The Illinois W4 form, also known as the "Employee's Withholding Certificate," is a crucial document that helps employers determine the correct amount of state income tax to withhold from their employees' wages. As an employer in Illinois, it's essential to understand the ins and outs of the W4 form to ensure compliance with state tax laws and avoid any potential penalties.

In this article, we'll provide a step-by-step guide on how to complete the Illinois W4 form, including the benefits of filing, working mechanisms, and key information related to the topic.

Benefits of Filing the Illinois W4 Form

Filing the Illinois W4 form is mandatory for all employees in Illinois, and it provides several benefits, including:

- Accurate tax withholding: The W4 form helps employers determine the correct amount of state income tax to withhold from their employees' wages, ensuring that employees don't overpay or underpay their taxes.

- Compliance with state tax laws: Filing the W4 form ensures that employers comply with Illinois state tax laws, avoiding any potential penalties or fines.

- Reduced risk of tax audits: By accurately completing the W4 form, employers can reduce the risk of tax audits and ensure that their employees' tax obligations are met.

Who Needs to File the Illinois W4 Form?

All employees in Illinois are required to file the W4 form, including:

- New hires: All new employees must complete the W4 form as part of the onboarding process.

- Existing employees: Employees who experience a change in their tax status, such as a change in marital status or number of dependents, must update their W4 form.

- Employers: Employers are responsible for collecting and maintaining the W4 forms for all their employees.

Step-by-Step Guide to Completing the Illinois W4 Form

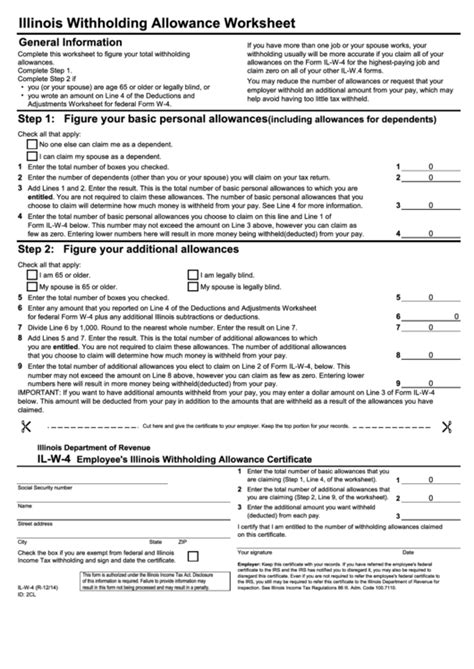

Completing the Illinois W4 form is a straightforward process that requires employees to provide their personal and tax information. Here's a step-by-step guide:

- Employee Information: The employee must provide their name, address, and Social Security number.

- Filing Status: The employee must choose their filing status, such as single, married, or head of household.

- Number of Allowances: The employee must claim the number of allowances they're eligible for, such as 0, 1, or 2.

- Dependents: The employee must list the number of dependents they claim, such as children or other qualifying dependents.

- Additional Withholding: The employee can choose to have additional taxes withheld from their wages.

- Certification: The employee must sign and date the form, certifying that the information provided is accurate.

Working Mechanisms of the Illinois W4 Form

The Illinois W4 form works by using the employee's filing status, number of allowances, and dependents to determine the correct amount of state income tax to withhold from their wages. The form uses a series of calculations to determine the employee's tax liability, taking into account the Illinois state income tax rates.

The Illinois W4 form uses the following calculations:

- Gross Income: The employee's gross income is calculated based on their wages and other income.

- Taxable Income: The employee's taxable income is calculated by subtracting deductions and exemptions from their gross income.

- Tax Liability: The employee's tax liability is calculated based on their taxable income and the Illinois state income tax rates.

Key Information Related to the Illinois W4 Form

Here are some key things to keep in mind when completing the Illinois W4 form:

- Illinois State Income Tax Rates: Illinois has a flat state income tax rate of 4.95%.

- Deductions and Exemptions: Employees can claim deductions and exemptions, such as the Illinois standard deduction or exemptions for dependents.

- Penalties for Non-Compliance: Employers who fail to comply with Illinois state tax laws may face penalties and fines.

Practical Examples and Statistical Data

Here's an example of how the Illinois W4 form works:

- Example 1: John is a single employee with no dependents. He earns $50,000 per year and claims 0 allowances. His Illinois state income tax withholding would be $2,475 per year (4.95% of $50,000).

- Example 2: Jane is a married employee with two dependents. She earns $75,000 per year and claims 2 allowances. Her Illinois state income tax withholding would be $3,712 per year (4.95% of $75,000).

According to the Illinois Department of Revenue, the state collects over $10 billion in income tax revenue each year.

Encouragement to Comment, Share, or Take Action

We hope this article has provided a comprehensive guide to the Illinois W4 form. If you have any questions or comments, please feel free to share them below. Additionally, if you're an employer or employee in Illinois, make sure to take action and complete the W4 form accurately to ensure compliance with state tax laws.

What is the Illinois W4 form?

+The Illinois W4 form is a document that employees complete to determine the correct amount of state income tax to withhold from their wages.

Who needs to file the Illinois W4 form?

+All employees in Illinois are required to file the W4 form, including new hires, existing employees, and employers.

What is the Illinois state income tax rate?

+The Illinois state income tax rate is 4.95%.