Navigating tax forms can be a daunting task, especially for those who are new to the world of taxes. Penn Foster, a well-known online education platform, provides its students and employees with a unique tax form that can be overwhelming to understand. In this article, we will break down the Penn Foster tax form into five manageable sections, providing you with a comprehensive guide to help you grasp its intricacies.

What is the Penn Foster Tax Form?

The Penn Foster tax form is a document that reports the income earned by students and employees of Penn Foster. This form is used to determine the amount of taxes owed to the government and is typically filed annually. Understanding the Penn Foster tax form is crucial to ensure accurate tax reporting and to avoid any potential penalties.

1. Identifying the Different Sections of the Penn Foster Tax Form

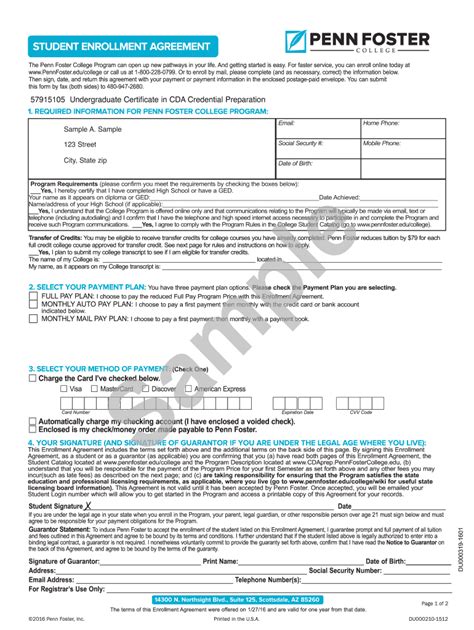

The Penn Foster tax form is divided into several sections, each with its own set of instructions and requirements. The main sections include:

- Student Information: This section requires students to provide their personal details, such as name, address, and social security number.

- Income Reporting: This section reports the income earned by students and employees of Penn Foster, including tuition payments, scholarships, and other forms of compensation.

- Tax Deductions and Credits: This section allows students and employees to claim tax deductions and credits, such as education credits and deductions for tuition payments.

- Tax Withholding: This section determines the amount of taxes withheld from income earned by students and employees of Penn Foster.

Breaking Down the Income Reporting Section

The Income Reporting section is one of the most critical parts of the Penn Foster tax form. This section requires students and employees to report all income earned from Penn Foster, including:

- Tuition payments

- Scholarships

- Grants

- Other forms of compensation

It is essential to accurately report all income earned, as this will affect the amount of taxes owed to the government.

2. Understanding Tax Deductions and Credits

Tax deductions and credits can significantly reduce the amount of taxes owed to the government. The Penn Foster tax form allows students and employees to claim various tax deductions and credits, including:

- Education Credits: Students can claim education credits for tuition payments and other education-related expenses.

- Tuition Payment Deductions: Students can deduct tuition payments from their taxable income.

- Other Deductions and Credits: Students and employees can claim other deductions and credits, such as charitable donations and mortgage interest.

Maximizing Tax Deductions and Credits

To maximize tax deductions and credits, it is essential to keep accurate records of all expenses and income. Students and employees should consult with a tax professional or financial advisor to ensure they are taking advantage of all available tax deductions and credits.

3. Navigating Tax Withholding

Tax withholding is the process of deducting taxes from income earned. The Penn Foster tax form requires students and employees to determine the amount of taxes withheld from their income. This section can be complex, and it is essential to understand the tax withholding process to avoid any potential penalties.

How to Determine Tax Withholding

To determine tax withholding, students and employees must consider several factors, including:

- Tax Filing Status: Students and employees must determine their tax filing status, such as single, married, or head of household.

- Number of Allowances: Students and employees can claim a certain number of allowances, which will affect the amount of taxes withheld.

- Tax Exemptions: Students and employees can claim tax exemptions, such as the standard deduction or itemized deductions.

4. Common Mistakes to Avoid When Filing the Penn Foster Tax Form

Filing the Penn Foster tax form can be complex, and it is easy to make mistakes. Some common mistakes to avoid include:

- Incorrect Social Security Number: Students and employees must ensure that their social security number is accurate and correctly reported on the tax form.

- Incomplete or Inaccurate Information: Students and employees must ensure that all information is complete and accurate, including income reporting and tax deductions and credits.

- Failure to Sign and Date the Form: Students and employees must sign and date the tax form, as this is a critical step in the filing process.

5. Seeking Help When Needed

Filing the Penn Foster tax form can be overwhelming, and it is essential to seek help when needed. Students and employees can consult with a tax professional or financial advisor to ensure they are accurately completing the tax form and taking advantage of all available tax deductions and credits.

By following these five steps, students and employees of Penn Foster can better understand the Penn Foster tax form and ensure accurate tax reporting. Remember to seek help when needed, and don't hesitate to reach out to a tax professional or financial advisor for guidance.

Now that you've learned more about the Penn Foster tax form, we invite you to share your thoughts and experiences in the comments below. Have you had any challenges with filing the Penn Foster tax form? How do you stay organized during tax season? Share your tips and advice with our community!

What is the deadline for filing the Penn Foster tax form?

+The deadline for filing the Penn Foster tax form is typically April 15th of each year. However, this deadline may vary depending on individual circumstances. It is essential to consult with a tax professional or financial advisor to determine the specific deadline for your situation.

Can I file the Penn Foster tax form electronically?

+Yes, you can file the Penn Foster tax form electronically. Penn Foster provides an online platform for students and employees to file their tax forms electronically. This can help reduce errors and expedite the filing process.

What if I need help with filing the Penn Foster tax form?

+If you need help with filing the Penn Foster tax form, you can consult with a tax professional or financial advisor. Penn Foster also provides resources and support to help students and employees with the filing process.