Filling out the DE 4 form in California can be a daunting task, especially for those who are new to the state's employment laws. However, with the right guidance, you can navigate this process with ease. In this article, we will provide a step-by-step guide on how to fill out the DE 4 form in California.

Understanding the DE 4 Form

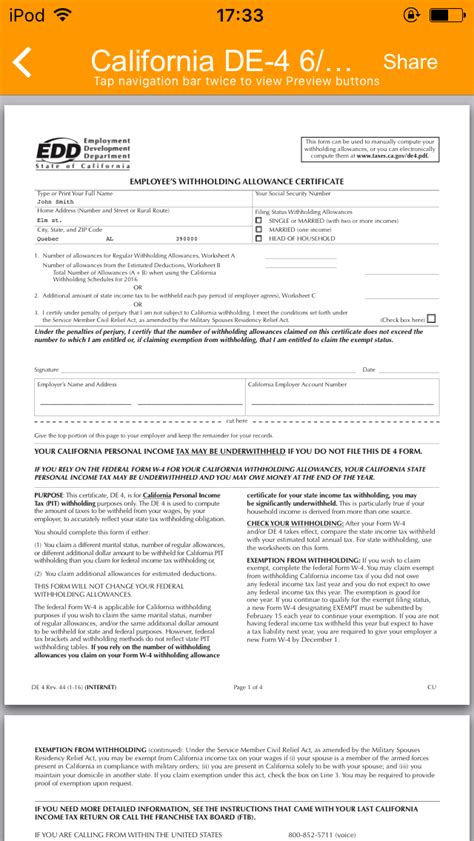

The DE 4 form, also known as the "Employee's Withholding Allowance Certificate," is a document that employees in California must complete to determine the amount of state income tax that will be withheld from their wages. This form is typically completed when an employee starts a new job or when their withholding allowances change.

Why is the DE 4 Form Important?

The DE 4 form is essential because it helps employers determine the correct amount of state income tax to withhold from an employee's wages. If an employee does not complete this form correctly, they may end up having too much or too little tax withheld, which can lead to penalties and interest.

Gathering Required Information

Before filling out the DE 4 form, you will need to gather some information, including:

- Your name and address

- Your social security number

- Your marital status

- The number of dependents you claim

- Your filing status (single, married, head of household, etc.)

- Your income and withholding information from your previous job (if applicable)

Step 1: Completing Section 1 - Employee Information

In Section 1 of the DE 4 form, you will need to provide your personal information, including your name, address, and social security number. Make sure to complete this section accurately, as any errors may delay the processing of your form.

Step 2: Completing Section 2 - Withholding Allowances

In Section 2, you will need to determine the number of withholding allowances you are eligible for. The number of allowances you claim will affect the amount of state income tax that is withheld from your wages. You can claim one allowance for yourself, your spouse, and each dependent you claim.

Step 3: Completing Section 3 - Additional Withholding

In Section 3, you will need to indicate if you want to have additional state income tax withheld from your wages. If you want to have additional tax withheld, you will need to specify the amount you want to have withheld.

Step 4: Completing Section 4 - Filing Status

In Section 4, you will need to indicate your filing status. Your filing status will affect the amount of state income tax that is withheld from your wages.

Step 5: Completing Section 5 - Certification

In Section 5, you will need to certify that the information you provided on the DE 4 form is accurate. You will also need to sign and date the form.

Common Mistakes to Avoid

When filling out the DE 4 form, there are several common mistakes to avoid, including:

- Failing to complete all sections of the form

- Providing inaccurate information

- Failing to sign and date the form

- Not claiming enough withholding allowances

Conclusion

Filling out the DE 4 form in California can be a complex process, but by following the steps outlined in this article, you can ensure that you complete the form correctly. Remember to gather all required information, complete all sections of the form, and avoid common mistakes. If you have any questions or concerns, you can contact the California Employment Development Department (EDD) for assistance.

What is the DE 4 form?

+The DE 4 form, also known as the "Employee's Withholding Allowance Certificate," is a document that employees in California must complete to determine the amount of state income tax that will be withheld from their wages.

How often do I need to complete the DE 4 form?

+You typically need to complete the DE 4 form when you start a new job or when your withholding allowances change.

What happens if I don't complete the DE 4 form correctly?

+If you don't complete the DE 4 form correctly, you may end up having too much or too little tax withheld, which can lead to penalties and interest.