Tax season can be a daunting time for individuals and businesses alike, especially when it comes to navigating the complex world of international taxation. One crucial form that plays a significant role in this process is the Schedule H Form 5471. In this article, we will delve into the essential facts about Schedule H Form 5471, its purpose, and what it entails.

The Schedule H Form 5471 is a crucial attachment to Form 5471, which is used by certain U.S. persons who have control over a foreign corporation. This form is used to report the income, deductions, and credits of the foreign corporation, as well as the U.S. person's share of these items.

Who Needs to File Schedule H Form 5471?

To determine if you need to file Schedule H Form 5471, you must first understand who is required to file Form 5471. The following U.S. persons are required to file Form 5471:

- U.S. shareholders of a foreign corporation

- U.S. persons who have control over a foreign corporation

- U.S. persons who have a 10% or more interest in a foreign corporation

If you fall into one of these categories, you will likely need to file Schedule H Form 5471 as an attachment to Form 5471.

Categories of Filers

There are several categories of filers who may need to file Schedule H Form 5471. These categories include:

- Category 1: U.S. shareholders of a foreign corporation who own 10% or more of the total voting power or value of the foreign corporation's stock

- Category 2: U.S. persons who have control over a foreign corporation, including officers, directors, and employees

- Category 3: U.S. persons who have a 10% or more interest in a foreign corporation, including partners, members, or shareholders

Each category of filer has specific requirements and instructions for completing Schedule H Form 5471.

What Information is Reported on Schedule H Form 5471?

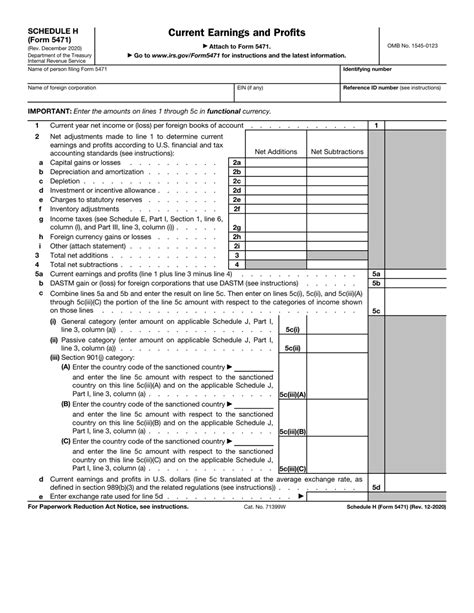

Schedule H Form 5471 is used to report the income, deductions, and credits of the foreign corporation, as well as the U.S. person's share of these items. The form requires the following information:

- The name and address of the foreign corporation

- The employer identification number (EIN) of the foreign corporation

- The country of incorporation and country of residence of the foreign corporation

- The income, deductions, and credits of the foreign corporation

- The U.S. person's share of the foreign corporation's income, deductions, and credits

Penalties for Failure to File Schedule H Form 5471

Failure to file Schedule H Form 5471 can result in significant penalties, including:

- A penalty of $10,000 for each failure to file

- An additional penalty of $10,000 for each failure to file a complete and accurate Form 5471

- A penalty of 10% of the amount of tax owed, if the failure to file is due to willful neglect or disregard of the rules and regulations

It is essential to file Schedule H Form 5471 accurately and on time to avoid these penalties.

Extension of Time to File

If you need more time to file Schedule H Form 5471, you can request an automatic 6-month extension by filing Form 7004. However, this extension only applies to the filing of the form and not to the payment of any tax owed.

Conclusion: Understanding Schedule H Form 5471

Schedule H Form 5471 is a critical component of international taxation, and understanding its requirements and implications is essential for U.S. persons with control over a foreign corporation. By familiarizing yourself with the essential facts about Schedule H Form 5471, you can ensure compliance with the IRS and avoid potential penalties.

If you have any questions or concerns about Schedule H Form 5471, we encourage you to comment below or share this article with others who may find it useful.

Who needs to file Schedule H Form 5471?

+Schedule H Form 5471 is required to be filed by certain U.S. persons who have control over a foreign corporation, including U.S. shareholders of a foreign corporation, U.S. persons who have control over a foreign corporation, and U.S. persons who have a 10% or more interest in a foreign corporation.

What information is reported on Schedule H Form 5471?

+Schedule H Form 5471 requires the reporting of the income, deductions, and credits of the foreign corporation, as well as the U.S. person's share of these items.

What are the penalties for failure to file Schedule H Form 5471?

+Failure to file Schedule H Form 5471 can result in significant penalties, including a penalty of $10,000 for each failure to file and an additional penalty of $10,000 for each failure to file a complete and accurate Form 5471.