Filing tax forms can be a daunting task, especially for individuals who are new to the process. The Cleo ATF Form 1 is one such form that requires careful attention to detail to ensure accurate and timely submission. In this article, we will provide 5 valuable tips to help you navigate the process of filing your Cleo ATF Form 1 with ease.

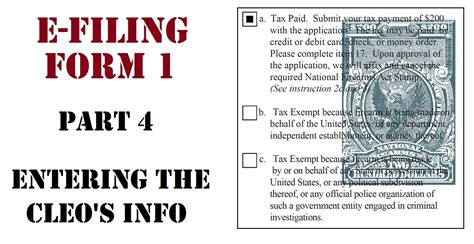

Understanding the Cleo ATF Form 1

Before we dive into the tips, it's essential to understand what the Cleo ATF Form 1 is and why it's necessary. The Cleo ATF Form 1 is a tax form used to report certain transactions related to firearms, specifically the making and registering of firearms. The form is required by the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) and must be filed accurately and on time to avoid any penalties or fines.

Tip 1: Gather Required Documents and Information

To ensure a smooth filing process, it's crucial to gather all required documents and information before starting to fill out the form. This includes:

- Your name and address

- The name and address of the firearms manufacturer (if applicable)

- The type and serial number of the firearm(s) being reported

- The date and time of the transaction

- Any other relevant information required by the ATF

Make sure to have all these documents and information readily available to avoid any delays or mistakes.

Breaking Down the Cleo ATF Form 1 Sections

The Cleo ATF Form 1 is divided into several sections, each requiring specific information. Understanding the layout and requirements of each section will help you navigate the form more efficiently.

Section 1: Applicant Information

This section requires your personal and contact information, including your name, address, and phone number. Make sure to provide accurate and up-to-date information to avoid any issues with your submission.

Tip 2: Use the Correct Filing Status

It's essential to determine the correct filing status for your Cleo ATF Form 1 submission. This will depend on the type of transaction being reported and your relationship with the firearms manufacturer (if applicable). Make sure to review the ATF guidelines carefully to determine the correct filing status for your specific situation.

Common Filing Statuses for Cleo ATF Form 1

- Individual: For individuals reporting personal firearms transactions

- Business: For businesses reporting firearms transactions on behalf of their company

- Trust or Estate: For trusts or estates reporting firearms transactions

Section 2: Firearm Information

This section requires detailed information about the firearm(s) being reported, including the type, serial number, and date of manufacture. Make sure to provide accurate and complete information to avoid any delays or issues with your submission.

Tip 3: Use the Correct Firearm Type

The Cleo ATF Form 1 requires you to report the type of firearm being made or registered. Make sure to use the correct firearm type code to avoid any delays or issues with your submission.

Common Firearm Types for Cleo ATF Form 1

- Handgun

- Rifle

- Shotgun

- Other ( specify type)

Section 3: Transaction Information

This section requires information about the transaction being reported, including the date and time of the transaction and the parties involved. Make sure to provide accurate and complete information to avoid any delays or issues with your submission.

Tip 4: Double-Check Your Math

Before submitting your Cleo ATF Form 1, make sure to double-check your math calculations to ensure accuracy. This includes calculating any applicable taxes or fees.

Common Math Errors to Avoid

- Incorrect tax calculations

- Inaccurate fee calculations

- Failure to report all required transactions

Section 4: Certification and Signature

This section requires your certification and signature, attesting to the accuracy and completeness of the information provided. Make sure to sign and date the form correctly to avoid any delays or issues with your submission.

Tip 5: Submit Your Form Accurately and On Time

Finally, make sure to submit your Cleo ATF Form 1 accurately and on time to avoid any penalties or fines. Review the ATF guidelines carefully to ensure you meet the required submission deadlines.

Common Submission Mistakes to Avoid

- Late submission

- Incomplete or inaccurate information

- Failure to pay applicable taxes or fees

What is the Cleo ATF Form 1 used for?

+The Cleo ATF Form 1 is used to report certain transactions related to firearms, specifically the making and registering of firearms.

Who needs to file the Cleo ATF Form 1?

+Individuals and businesses that engage in certain firearms transactions need to file the Cleo ATF Form 1.

What is the deadline for submitting the Cleo ATF Form 1?

+The deadline for submitting the Cleo ATF Form 1 varies depending on the type of transaction being reported. Review the ATF guidelines carefully to ensure you meet the required submission deadlines.

By following these 5 tips, you'll be well on your way to filing your Cleo ATF Form 1 accurately and efficiently. Remember to gather all required documents and information, use the correct filing status, and double-check your math calculations to avoid any delays or issues with your submission. If you have any further questions or concerns, don't hesitate to reach out to the ATF or a qualified tax professional for guidance.