As a sneakerhead or a collector of limited edition items, you're likely no stranger to StockX, the popular online marketplace where you can buy and sell rare and unique goods. But when tax season rolls around, navigating the world of StockX taxes can be a daunting task. That's why we're here to help you understand your StockX tax form and make the process as smooth as possible.

Whether you're a seasoned seller or just starting out, it's essential to understand the tax implications of buying and selling on StockX. In this article, we'll break down the key components of your StockX tax form, explain how to report your income and expenses, and provide valuable tips to help you stay on top of your taxes.

What is a StockX Tax Form?

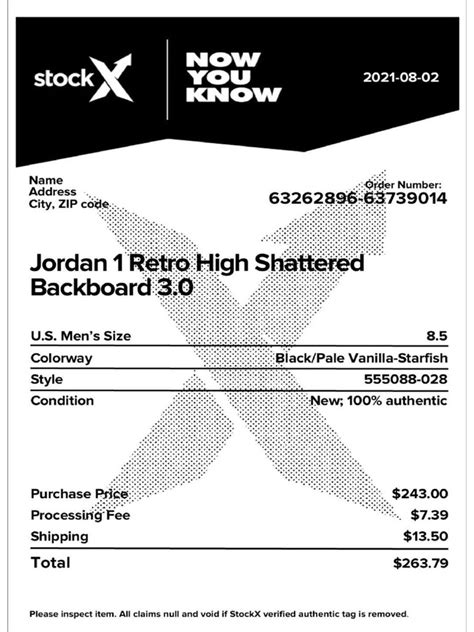

A StockX tax form is a document that outlines the income and expenses related to your buying and selling activities on the platform. As a seller on StockX, you're required to report your earnings to the Internal Revenue Service (IRS) and pay taxes on your profits. The tax form provides a summary of your transactions, including the amount of money you earned, the fees you paid, and any other relevant tax information.

Understanding the Different Sections of Your StockX Tax Form

Your StockX tax form is divided into several sections, each providing valuable information about your transactions. Here's a breakdown of what you can expect to see:

- Gross Proceeds: This section shows the total amount of money you earned from selling items on StockX.

- StockX Fees: This section outlines the fees you paid to StockX for using their platform.

- Net Proceeds: This section shows the amount of money you took home after StockX fees were deducted.

- Cost Basis: This section reports the original purchase price of the items you sold.

How to Report Your StockX Income on Your Tax Return

When it comes to reporting your StockX income on your tax return, there are a few things to keep in mind. Here are some tips to help you navigate the process:

- Report Your Income: You'll need to report your net proceeds from StockX on your tax return. This is the amount of money you took home after fees were deducted.

- Claim Your Expenses: If you have expenses related to your StockX activities, such as shipping costs or packaging materials, you can claim them as deductions on your tax return.

- Keep Accurate Records: Make sure to keep accurate records of your StockX transactions, including receipts, invoices, and bank statements.

Tips for Staying on Top of Your StockX Taxes

Here are some valuable tips to help you stay on top of your StockX taxes:

- Keep Track of Your Transactions: Use a spreadsheet or accounting software to keep track of your StockX transactions.

- Set Aside Money for Taxes: Set aside a portion of your earnings each month to cover your taxes.

- Consult a Tax Professional: If you're unsure about how to report your StockX income or claim your expenses, consider consulting a tax professional.

Common Mistakes to Avoid When Reporting Your StockX Income

When reporting your StockX income, there are several common mistakes to avoid. Here are a few:

- Failing to Report Income: Make sure to report all of your StockX income, including any earnings from international sales.

- Incorrectly Calculating Net Proceeds: Double-check your calculations to ensure you're reporting the correct net proceeds.

- Missing Deadlines: Make sure to file your tax return on time to avoid penalties and interest.

StockX Tax FAQs

Here are some frequently asked questions about StockX taxes:

- Do I need to report my StockX income on my tax return?: Yes, you're required to report your StockX income on your tax return.

- How do I calculate my net proceeds?: Your net proceeds are the amount of money you took home after StockX fees were deducted.

- Can I deduct my StockX fees as a business expense?: Yes, you can deduct your StockX fees as a business expense on your tax return.

What is the deadline for filing my StockX tax return?

+The deadline for filing your StockX tax return is typically April 15th of each year.

Can I amend my StockX tax return if I made a mistake?

+Yes, you can amend your StockX tax return if you made a mistake. You'll need to file an amended return with the IRS.

Do I need to keep records of my StockX transactions?

+Yes, it's recommended that you keep accurate records of your StockX transactions, including receipts, invoices, and bank statements.

We hope this article has helped you understand your StockX tax form and provided valuable tips for navigating the world of StockX taxes. Remember to keep accurate records, report your income correctly, and avoid common mistakes. If you have any questions or concerns, don't hesitate to reach out to a tax professional for guidance. Happy selling!