As a taxpayer, it's essential to understand the process of filing Form GA-8453, the Individual Income Tax Declaration for Electronic Filing. This form is a crucial part of the tax filing process in Georgia, and accuracy is key to avoid any delays or penalties. In this article, we'll walk you through the 5 ways to file Form GA-8453 correctly, ensuring a smooth and hassle-free experience.

Understanding Form GA-8453

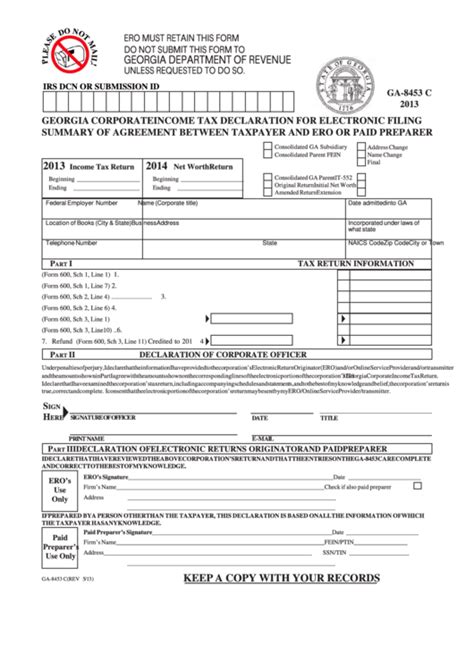

Before we dive into the filing process, let's quickly understand what Form GA-8453 is all about. This form is a declaration that you, as a taxpayer, have reviewed and verified the accuracy of your individual income tax return. It's a requirement for e-filing your tax return in Georgia, and it helps the state's Department of Revenue verify the authenticity of your return.

5 Ways to File Form GA-8453 Correctly

1. Gather Required Information

Before you start filling out Form GA-8453, make sure you have all the necessary information. You'll need:

- Your social security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's social security number or ITIN (if applicable)

- Your dependent's social security number or ITIN (if applicable)

- Your Georgia income tax return information, including your adjusted gross income and total tax liability

2. Choose the Correct Filing Status

Your filing status is crucial in determining your tax liability. Choose the correct filing status from the following options:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

3. Complete Form GA-8453 Accurately

Fill out Form GA-8453 carefully, making sure to:

- Sign and date the form

- Provide your name and address

- Enter your social security number or ITIN

- Enter your spouse's social security number or ITIN (if applicable)

- Enter your dependent's social security number or ITIN (if applicable)

- Verify your Georgia income tax return information

4. Attach Supporting Documents (If Required)

Depending on your tax situation, you may need to attach supporting documents to your Form GA-8453. These documents may include:

- W-2 forms

- 1099 forms

- Schedule A (Itemized Deductions)

- Schedule B (Interest and Dividend Income)

5. E-File or Mail Your Return

Once you've completed Form GA-8453, you can either e-file or mail your return to the Georgia Department of Revenue. Make sure to follow the instructions carefully and keep a copy of your return for your records.

Common Mistakes to Avoid

When filing Form GA-8453, avoid these common mistakes:

- Inaccurate or incomplete information

- Failure to sign and date the form

- Incorrect filing status

- Failure to attach supporting documents (if required)

- Mailing or e-filing your return incorrectly

Conclusion

Filing Form GA-8453 correctly is crucial to avoid any delays or penalties in your tax return. By following these 5 steps and avoiding common mistakes, you can ensure a smooth and hassle-free experience. Remember to gather required information, choose the correct filing status, complete the form accurately, attach supporting documents (if required), and e-file or mail your return correctly. If you're unsure about any part of the process, consider consulting a tax professional or contacting the Georgia Department of Revenue for assistance.

FAQs

What is Form GA-8453?

+Form GA-8453 is the Individual Income Tax Declaration for Electronic Filing in Georgia. It's a declaration that you, as a taxpayer, have reviewed and verified the accuracy of your individual income tax return.

Do I need to attach supporting documents to my Form GA-8453?

+Depending on your tax situation, you may need to attach supporting documents to your Form GA-8453. These documents may include W-2 forms, 1099 forms, Schedule A (Itemized Deductions), and Schedule B (Interest and Dividend Income).

Can I e-file my Form GA-8453?

+Yes, you can e-file your Form GA-8453 through the Georgia Department of Revenue's website or through a tax preparation software. Make sure to follow the instructions carefully and keep a copy of your return for your records.