The world of tax compliance can be complex and overwhelming, especially for individuals and businesses dealing with international transactions. Form Eta 750b is a crucial document for those involved in the export of goods and services from the United States. In this article, we will delve into the details and requirements of Form Eta 750b, exploring its purpose, eligibility, and the steps needed to complete it accurately.

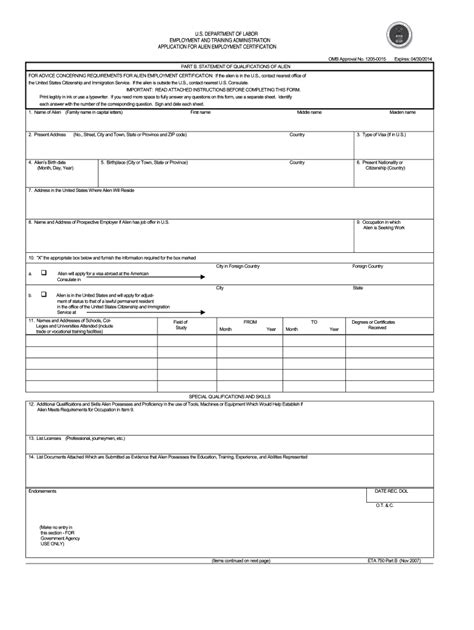

What is Form Eta 750b?

Form Eta 750b, also known as the Shipper's Export Declaration, is a mandatory document required by the U.S. Census Bureau for all exports of goods valued at $2,500 or more. The form is used to collect data on exports, which is essential for statistical analysis, export control, and tax compliance. The information provided on Form Eta 750b helps the U.S. government to track exports, monitor trade patterns, and enforce regulations.

Eligibility and Requirements

To determine if you need to file Form Eta 750b, you must consider the following factors:

- Value of the export: The total value of the goods being exported must be $2,500 or more.

- Type of goods: The export must be a tangible good, such as merchandise, commodities, or equipment.

- Destination country: The export must be destined for a foreign country.

- Mode of transportation: The export can be transported by air, land, or sea.

If your export meets these criteria, you are required to file Form Eta 750b with the U.S. Census Bureau.

Who is Responsible for Filing Form Eta 750b?

The responsibility for filing Form Eta 750b typically falls on the exporter, also known as the U.S. Principal Party in Interest (USPPI). The USPPI is usually the person or company that receives the primary benefit from the export transaction.

However, in some cases, the freight forwarder or the exporting carrier may also be responsible for filing Form Eta 750b. It is essential to understand your role in the export transaction to determine who is responsible for filing the form.

How to Complete Form Eta 750b

Completing Form Eta 750b requires careful attention to detail and accuracy. Here are the steps to follow:

- Obtain an Internal Transaction Number (ITN): Before filing Form Eta 750b, you need to obtain an ITN from the U.S. Census Bureau's Automated Export System (AES). The ITN is a unique identifier assigned to each export transaction.

- Gather required information: Collect all necessary information, including:

- Exporter's name and address

- Consignee's name and address

- Country of destination

- Description of goods

- Value of goods

- Mode of transportation

- Date of export

- Fill out Form Eta 750b: Use the AES to complete Form Eta 750b. The form has several sections, including:

- Section 1: Exporter's Information

- Section 2: Consignee's Information

- Section 3: Goods Information

- Section 4: Mode of Transportation

- Section 5: Export Information

- Submit Form Eta 750b: File Form Eta 750b with the U.S. Census Bureau through the AES.

Penalties for Non-Compliance

Failure to file Form Eta 750b or providing inaccurate information can result in penalties, fines, and even the loss of export privileges. It is essential to take the time to complete the form accurately and submit it on time.

Conclusion

In conclusion, Form Eta 750b is a critical document for exporters of goods from the United States. Understanding the requirements and details of the form is essential to ensure compliance with U.S. regulations. By following the steps outlined in this article, you can complete Form Eta 750b accurately and avoid potential penalties.

FAQs

Who is responsible for filing Form Eta 750b?

+The responsibility for filing Form Eta 750b typically falls on the exporter, also known as the U.S. Principal Party in Interest (USPPI).

What is the purpose of Form Eta 750b?

+The purpose of Form Eta 750b is to collect data on exports, which is essential for statistical analysis, export control, and tax compliance.

What are the penalties for non-compliance with Form Eta 750b?

+Failure to file Form Eta 750b or providing inaccurate information can result in penalties, fines, and even the loss of export privileges.

We hope this article has provided you with a comprehensive understanding of Form Eta 750b and its requirements. If you have any further questions or concerns, please do not hesitate to comment below.