As the tax season approaches, many organizations and individuals in New York City are preparing to file their tax exempt forms. Filing tax exempt forms can be a complex and time-consuming process, but with the right guidance, it can be done efficiently and effectively. In this article, we will explore five ways to file tax exempt form in NYC.

Why File Tax Exempt Forms?

Before we dive into the different ways to file tax exempt forms, let's first understand why filing these forms is important. Tax exempt organizations, such as non-profits, charities, and churches, are exempt from paying federal income taxes. However, they are still required to file annual information returns with the Internal Revenue Service (IRS) to maintain their tax-exempt status.

In NYC, tax exempt organizations must also file forms with the New York State Department of Taxation and Finance (DTF) and the New York City Department of Finance (DOF). Filing these forms ensures that the organization is in compliance with state and local tax laws and regulations.

1. E-File with the IRS

The IRS offers a convenient and secure way to file tax exempt forms electronically through its website. To e-file, organizations must register for an account on the IRS website and obtain a username and password. Once registered, they can submit their forms online and receive an electronic confirmation of receipt.

Benefits of E-Filing with the IRS:

- Faster processing times

- Reduced errors

- Electronic confirmation of receipt

- Ability to file 24/7

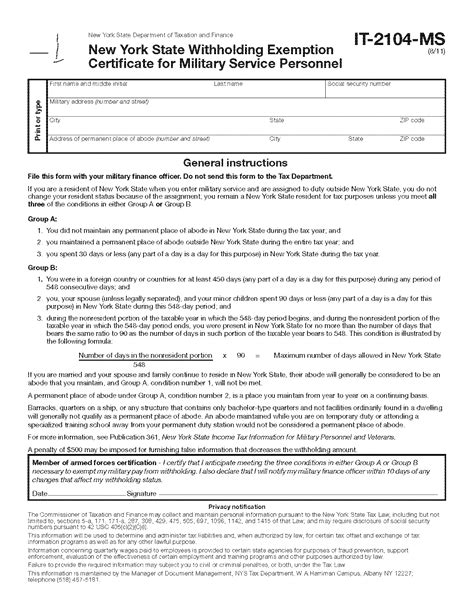

2. File with the New York State Department of Taxation and Finance

In addition to filing with the IRS, tax exempt organizations in NYC must also file forms with the New York State Department of Taxation and Finance (DTF). The DTF requires organizations to file a Report of Sales Tax Exemption (Form ST-119) and a Report of Annual Information (Form CT-12).

Benefits of Filing with the DTF:

- Ensures compliance with state tax laws and regulations

- Helps organizations maintain their tax-exempt status

- Provides a record of annual information

3. File with the New York City Department of Finance

Tax exempt organizations in NYC must also file forms with the New York City Department of Finance (DOF). The DOF requires organizations to file a Certificate of Tax Exemption (Form G-26) and a Report of Annual Information (Form NYC-9.5).

Benefits of Filing with the DOF:

- Ensures compliance with local tax laws and regulations

- Helps organizations maintain their tax-exempt status

- Provides a record of annual information

4. Use Tax Exempt Software

Tax exempt software can help organizations streamline the filing process and reduce errors. These software programs can help with form preparation, e-filing, and tracking.

Benefits of Using Tax Exempt Software:

- Reduces errors and inaccuracies

- Streamlines the filing process

- Provides a record of annual information

- Offers e-filing capabilities

5. Consult with a Tax Professional

Finally, tax exempt organizations in NYC may want to consider consulting with a tax professional to ensure that their forms are filed correctly and on time. Tax professionals can provide guidance on the filing process and help organizations navigate any complex tax laws and regulations.

Benefits of Consulting with a Tax Professional:

- Provides expert guidance on tax laws and regulations

- Helps ensure accuracy and compliance

- Offers personalized support and assistance

In conclusion, filing tax exempt forms in NYC can be a complex process, but with the right guidance and support, it can be done efficiently and effectively. By e-filing with the IRS, filing with the DTF and DOF, using tax exempt software, and consulting with a tax professional, organizations can ensure that their forms are filed correctly and on time.

What's Next?

If you're a tax exempt organization in NYC, it's essential to take the necessary steps to file your tax exempt forms correctly and on time. By following the steps outlined in this article, you can ensure that your organization is in compliance with state and local tax laws and regulations.

We encourage you to share your thoughts and experiences with filing tax exempt forms in NYC. Have you encountered any challenges or obstacles during the filing process? What tips and advice can you offer to others?

What is the deadline for filing tax exempt forms in NYC?

+The deadline for filing tax exempt forms in NYC varies depending on the type of form and the organization's fiscal year. Generally, the deadline is May 15th for calendar-year organizations and the 15th day of the fifth month after the organization's fiscal year ends.

What are the consequences of not filing tax exempt forms in NYC?

+Failure to file tax exempt forms in NYC can result in penalties, fines, and even loss of tax-exempt status. Organizations may also be subject to audit and examination by the IRS, DTF, and DOF.

Can tax exempt organizations file their forms electronically?

+Yes, tax exempt organizations can file their forms electronically through the IRS website. The IRS offers a convenient and secure way to file tax exempt forms electronically.