As a corporation, it's essential to maintain accurate and detailed financial records, including a balance sheet. The Form 1120S Schedule L is a crucial document that provides a snapshot of a corporation's financial position at a specific point in time. In this article, we'll delve into the essentials of the Form 1120S Schedule L, including its purpose, components, and how to prepare it accurately.

Understanding the Form 1120S Schedule L

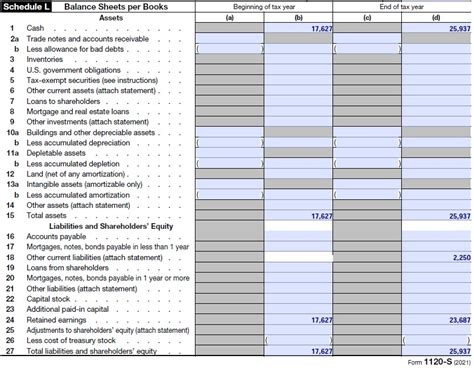

The Form 1120S Schedule L is a supporting schedule to the Form 1120S, which is the income tax return for S corporations. The Schedule L is used to report the corporation's balance sheet information, including assets, liabilities, and equity. The purpose of the Schedule L is to provide the IRS with a detailed picture of the corporation's financial position, which is essential for determining its tax liability.

Components of the Form 1120S Schedule L

The Form 1120S Schedule L is divided into several sections, each reporting specific information about the corporation's balance sheet. The main components of the Schedule L include:

- Assets: This section reports the corporation's assets, including cash, accounts receivable, inventory, and property.

- Liabilities: This section reports the corporation's liabilities, including accounts payable, loans, and taxes owed.

- Equity: This section reports the corporation's equity, including capital stock, retained earnings, and treasury stock.

Preparing the Form 1120S Schedule L

Preparing the Form 1120S Schedule L requires careful attention to detail and accurate financial reporting. Here are some steps to follow:

- Gather financial statements: Collect the corporation's financial statements, including the balance sheet, income statement, and cash flow statement.

- Identify assets: List the corporation's assets, including cash, accounts receivable, inventory, and property.

- Identify liabilities: List the corporation's liabilities, including accounts payable, loans, and taxes owed.

- Calculate equity: Calculate the corporation's equity, including capital stock, retained earnings, and treasury stock.

- Complete the Schedule L: Complete the Schedule L by reporting the corporation's assets, liabilities, and equity in the respective sections.

Tips for Accurate Preparation

To ensure accurate preparation of the Form 1120S Schedule L, follow these tips:

- Use the corporation's financial statements as the basis for completing the Schedule L.

- Ensure that all assets, liabilities, and equity are reported accurately and in the correct sections.

- Use the correct accounting methods and principles when preparing the Schedule L.

- Review the Schedule L carefully for errors or omissions before submitting it to the IRS.

Common Mistakes to Avoid

When preparing the Form 1120S Schedule L, it's essential to avoid common mistakes that can lead to errors or delays in processing. Here are some common mistakes to avoid:

- Failing to report all assets, liabilities, and equity.

- Reporting incorrect or incomplete information.

- Using incorrect accounting methods or principles.

- Failing to sign and date the Schedule L.

Consequences of Inaccurate Reporting

Inaccurate reporting on the Form 1120S Schedule L can have serious consequences, including:

- Delays in processing the corporation's tax return.

- Errors or omissions that can lead to additional taxes or penalties.

- Loss of credibility with the IRS and other stakeholders.

Best Practices for Maintaining Accurate Financial Records

To maintain accurate financial records and ensure accurate reporting on the Form 1120S Schedule L, follow these best practices:

- Keep accurate and detailed financial statements, including the balance sheet, income statement, and cash flow statement.

- Use a reliable accounting system to track financial transactions.

- Review financial records regularly to ensure accuracy and completeness.

- Seek professional advice from a certified public accountant (CPA) or other qualified professional.

Conclusion

In conclusion, the Form 1120S Schedule L is an essential document that provides a snapshot of a corporation's financial position. To ensure accurate reporting, it's essential to follow best practices for maintaining accurate financial records and avoid common mistakes. By doing so, corporations can ensure compliance with tax regulations and maintain a positive reputation with the IRS and other stakeholders.

What is the purpose of the Form 1120S Schedule L?

+The Form 1120S Schedule L is used to report a corporation's balance sheet information, including assets, liabilities, and equity.

What are the main components of the Form 1120S Schedule L?

+The main components of the Form 1120S Schedule L include assets, liabilities, and equity.

What are the consequences of inaccurate reporting on the Form 1120S Schedule L?

+Inaccurate reporting on the Form 1120S Schedule L can lead to delays in processing, errors or omissions, and loss of credibility with the IRS and other stakeholders.