Are you looking to withdraw funds from your Schwab IRA account? Filling out the Schwab IRA distribution form can be a daunting task, but don't worry, we've got you covered. In this article, we will guide you through the process with 5 easy steps to fill out the Schwab IRA distribution form.

Withdrawing funds from your IRA account can be a significant decision, and it's essential to understand the process and potential tax implications. Before we dive into the steps, let's quickly cover the basics of IRA distributions.

Understanding IRA Distributions

IRA distributions refer to the process of withdrawing funds from your Individual Retirement Account (IRA). There are several types of IRA distributions, including:

- Required Minimum Distributions (RMDs): Mandatory withdrawals from traditional IRAs starting at age 72.

- Early distributions: Withdrawals made before age 59 1/2, subject to a 10% penalty and income tax.

- Normal distributions: Withdrawals made after age 59 1/2, taxed as ordinary income.

Why Fill Out the Schwab IRA Distribution Form?

Filling out the Schwab IRA distribution form is necessary to initiate the withdrawal process. The form provides essential information to Schwab, allowing them to process your request efficiently. By completing the form accurately, you can ensure a smooth and hassle-free distribution process.

5 Easy Steps to Fill Out the Schwab IRA Distribution Form

Now that we've covered the basics, let's move on to the 5 easy steps to fill out the Schwab IRA distribution form:

Step 1: Gather Required Information and Documents

Before filling out the form, gather the following information and documents:

- Your Schwab IRA account number

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your current address and phone number

- The reason for the distribution (e.g., RMD, early withdrawal, or normal distribution)

- The distribution amount and frequency (if applicable)

Make sure you have all the necessary documents and information readily available to avoid any delays or complications.

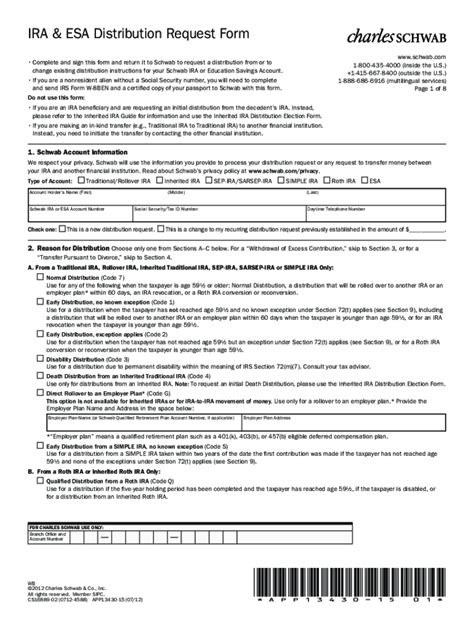

Step 2: Download and Review the Schwab IRA Distribution Form

Download the Schwab IRA distribution form from the Schwab website or request a copy by contacting Schwab customer service. Review the form carefully, paying attention to the following sections:

- Account information

- Distribution details

- Tax withholding options

- Certification and signature

Understanding the Form Sections

Take your time to understand each section of the form. If you're unsure about any part of the process, consider consulting with a financial advisor or contacting Schwab customer support.

Step 3: Fill Out the Form Accurately and Completely

Fill out the form accurately and completely, using the information and documents gathered in Step 1. Double-check your entries to avoid errors or omissions.

Some key sections to focus on include:

- Account information: Ensure your account number and Social Security number or ITIN are correct.

- Distribution details: Specify the distribution amount, frequency, and reason.

- Tax withholding options: Choose your tax withholding option, if applicable.

Step 4: Sign and Date the Form

Once you've completed the form, sign and date it. Make sure your signature matches the one on file with Schwab.

Importance of Signing and Dating the Form

Signing and dating the form is crucial, as it certifies your request and confirms your identity. Schwab may not process your request without a valid signature and date.

Step 5: Submit the Form to Schwab

Submit the completed form to Schwab via mail, fax, or online upload, depending on your preference. Make sure to follow Schwab's submission guidelines to avoid any delays.

After Submitting the Form

After submitting the form, Schwab will review and process your request. You can expect the following:

- Processing time: 3-5 business days for most distributions

- Tax withholding: Schwab will withhold taxes, if applicable, according to your chosen option

- Distribution delivery: Your distribution will be delivered via check, direct deposit, or wire transfer, depending on your selection

By following these 5 easy steps, you can fill out the Schwab IRA distribution form accurately and efficiently. Remember to review the form carefully and seek assistance if needed.

Additional Tips and Reminders

- Consult with a financial advisor or tax professional to ensure you understand the tax implications of your distribution.

- Keep a copy of the completed form for your records.

- Verify your account information and distribution details before submitting the form.

We hope this article has helped you navigate the process of filling out the Schwab IRA distribution form. If you have any questions or concerns, feel free to comment below.

What is the deadline for submitting the Schwab IRA distribution form?

+The deadline for submitting the Schwab IRA distribution form varies depending on the type of distribution. For RMDs, the deadline is typically December 31st of each year. For early distributions, there is no specific deadline, but you should submit the form as soon as possible to avoid delays.

Can I submit the Schwab IRA distribution form online?

+Yes, you can submit the Schwab IRA distribution form online through the Schwab website. However, you may need to create an online account or log in to your existing account to access the form.

What happens if I make a mistake on the Schwab IRA distribution form?

+If you make a mistake on the Schwab IRA distribution form, contact Schwab customer support immediately. They will guide you through the correction process and help you avoid any delays or complications.