Understanding the Importance of Tx Sos Form 807

The Tx Sos Form 807 is a relatively straightforward document, but it requires careful attention to detail to avoid errors. The form typically includes information about the business, such as its name, address, and registered agent, as well as details about its management structure and ownership. The form must be signed and dated by an authorized representative of the business, and it must be filed with the Secretary of State's office by the designated deadline.

Tips for Completing Tx Sos Form 807

Tip 1: Gather Required Information

Before starting to fill out the form, gather all the required information, including:- Business name and address

- Registered agent's name and address

- Management structure and ownership details

- Authorized representative's signature and date

Tip 2: Use the Correct Form Version

Make sure you are using the most recent version of the Tx Sos Form 807. You can download the form from the Texas Secretary of State's website or obtain a copy from your local business filing office.Tip 3: Fill Out the Form Carefully

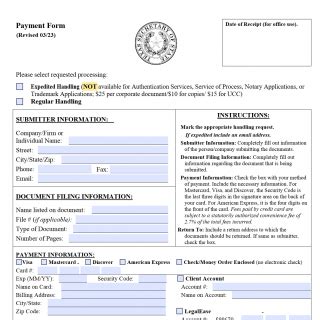

Fill out the form carefully and accurately, using black ink and printing or typing in a clear, legible font. Make sure to sign and date the form in the designated areas.Tip 4: Use the Correct Filing Fee

Attach the correct filing fee to the form. The filing fee for the Tx Sos Form 807 is currently $75, but this fee is subject to change, so check with the Texas Secretary of State's office for the most up-to-date information.Tip 5: File the Form on Time

File the form by the designated deadline to avoid penalties and fines. The Tx Sos Form 807 must be filed annually, typically by the anniversary of the business's formation or registration date.Tip 6: Keep a Copy of the Form

Keep a copy of the completed form for your records. This will help you track your filing history and ensure that you have proof of compliance with the Texas Secretary of State's office.Tip 7: Seek Professional Help if Needed

If you are unsure about how to complete the Tx Sos Form 807 or have complex business structures, consider seeking the help of a professional, such as an attorney or business filing expert. They can guide you through the process and ensure that your form is completed accurately and efficiently.Benefits of Filing Tx Sos Form 807

- Maintaining good standing with the state

- Avoiding penalties and fines

- Ensuring compliance with state regulations

- Updating the state's records with the most current business information

- Providing proof of compliance with state filing requirements

Common Mistakes to Avoid

- Inaccurate or incomplete information

- Failure to sign and date the form

- Incorrect filing fee

- Late filing

- Failure to keep a copy of the form for your records

By following these 7 tips and avoiding common mistakes, you can ensure that your Tx Sos Form 807 is completed accurately and efficiently, maintaining your business's good standing with the state.

Conclusion: Stay Compliant with Tx Sos Form 807

What is the purpose of the Tx Sos Form 807?

+The Tx Sos Form 807 is used to update the state's records and ensure that the business remains in good standing.

What information is required on the Tx Sos Form 807?

+The form requires information about the business, such as its name, address, and registered agent, as well as details about its management structure and ownership.

What is the filing fee for the Tx Sos Form 807?

+The filing fee for the Tx Sos Form 807 is currently $75, but this fee is subject to change, so check with the Texas Secretary of State's office for the most up-to-date information.