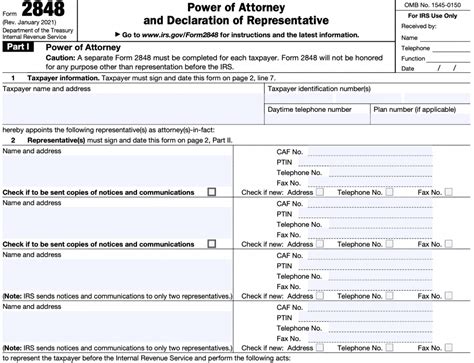

Completing Form 2848 is a crucial step for individuals and businesses that need to authorize a representative to handle their tax-related matters with the Internal Revenue Service (IRS). This form, also known as the Power of Attorney and Declaration of Representative, allows taxpayers to grant permission to a trusted individual or organization to act on their behalf in matters such as audits, collections, and appeals. In this article, we will guide you through the 5 steps to complete Form 2848 accurately and efficiently.

Understanding the Importance of Form 2848

Before we dive into the steps to complete Form 2848, it's essential to understand the significance of this document. Form 2848 is a critical tool for taxpayers who need assistance with their tax-related issues. By completing this form, taxpayers can authorize a representative to communicate with the IRS on their behalf, ensuring that their tax matters are handled professionally and efficiently.

Step 1: Identify the Representative and Taxpayer Information

The first step in completing Form 2848 is to identify the representative and taxpayer information. This includes:

- The taxpayer's name, address, and taxpayer identification number (TIN)

- The representative's name, address, and taxpayer identification number (TIN)

- The type of tax return or matter for which the representative is being authorized (e.g., individual income tax, business tax, employment tax)

Step 2: Specify the Authority and Representation

The second step is to specify the authority and representation. This includes:

- The specific authority being granted to the representative (e.g., authority to receive and inspect tax returns and return information, authority to perform certain acts)

- The specific tax matters for which the representative is being authorized (e.g., examination, collection, appeal)

It's essential to carefully review and complete this section to ensure that the representative has the necessary authority to act on the taxpayer's behalf.

Step 3: Provide the Representative's Contact Information

The third step is to provide the representative's contact information, including:

- The representative's name and title

- The representative's business address and phone number

- The representative's fax number and email address (if applicable)

This information is crucial for the IRS to communicate with the representative and ensure that the taxpayer's tax matters are handled efficiently.

Step 4: Sign and Date the Form

The fourth step is to sign and date the form. The taxpayer must sign and date the form in the presence of a notary public or other authorized official. The representative must also sign and date the form, acknowledging their acceptance of the authority and representation.

It's essential to ensure that the form is signed and dated correctly to avoid any delays or issues with the IRS.

Step 5: File the Form with the IRS

The final step is to file the completed Form 2848 with the IRS. The form can be filed electronically or by mail, depending on the taxpayer's preference. It's essential to keep a copy of the form for the taxpayer's records and to provide a copy to the representative.

By following these 5 steps, taxpayers can ensure that Form 2848 is completed accurately and efficiently, allowing their representative to handle their tax-related matters with the IRS.

Benefits of Completing Form 2848

Completing Form 2848 provides several benefits to taxpayers, including:

- Convenience: Taxpayers can grant authority to a representative to handle their tax-related matters, saving time and effort.

- Efficiency: Representatives can communicate directly with the IRS, ensuring that tax matters are handled efficiently and effectively.

- Professionalism: Taxpayers can ensure that their tax matters are handled by a qualified and experienced representative.

Common Mistakes to Avoid When Completing Form 2848

When completing Form 2848, taxpayers should avoid the following common mistakes:

- Inaccurate or incomplete information: Ensure that all information is accurate and complete to avoid delays or issues with the IRS.

- Incorrect signing and dating: Ensure that the form is signed and dated correctly to avoid any delays or issues with the IRS.

- Failure to provide representative's contact information: Ensure that the representative's contact information is provided to ensure efficient communication with the IRS.

Conclusion

Completing Form 2848 is a crucial step for taxpayers who need to authorize a representative to handle their tax-related matters with the IRS. By following the 5 steps outlined in this article, taxpayers can ensure that the form is completed accurately and efficiently, allowing their representative to handle their tax matters effectively. Remember to avoid common mistakes and ensure that the form is signed and dated correctly to avoid any delays or issues with the IRS.

If you have any questions or concerns about completing Form 2848, we encourage you to leave a comment below or share this article with others who may find it helpful. Don't forget to check out our other articles on tax-related topics and stay informed about the latest tax news and updates.

What is Form 2848 used for?

+Form 2848 is used to authorize a representative to handle a taxpayer's tax-related matters with the IRS.

Who can sign Form 2848?

+The taxpayer must sign and date the form in the presence of a notary public or other authorized official.

Can Form 2848 be filed electronically?

+Yes, Form 2848 can be filed electronically or by mail, depending on the taxpayer's preference.