Amending Form 2290 can be a daunting task, but with the right guidance, it can be done easily and efficiently. The Heavy Vehicle Use Tax (HVUT) is an annual tax imposed on heavy vehicles that operate on public highways, and Form 2290 is used to report and pay this tax. However, sometimes errors or changes may occur, requiring an amendment to the original return. In this article, we will walk you through the step-by-step process of amending Form 2290.

Why Amend Form 2290?

Before we dive into the amendment process, it's essential to understand why you might need to amend Form 2290. Some common reasons for amending the form include:

- Errors in the original return, such as incorrect vehicle information or tax calculations

- Changes in vehicle information, such as a change in vehicle weight or mileage

- Addition or removal of vehicles from the original return

- Correction of mathematical errors or recalculations of tax owed

Who Needs to Amend Form 2290?

Any taxpayer who has filed Form 2290 and needs to correct or update information must amend the return. This includes:

- Individual taxpayers who own and operate heavy vehicles

- Businesses that own and operate heavy vehicles

- Tax professionals who prepared the original return on behalf of their clients

Step-by-Step Instructions for Amending Form 2290

Amending Form 2290 requires attention to detail and careful completion of the necessary forms. Follow these steps to ensure a smooth amendment process:

Step 1: Gather Required Documents

Before starting the amendment process, gather all necessary documents, including:

- A copy of the original Form 2290 return

- Proof of payment for the original tax return (if applicable)

- Any supporting documentation for changes or corrections, such as updated vehicle registrations or weight certificates

Step 2: Complete Form 2290 Amendment

Obtain a copy of Form 2290, Amendment to Heavy Highway Vehicle Use Tax Return, from the IRS website or by contacting the IRS directly. Complete the form according to the instructions provided, making sure to:

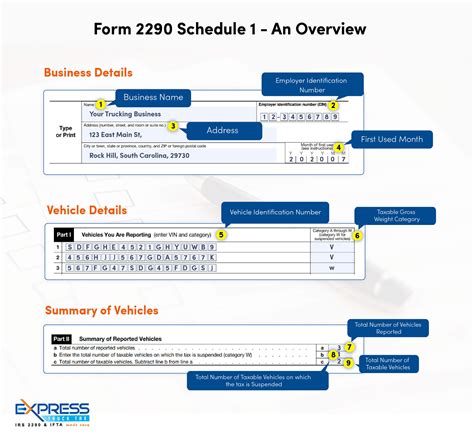

- Enter the taxpayer's name, address, and Employer Identification Number (EIN)

- Indicate the type of amendment being made (e.g., correction of error, addition of vehicle, etc.)

- Provide detailed explanations for the changes or corrections being made

Step 3: Calculate and Pay Any Additional Tax

If the amendment results in additional tax owed, calculate the correct amount and pay it using one of the following methods:

- Electronic Federal Tax Payment System (EFTPS)

- Check or money order payable to the United States Treasury

- Credit or debit card through an approved payment processor

Step 4: Submit the Amendment

Mail the completed Form 2290 Amendment to the IRS address listed in the instructions. Make sure to include all supporting documentation and payment for any additional tax owed (if applicable).

Step 5: Follow Up with the IRS

After submitting the amendment, follow up with the IRS to confirm receipt and processing of the amended return. You can contact the IRS directly or check the status of your amendment online through the IRS website.

Tips for a Smooth Amendment Process

To ensure a smooth amendment process, keep the following tips in mind:

- Double-check all information for accuracy before submitting the amendment

- Use clear and concise language when explaining changes or corrections

- Include all required supporting documentation

- Pay any additional tax owed promptly to avoid penalties and interest

Conclusion

Amending Form 2290 can seem overwhelming, but by following these step-by-step instructions, you can ensure a smooth and efficient process. Remember to gather all required documents, complete the Form 2290 Amendment accurately, calculate and pay any additional tax owed, submit the amendment, and follow up with the IRS. If you have any questions or concerns, don't hesitate to reach out to the IRS or a tax professional for guidance.

FAQ Section

What is the deadline for amending Form 2290?

+The deadline for amending Form 2290 is generally three years from the original filing deadline.

Can I amend Form 2290 online?

+No, currently, the IRS does not allow electronic filing of amended Form 2290 returns. You must mail the completed form and supporting documentation to the IRS.

How long does it take for the IRS to process an amended Form 2290?

+The processing time for amended Form 2290 returns can vary, but it typically takes several weeks to several months for the IRS to process and update the taxpayer's account.