Filling out a W-4 form correctly is crucial for ensuring that the right amount of taxes is withheld from your paycheck. In Connecticut, the W-4 form is used to determine the amount of state income tax that should be withheld from your wages. Here are 5 ways to fill out the W-4 form CT correctly.

Understanding the Importance of Accurate W-4 Forms

Before we dive into the steps to fill out the W-4 form CT correctly, it's essential to understand the importance of accurate forms. An incorrect W-4 form can lead to underpayment or overpayment of taxes, resulting in penalties and fines. In addition, accurate W-4 forms help employers to withhold the correct amount of taxes, which can impact their compliance with tax laws.

Step 1: Determine Your Filing Status

The first step in filling out the W-4 form CT is to determine your filing status. Your filing status affects the amount of taxes that are withheld from your paycheck. The filing status options on the W-4 form CT include:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the filing status that applies to you. If you're unsure about your filing status, you can consult with a tax professional or refer to the IRS website.

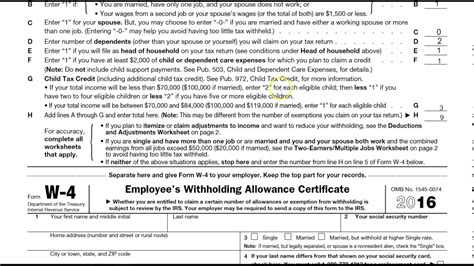

Step 2: Claim Allowances

The next step is to claim allowances on the W-4 form CT. Allowances reduce the amount of taxes withheld from your paycheck. You can claim allowances for yourself, your spouse, and your dependents. The number of allowances you claim will depend on your filing status and the number of dependents you have.

For example, if you're single and have no dependents, you may claim one allowance. If you're married filing jointly and have two dependents, you may claim three allowances.

Step 3: Report Additional Income

If you have additional income that's not subject to withholding, you'll need to report it on the W-4 form CT. This includes income from self-employment, investments, and other sources. You'll need to estimate the amount of additional income you expect to earn and report it on the form.

For example, if you're self-employed and expect to earn $50,000 in additional income, you'll need to report this amount on the W-4 form CT.

Types of Additional Income

- Self-employment income

- Investment income

- Retirement income

- Other income

Step 4: Claim Credits

The W-4 form CT allows you to claim credits for certain types of income. For example, if you're eligible for the Earned Income Tax Credit (EITC), you can claim it on the form. Other credits you may be eligible for include the Child Tax Credit and the Education Credits.

To claim credits, you'll need to complete the relevant sections on the W-4 form CT. You'll need to provide information about your income, filing status, and dependents.

Step 5: Sign and Date the Form

The final step is to sign and date the W-4 form CT. This is an important step, as it confirms that the information you've provided is accurate and complete. Make sure to sign and date the form in the presence of your employer or HR representative.

By following these steps, you can ensure that your W-4 form CT is filled out correctly. Remember to review and update your W-4 form CT regularly to ensure that your tax withholding is accurate.

What's Next?

Once you've completed the W-4 form CT, you'll need to submit it to your employer. Your employer will use the information on the form to determine the amount of state income tax to withhold from your paycheck.

If you have any questions or concerns about filling out the W-4 form CT, you can consult with a tax professional or contact the Connecticut Department of Revenue Services.

Conclusion

Filling out the W-4 form CT correctly is essential for ensuring that the right amount of taxes is withheld from your paycheck. By following the steps outlined in this article, you can ensure that your W-4 form CT is accurate and complete. Remember to review and update your W-4 form CT regularly to ensure that your tax withholding is accurate.

Final Thoughts

Filling out the W-4 form CT may seem like a daunting task, but it's a crucial step in ensuring that your taxes are accurate. By following the steps outlined in this article, you can ensure that your W-4 form CT is filled out correctly. Remember to review and update your W-4 form CT regularly to ensure that your tax withholding is accurate.

FAQ Section

What is the W-4 form CT used for?

+The W-4 form CT is used to determine the amount of state income tax that should be withheld from your wages.

How often should I review and update my W-4 form CT?

+You should review and update your W-4 form CT regularly to ensure that your tax withholding is accurate.