, consider seeking help from a tax professional.

- Double-Check Your Math: Ensure that your calculations are accurate, as errors can lead to delays or penalties.

- Keep Records: Keep records of your income, deductions, and credits, as you may need to refer to them during an audit.

Common Mistakes to Avoid

- Math Errors: Ensure that your calculations are accurate, as errors can lead to delays or penalties.

- Inaccurate Information: Ensure that you provide accurate information, as inaccuracies can lead to delays or penalties.

- Missing Documents: Ensure that you have all necessary documents, as missing documents can lead to delays or penalties.

Conclusion

The Rut 25 tax form is a critical component of the tax filing process, and understanding its purpose, components, and instructions is essential for taxpayers. By following the tips and instructions outlined in this comprehensive guide, you'll be well on your way to mastering this essential tax form. Remember to seek professional help if you're unsure about completing the form, and keep records of your income, deductions, and credits to ensure a smooth tax filing process.

We hope this article has been informative and helpful. If you have any questions or comments, please feel free to share them below. Don't forget to share this article with others who may find it useful.

What is the purpose of the Rut 25 tax form?

+The Rut 25 tax form is used by taxpayers to report their income and claim deductions and credits.

What are the components of the Rut 25 tax form?

+The Rut 25 tax form consists of several sections and schedules, including the identification section, income section, deductions section, and credits section.

How do I complete the Rut 25 tax form?

+Complete the form by gathering required documents, completing the identification section, reporting your income, claiming deductions and credits, and calculating your tax liability.