As a TD Bank customer, setting up direct deposit is a convenient way to have your paycheck, benefits, or other regular deposits electronically deposited into your account. Not only does it save you time and effort, but it also ensures that your funds are available to you as soon as possible. In this article, we will walk you through the easy enrollment guide for the TD Direct Deposit Form.

Direct deposit is a secure and efficient way to receive your funds, eliminating the need for paper checks and the risk of lost or stolen checks. With TD Bank's direct deposit service, you can have your deposits automatically credited to your account, making it easier to manage your finances.

Setting up direct deposit with TD Bank is a straightforward process that can be completed in a few simple steps. Before we dive into the enrollment guide, let's take a look at the benefits of using TD Direct Deposit.

Benefits of TD Direct Deposit

By using TD Direct Deposit, you can enjoy the following benefits:

- Convenience: Direct deposit eliminates the need to visit a bank branch or ATM to deposit your check.

- Security: Your funds are deposited electronically, reducing the risk of lost or stolen checks.

- Time-saving: Your deposits are automatically credited to your account, saving you time and effort.

- Flexibility: You can have your deposits directed to multiple accounts, such as your checking, savings, or money market account.

Now, let's move on to the easy enrollment guide for the TD Direct Deposit Form.

TD Direct Deposit Form: Easy Enrollment Guide

To enroll in TD Direct Deposit, follow these simple steps:

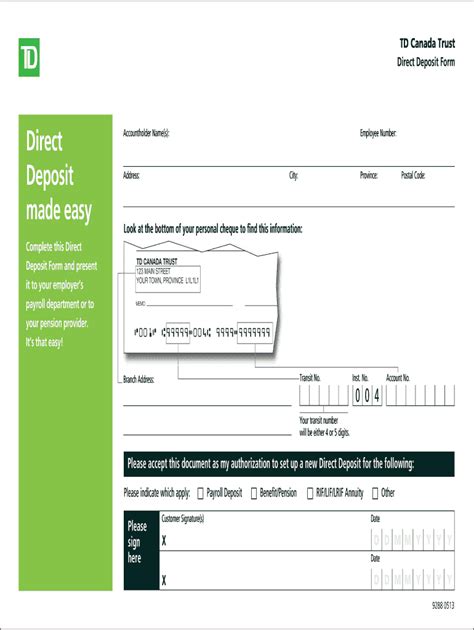

- Gather required information: You will need to provide your TD Bank account number, routing number, and the type of deposit you want to set up (e.g., payroll, benefits, or other regular deposits).

- Complete the TD Direct Deposit Form: You can obtain the form from the TD Bank website or by visiting a bank branch. Fill out the form with the required information and sign it.

- Submit the form: Return the completed form to TD Bank by mail, fax, or in person at a bank branch.

TD Direct Deposit Form: Required Information

To complete the TD Direct Deposit Form, you will need to provide the following information:

- Account number: Your TD Bank account number, which can be found on your account statement or online banking profile.

- Routing number: The routing number for TD Bank, which is 031101266.

- Type of deposit: The type of deposit you want to set up, such as payroll, benefits, or other regular deposits.

TD Direct Deposit: FAQs

Here are some frequently asked questions about TD Direct Deposit:

- Q: What is the TD Bank routing number? A: The TD Bank routing number is 031101266.

- Q: How long does it take to set up direct deposit? A: Setting up direct deposit typically takes 1-2 pay periods.

- Q: Can I have my deposits directed to multiple accounts? A: Yes, you can have your deposits directed to multiple accounts, such as your checking, savings, or money market account.

By following the easy enrollment guide for the TD Direct Deposit Form, you can start enjoying the benefits of direct deposit and simplify your financial life.

We hope this article has provided you with a comprehensive guide to enrolling in TD Direct Deposit. If you have any further questions or concerns, please don't hesitate to comment below.

What is the TD Direct Deposit Form used for?

+The TD Direct Deposit Form is used to enroll in TD Bank's direct deposit service, which allows you to have your paycheck, benefits, or other regular deposits electronically deposited into your account.

How do I obtain the TD Direct Deposit Form?

+You can obtain the TD Direct Deposit Form from the TD Bank website or by visiting a bank branch.

How long does it take to set up direct deposit?

+Setting up direct deposit typically takes 1-2 pay periods.