Understanding the Importance of a W-9 Form for Businesses and Individuals

In the United States, the W-9 form is a crucial document that businesses and individuals use to provide their taxpayer identification number (TIN) to other entities that will be reporting income paid to them on information returns, such as the 1099-MISC. The W-9 form, officially known as the Request for Taxpayer Identification Number and Certification, plays a significant role in ensuring compliance with tax laws and regulations.

Businesses and individuals that are required to file information returns, such as independent contractors, freelancers, and small business owners, need to obtain a completed W-9 form from their payees before making payments. This form serves as a certification that the payee is a U.S. person, including a resident alien, and is subject to reporting requirements.

Who Needs to Use a W-9 Form?

Businesses and individuals that need to report income paid to others on information returns, such as the 1099-MISC, require a completed W-9 form from their payees. Some examples of entities that need to use a W-9 form include:

- Businesses that pay independent contractors or freelancers for services rendered

- Small business owners that pay rent to landlords or property managers

- Tax-exempt organizations that pay compensation to employees or contractors

Benefits of Using a W-9 Form

Using a W-9 form provides several benefits, including:

- Compliance with tax laws and regulations: By obtaining a completed W-9 form from payees, businesses and individuals can ensure compliance with tax laws and regulations, reducing the risk of penalties and fines.

- Accurate reporting of income: The W-9 form ensures that income paid to payees is accurately reported on information returns, such as the 1099-MISC.

- Reduced administrative burden: By having a completed W-9 form on file, businesses and individuals can reduce their administrative burden when it comes to reporting income paid to payees.

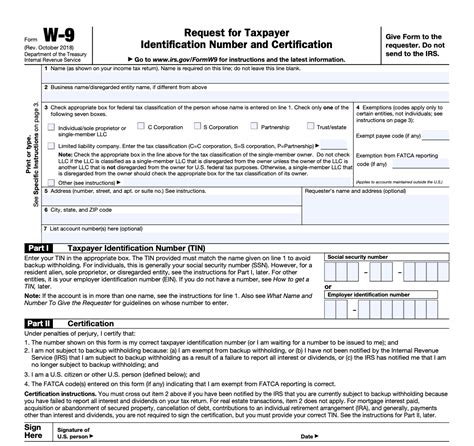

How to Fill Out a W-9 Form

Filling out a W-9 form is a straightforward process that requires the payee to provide their taxpayer identification number (TIN) and certify their identity. Here are the steps to fill out a W-9 form:

- Enter your business name: If you are a business, enter your business name as it appears on your tax return.

- Enter your business entity type: Check the box that corresponds to your business entity type, such as individual, corporation, or partnership.

- Enter your address: Enter your address as it appears on your tax return.

- Enter your TIN: Enter your taxpayer identification number (TIN), which can be your Social Security number or Employer Identification Number (EIN).

- Certify your identity: Sign and date the form to certify your identity.

2017 Blank W-9 Form

You can obtain a 2017 blank W-9 form from the IRS website or by contacting the IRS directly. Here is a summary of the information required on the 2017 W-9 form:

- Name: Enter your business name as it appears on your tax return.

- Business entity type: Check the box that corresponds to your business entity type.

- Address: Enter your address as it appears on your tax return.

- TIN: Enter your taxpayer identification number (TIN).

- Certification: Sign and date the form to certify your identity.

Common Mistakes to Avoid When Filling Out a W-9 Form

When filling out a W-9 form, it is essential to avoid common mistakes that can lead to errors and delays in processing. Here are some common mistakes to avoid:

- Inaccurate TIN: Ensure that you enter your correct taxpayer identification number (TIN).

- Incomplete information: Make sure to complete all the required fields on the form.

- Incorrect certification: Ensure that you sign and date the form correctly.

Conclusion

In conclusion, the W-9 form is a critical document that businesses and individuals use to provide their taxpayer identification number (TIN) to other entities that will be reporting income paid to them on information returns. By understanding the importance of a W-9 form and following the steps to fill it out correctly, businesses and individuals can ensure compliance with tax laws and regulations, reduce administrative burdens, and avoid common mistakes.

We invite you to share your thoughts and experiences with W-9 forms in the comments section below. Have you encountered any challenges or issues when filling out a W-9 form? Share your story and help others learn from your experiences.

What is a W-9 form used for?

+A W-9 form is used to provide a taxpayer identification number (TIN) to other entities that will be reporting income paid to them on information returns, such as the 1099-MISC.

Who needs to use a W-9 form?

+Businesses and individuals that need to report income paid to others on information returns, such as independent contractors, freelancers, and small business owners, require a completed W-9 form from their payees.

How do I fill out a W-9 form?

+To fill out a W-9 form, enter your business name, business entity type, address, and TIN, and certify your identity by signing and dating the form.