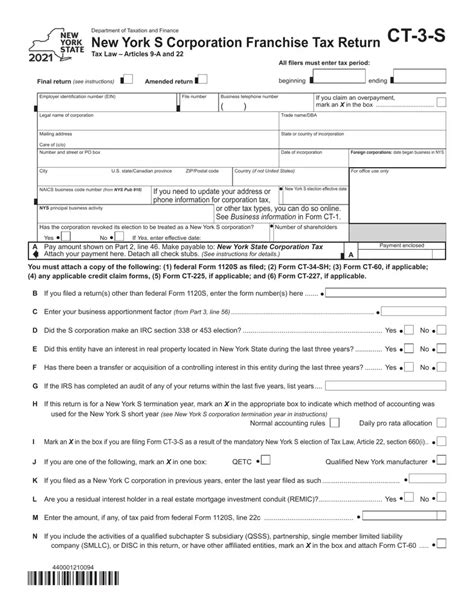

Filing taxes can be a daunting task, especially when it comes to navigating the complex world of business taxes. For New York State businesses, one of the most important forms to complete is the CT-3-S, also known as the New York State Sales and Use Tax Return. In this article, we will break down the steps to complete the CT-3-S form correctly, ensuring you avoid any potential penalties or fines.

Understanding the CT-3-S Form

The CT-3-S form is a quarterly return that New York State businesses must file to report their sales and use tax liability. The form is used to calculate the amount of sales tax owed to the state, as well as any use tax owed on purchases made from out-of-state vendors. It's essential to complete the form accurately to avoid any errors or omissions that may lead to penalties.

Step 1: Gather Required Information

Before starting the CT-3-S form, gather all required information, including:

- Your business's name and address

- Your New York State sales tax vendor account number

- Your federal employer identification number (FEIN)

- A list of all sales and purchases made during the quarter

- Any exempt sales or purchases

Tips for Gathering Information

- Keep accurate records of all sales and purchases throughout the quarter.

- Make sure to save receipts and invoices for all purchases.

- Consult with your accountant or bookkeeper to ensure all information is accurate.

Step 2: Complete the Form

Once you have gathered all required information, complete the CT-3-S form according to the instructions provided. The form is divided into several sections, including:

- Section 1: Business Information

- Section 2: Sales and Use Tax Liability

- Section 3: Exempt Sales and Purchases

- Section 4: Tax Due or Overpayment

Tips for Completing the Form

- Read the instructions carefully before starting the form.

- Use a calculator to ensure accuracy when calculating sales tax liability.

- Double-check all information for accuracy before submitting the form.

Step 3: Calculate Sales Tax Liability

One of the most critical parts of the CT-3-S form is calculating the sales tax liability. To do this, you'll need to calculate the total amount of sales tax owed on all taxable sales made during the quarter.

Formula for Calculating Sales Tax Liability

- Total Taxable Sales x Sales Tax Rate = Sales Tax Liability

Step 4: Report Exempt Sales and Purchases

If your business made any exempt sales or purchases during the quarter, you'll need to report them on the CT-3-S form. This includes sales or purchases made to exempt organizations, such as non-profits or government agencies.

Tips for Reporting Exempt Sales and Purchases

- Keep accurate records of all exempt sales and purchases.

- Consult with your accountant or bookkeeper to ensure all exempt sales and purchases are reported correctly.

Step 5: Submit the Form and Payment

Once the CT-3-S form is complete, submit it to the New York State Department of Taxation and Finance along with any payment due. You can submit the form and payment online, by mail, or in person.

Tips for Submitting the Form and Payment

- Make sure to submit the form and payment on time to avoid penalties.

- Keep a copy of the form and payment for your records.

- Consult with your accountant or bookkeeper if you have any questions or concerns.

By following these steps and tips, you can ensure that your CT-3-S form is completed correctly and submitted on time. Remember to keep accurate records, calculate sales tax liability carefully, and report exempt sales and purchases correctly. If you have any questions or concerns, don't hesitate to consult with your accountant or bookkeeper.

We hope this article has been helpful in guiding you through the process of completing the CT-3-S form. If you have any further questions or concerns, please don't hesitate to reach out. Share your experiences and tips for completing the CT-3-S form in the comments below!

What is the CT-3-S form?

+The CT-3-S form is a quarterly return that New York State businesses must file to report their sales and use tax liability.

What information do I need to complete the CT-3-S form?

+You'll need to gather information such as your business's name and address, New York State sales tax vendor account number, federal employer identification number (FEIN), and a list of all sales and purchases made during the quarter.

How do I calculate sales tax liability?

+To calculate sales tax liability, multiply the total amount of taxable sales by the sales tax rate.