Understanding the Nebraska Inheritance Tax Worksheet Form 500

When a loved one passes away, it can be a challenging and emotional time for those left behind. In addition to dealing with the emotional fallout, there are also various legal and financial matters that need to be addressed. In Nebraska, one of these matters is the inheritance tax. The Nebraska Inheritance Tax Worksheet Form 500 is a crucial document that helps calculate the amount of inheritance tax owed. In this article, we will delve into the world of Nebraska inheritance tax, explore the Form 500, and provide a comprehensive guide on how to navigate this complex process.

What is the Nebraska Inheritance Tax?

The Nebraska inheritance tax is a state tax levied on the transfer of property from a deceased person to their beneficiaries. The tax is imposed on the beneficiaries, not the estate of the deceased. Nebraska is one of only six states in the United States that still impose an inheritance tax. The tax rate varies depending on the relationship between the beneficiary and the deceased, as well as the value of the property being inherited.

Who Needs to File Form 500?

Form 500 is required for all estates that exceed the minimum threshold for filing. This threshold is adjusted annually for inflation. In general, the form is required for estates with a gross value exceeding $40,000. However, even if the estate value is below this threshold, Form 500 may still be required if the estate includes certain types of property, such as real estate or business interests.

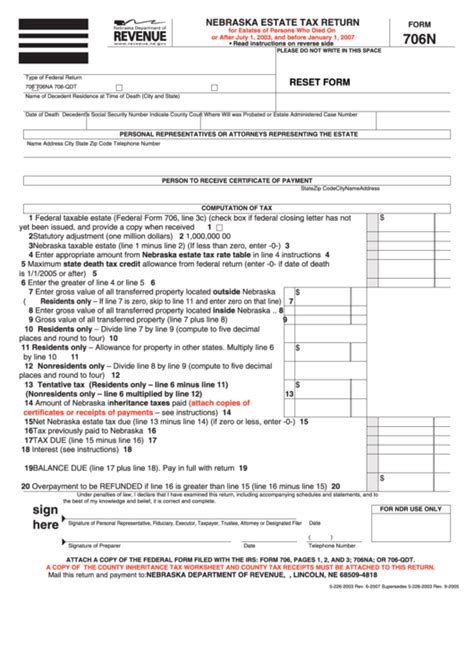

What Information is Required on Form 500?

Form 500 requires a significant amount of information about the estate, the deceased, and the beneficiaries. This includes:

- The name and address of the deceased

- The name and address of the executor or personal representative of the estate

- A detailed list of all assets in the estate, including their value

- A list of all beneficiaries, including their relationship to the deceased and their address

- The amount of inheritance tax owed, calculated using the rates and schedules provided by the Nebraska Department of Revenue

Calculating the Inheritance Tax

Calculating the inheritance tax can be complex, as it involves applying different tax rates to different types of property. The tax rate varies depending on the relationship between the beneficiary and the deceased, with closer relatives (such as spouses and children) paying lower rates than more distant relatives (such as nieces and nephews).

Here is a simplified example of how the inheritance tax might be calculated:

- The estate includes a house valued at $200,000 and a bank account valued at $50,000.

- The beneficiary is the deceased's child.

- Using the Nebraska inheritance tax rates, the tax on the house would be 1% of the value (=$2,000), and the tax on the bank account would be 1.5% of the value (=$750).

- The total inheritance tax owed would be $2,000 + $750 = $2,750.

Penalties for Failure to File or Pay

Failure to file Form 500 or pay the inheritance tax can result in significant penalties. The Nebraska Department of Revenue may impose a penalty of up to 25% of the unpaid tax, as well as interest on the unpaid amount. In addition, the department may also impose a penalty for failure to file, which can be up to $500.

Conclusion

The Nebraska Inheritance Tax Worksheet Form 500 is a complex document that requires careful attention to detail. By understanding the tax rates, schedules, and requirements, beneficiaries and executors can ensure that they comply with the law and avoid penalties. If you are dealing with an estate that requires Form 500, it is recommended that you seek the advice of a qualified tax professional or attorney to ensure that everything is handled correctly.

Final Thoughts

We hope this guide has provided you with a comprehensive understanding of the Nebraska Inheritance Tax Worksheet Form 500. If you have any further questions or concerns, please do not hesitate to comment below. We would be happy to hear from you and provide any additional information or guidance you may need.

** Share this article with your friends and family who may be affected by the Nebraska inheritance tax. **

What is the Nebraska inheritance tax rate?

+The Nebraska inheritance tax rate varies depending on the relationship between the beneficiary and the deceased. The rate ranges from 1% to 18% of the value of the property being inherited.

Who is required to file Form 500?

+Form 500 is required for all estates that exceed the minimum threshold for filing, which is adjusted annually for inflation. Currently, the threshold is $40,000.

What is the deadline for filing Form 500?

+The deadline for filing Form 500 is typically nine months from the date of the deceased's passing. However, this deadline may be extended in certain circumstances.