Managing your finances effectively often requires authorizing others to access your accounts or make transactions on your behalf. For PNC Bank customers, this involves using a PNC Bank Authorization Form. This form is a crucial document that grants permission to a third party to manage your account or conduct specific financial activities. In this article, we will explore what the PNC Bank Authorization Form is, its importance, how to download and fill it out, and provide insights into the various types of authorization forms PNC Bank offers.

The Importance of Authorization Forms

Authorization forms are legal documents that protect both you and your bank by ensuring that all transactions are legitimate and authorized. By signing an authorization form, you are giving explicit permission to another party to act on your behalf, which can help prevent unauthorized access or transactions. For businesses and individuals alike, these forms are essential for managing finances efficiently, especially when multiple people need to access an account or when third-party services are involved.

Understanding the PNC Bank Authorization Form

The PNC Bank Authorization Form is designed to be straightforward and easy to understand. The form typically requires your account information, the type of authorization you are granting, and the specific permissions you are allowing the third party to have. This could include access to view account balances, make withdrawals, or conduct other financial transactions.

To ensure the security of your account, the form will also require your signature, which serves as your legal endorsement of the authorization. PNC Bank may also have specific requirements or restrictions for the use of authorization forms, which you can learn more about by contacting their customer service.

Downloading the PNC Bank Authorization Form

PNC Bank aims to make banking as accessible and convenient as possible for its customers. One way they achieve this is by providing easy access to necessary forms, including authorization forms. Here’s how you can download the PNC Bank Authorization Form:

- Visit the PNC Bank Website: Start by visiting the official PNC Bank website at .

- Navigate to Forms and Applications: Look for a section on the website related to forms and applications. This is often found under “Customer Service” or “Account Management.”

- Select the Authorization Form: Once you are in the forms section, select the authorization form that matches your needs. PNC Bank may offer different types of authorization forms for personal and business accounts.

- Download the Form: Click on the form to download it. Most forms are available in PDF format, which you can open with Adobe Acrobat Reader.

Filling Out the PNC Bank Authorization Form

Filling out the authorization form is a straightforward process. Here are the steps to follow:

- Read the Form Carefully: Before filling out the form, read it carefully to understand what information is required and what you are authorizing.

- Fill in Your Account Information: Enter your account number and other relevant account details as requested on the form.

- Specify the Authorization: Clearly specify what actions you are authorizing the third party to take on your behalf. This could include viewing account information, making transactions, or other activities.

- Sign the Form: Your signature is crucial as it legally binds the authorization. Ensure you sign the form in the presence of a notary public if required.

Types of Authorization Forms

PNC Bank offers various authorization forms tailored to different needs. These may include:

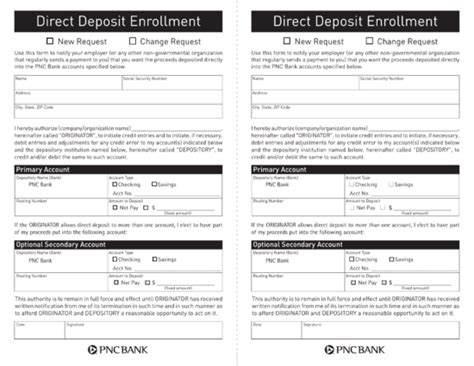

- Direct Deposit Authorization Form: For setting up direct deposits into your account.

- Automatic Payment Authorization Form: For authorizing regular payments from your account.

- Third-Party Authorization Form: For granting access to your account information or allowing transactions by a third party.

Common Questions and Concerns

Q: How do I know which authorization form I need? A: The type of form you need depends on the specific transaction or access you want to authorize. Contact PNC Bank customer service for guidance if you’re unsure.

Q: Can I fill out the authorization form online? A: While you can download the form online, you typically need to print it, fill it out, and sign it manually. Some forms may require notarization.

Q: How long is the authorization valid? A: The validity period of the authorization depends on the terms specified in the form. Some authorizations may be ongoing until you revoke them, while others may have a specified end date.

What if I need to revoke the authorization?

+To revoke an authorization, you typically need to submit a written request to PNC Bank. It’s essential to follow the bank’s procedures for revocation to ensure your request is processed correctly.

Can I use an authorization form for a business account?

+Yes, PNC Bank provides authorization forms for business accounts. These forms are designed to meet the specific needs of businesses, allowing owners or authorized personnel to manage accounts effectively.

Do I need a lawyer to fill out the authorization form?

+While it’s not typically necessary to have a lawyer, it’s advisable to seek legal counsel if you’re unsure about any aspect of the authorization process. This can help protect your interests and ensure the form is completed correctly.

Final Thoughts

Managing your finances with PNC Bank involves using various tools and documents, including authorization forms. By understanding the purpose and process of these forms, you can better control your financial transactions and protect your account security. Remember, it’s crucial to fill out the form accurately and completely to avoid any issues or delays. If you have any questions or concerns, don’t hesitate to reach out to PNC Bank’s customer service for assistance.

We hope this article has provided you with valuable insights into the PNC Bank Authorization Form and how to use it effectively. Whether you’re a new or existing customer, understanding this process can help you manage your accounts more efficiently. Feel free to share your experiences or ask further questions in the comments below.