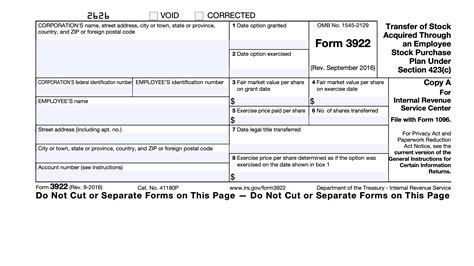

The tax season is upon us, and it's that time of the year when we all scramble to gather our documents and file our tax returns. One of the forms that you might need to file is the Turbotax Form 3922, also known as the Transfer of Stock Acquired Through an Employee Stock Purchase Plan Under Section 423(c). In this article, we will provide you with 5 tips for filing Turbotax Form 3922, to make the process easier and less daunting.

Understanding the Purpose of Turbotax Form 3922

Before we dive into the tips, let's understand the purpose of Turbotax Form 3922. This form is used to report the transfer of stock acquired through an employee stock purchase plan (ESPP) under Section 423(c) of the Internal Revenue Code. The form is used to report the transfer of stock to the IRS and to provide information about the transfer to the employee.

Tips for Filing Turbotax Form 3922

Tip 1: Gather All Required Documents

Before you start filing Turbotax Form 3922, make sure you have all the required documents. These documents include:

- A copy of the employee stock purchase plan (ESPP) agreement

- A copy of the stock certificate or confirmation statement

- The employee's W-2 form

- The employee's Social Security number or Individual Taxpayer Identification Number (ITIN)

Why is it Important to Gather All Required Documents?

Gathering all the required documents is crucial to ensure that you file the form accurately and avoid any errors. The documents will provide you with the necessary information to complete the form, such as the employee's name, Social Security number, and the number of shares transferred.

Tip 2: Understand the Filing Requirements

Who Needs to File Turbotax Form 3922?

Turbotax Form 3922 needs to be filed by the employer, not the employee. The employer is required to file the form for each employee who participates in the ESPP and receives a transfer of stock.

When is the Form Due?

The form is due on the 31st day of January following the calendar year in which the transfer of stock was made.

Tip 3: Complete the Form Accurately

How to Complete Turbotax Form 3922

To complete Turbotax Form 3922, you will need to provide the following information:

- The employee's name, Social Security number, and address

- The employer's name, address, and Employer Identification Number (EIN)

- The number of shares transferred

- The date of the transfer

- The fair market value of the shares on the date of the transfer

Why is it Important to Complete the Form Accurately?

Completing the form accurately is crucial to ensure that the IRS receives the correct information. Inaccurate information can lead to errors and delays in processing the form.

Tip 4: File the Form Electronically

Benefits of Filing Turbotax Form 3922 Electronically

Filing Turbotax Form 3922 electronically has several benefits, including:

- Faster processing time

- Reduced errors

- Ability to track the status of the form

How to File Turbotax Form 3922 Electronically

To file the form electronically, you will need to use the IRS's Electronic Federal Tax Payment System (EFTPS). You can access the system through the IRS website.

Tip 5: Keep a Record of the Form

Why is it Important to Keep a Record of the Form?

Keeping a record of the form is crucial in case of an audit or if the IRS requests additional information. You should keep a copy of the form and any supporting documents for at least three years.

Conclusion

Filing Turbotax Form 3922 can be a daunting task, but with the right tips and guidance, it can be made easier. By gathering all the required documents, understanding the filing requirements, completing the form accurately, filing the form electronically, and keeping a record of the form, you can ensure that you file the form correctly and avoid any errors.

We hope this article has provided you with valuable tips and guidance on filing Turbotax Form 3922. If you have any questions or need further assistance, please don't hesitate to comment below.

What is the purpose of Turbotax Form 3922?

+Turbotax Form 3922 is used to report the transfer of stock acquired through an employee stock purchase plan (ESPP) under Section 423(c) of the Internal Revenue Code.

Who needs to file Turbotax Form 3922?

+The employer needs to file Turbotax Form 3922 for each employee who participates in the ESPP and receives a transfer of stock.

When is the form due?

+The form is due on the 31st day of January following the calendar year in which the transfer of stock was made.