The 2017 W-9 form is a crucial document used by the Internal Revenue Service (IRS) to gather information from individuals and businesses that will be used to report various types of income and payments. In this article, we will provide a comprehensive guide on how to obtain a blank 2017 W-9 form, instructions on how to fill it out, and important information about the form's purpose and requirements.

Why is the W-9 Form Necessary?

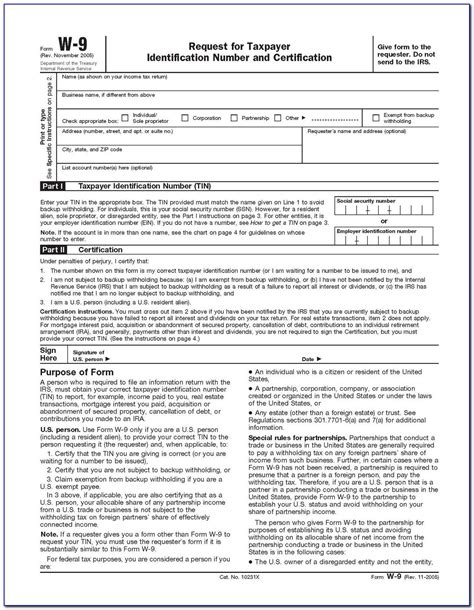

The W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is used by payers to gather information from payees, such as freelancers, independent contractors, and vendors. The form is necessary to ensure that the payee's tax identification number (TIN) and certification are accurate and up-to-date.

How to Obtain a Blank 2017 W-9 Form

You can download a blank 2017 W-9 form from the IRS website or obtain it from the payer who requires the form. Here are the steps to download the form from the IRS website:

- Visit the IRS website at .

- Click on the "Forms and Publications" tab.

- Search for "W-9" in the search bar.

- Click on the "Form W-9 (Rev. 12-2017)" link.

- Download the form in PDF format.

Instructions for Completing the 2017 W-9 Form

The 2017 W-9 form is a one-page document that requires the payee to provide their name, business name, address, TIN, and certification. Here are the step-by-step instructions for completing the form:

**Section 1: Name and Business Name**

- Enter your name as it appears on your tax return.

- Enter your business name, if different from your name.

**Section 2: Business Entity Type**

- Check the box that corresponds to your business entity type (individual, sole proprietor, single-member LLC, etc.).

**Section 3: Address**

- Enter your address, including your street address, city, state, and ZIP code.

**Section 4: Taxpayer Identification Number (TIN)**

- Enter your TIN, which is your Social Security number or Employer Identification Number (EIN).

**Section 5: Certification**

- Check the box to certify that the information provided is accurate and true.

- Sign and date the form.

Important Information About the W-9 Form

- The W-9 form is used for reporting purposes only and does not affect your tax liability.

- You are required to provide a W-9 form to any payer who requires it, such as clients, vendors, and employers.

- You must update your W-9 form whenever your business information changes.

- Failure to provide a W-9 form or providing false information can result in penalties and fines.

**Benefits of Using the W-9 Form**

- The W-9 form helps to prevent identity theft and ensures that payees are properly identified.

- The form helps to reduce errors in reporting and payment processing.

- The form provides a clear and standardized way for payers to gather information from payees.

Conclusion

The 2017 W-9 form is a critical document that plays a vital role in ensuring accurate reporting and payment processing. By following the instructions and guidelines outlined in this article, you can ensure that your W-9 form is completed correctly and that you are in compliance with IRS regulations.

Additional Resources

- IRS Form W-9 Instructions:

- IRS Publication 15:

FAQ Section

What is the purpose of the W-9 form?

+The W-9 form is used by payers to gather information from payees, such as freelancers, independent contractors, and vendors, for reporting purposes.

Who needs to complete a W-9 form?

+Payees, such as freelancers, independent contractors, and vendors, are required to complete a W-9 form for any payer who requires it.

What information is required on the W-9 form?

+The W-9 form requires payees to provide their name, business name, address, TIN, and certification.