Taxes can be a daunting task for many individuals, especially when it comes to reporting certain types of income or transactions. One such requirement is filing Form 3922, also known as the Exercise of an Incentive Stock Option Under Section 422(b). This form is used to report the exercise of an incentive stock option, which is a type of employee stock option that allows employees to purchase company stock at a discounted price.

Understanding Form 3922

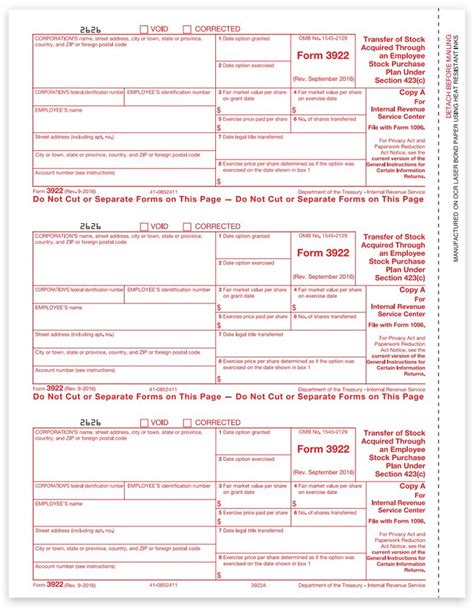

Form 3922 is an informational return that must be filed by employers who have granted incentive stock options to their employees. The form is used to report the exercise of these options, including the date of exercise, the number of shares exercised, and the fair market value of the shares on the date of exercise. The information reported on Form 3922 is used by the IRS to verify the tax treatment of the options and to ensure that the employer and employee are in compliance with the tax laws.

Who Needs to File Form 3922?

Employers who have granted incentive stock options to their employees are required to file Form 3922. This includes corporations, partnerships, and other types of business entities. The form must be filed for each employee who exercises an incentive stock option during the tax year.

Benefits of Filing Form 3922 with TurboTax

Filing Form 3922 can be a complex and time-consuming process, especially for those who are not familiar with tax laws and regulations. That's where TurboTax comes in. With TurboTax, you can easily and accurately file Form 3922 with the guidance of tax experts.

Expert Guidance

TurboTax provides expert guidance throughout the filing process, ensuring that you accurately report the exercise of incentive stock options. The software will guide you through the process of reporting the required information, including the date of exercise, the number of shares exercised, and the fair market value of the shares.

Accuracy Guarantee

TurboTax guarantees the accuracy of your Form 3922 filing. If you receive an audit or notice from the IRS, TurboTax will provide you with guidance and support to help you resolve the issue.

How to File Form 3922 with TurboTax

Filing Form 3922 with TurboTax is a straightforward process. Here are the steps to follow:

- Gather required information: Before you start the filing process, gather all the required information, including the date of exercise, the number of shares exercised, and the fair market value of the shares.

- Create a TurboTax account: If you don't already have a TurboTax account, create one by providing your email address and password.

- Select the correct form: Select Form 3922 from the list of available forms.

- Enter required information: Enter the required information, including the date of exercise, the number of shares exercised, and the fair market value of the shares.

- Review and submit: Review your form for accuracy and submit it to the IRS.

Tips for Filing Form 3922

Here are some tips to keep in mind when filing Form 3922:

- File on time: File Form 3922 by January 31st of each year for the previous tax year.

- Use the correct form: Use Form 3922 to report the exercise of incentive stock options.

- Report all required information: Report all required information, including the date of exercise, the number of shares exercised, and the fair market value of the shares.

- Keep records: Keep accurate records of the exercise of incentive stock options, including the date of exercise, the number of shares exercised, and the fair market value of the shares.

Conclusion

Filing Form 3922 can be a complex and time-consuming process, but with TurboTax, you can easily and accurately file the form with the guidance of tax experts. By following the steps outlined above and keeping accurate records, you can ensure that you are in compliance with the tax laws and avoid any potential penalties or fines.

Get Started Today

Don't wait any longer to file Form 3922. Get started today with TurboTax and ensure that you are in compliance with the tax laws.

What is Form 3922?

+Form 3922 is an informational return that must be filed by employers who have granted incentive stock options to their employees.

Who needs to file Form 3922?

+Employers who have granted incentive stock options to their employees are required to file Form 3922.

How do I file Form 3922 with TurboTax?

+To file Form 3922 with TurboTax, create a TurboTax account, select the correct form, enter the required information, review and submit.