Minnesota Form M1PR is a vital document for individuals who need to file their property tax refund. Completing this form accurately is essential to ensure that you receive the correct refund amount. Here are the 5 steps to complete Minnesota Form M1PR.

**Step 1: Gather Required Documents and Information**

Before starting to fill out Form M1PR, make sure you have all the necessary documents and information. You will need:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your property tax statement (also known as the "Tax Statement")

- The amount of property taxes you paid for the year

- The amount of any refunds you received for the previous year

- Information about any changes to your property, such as new construction or improvements

**Why is this information important?**

Having all the required documents and information will help you complete the form accurately and ensure that you receive the correct refund amount.

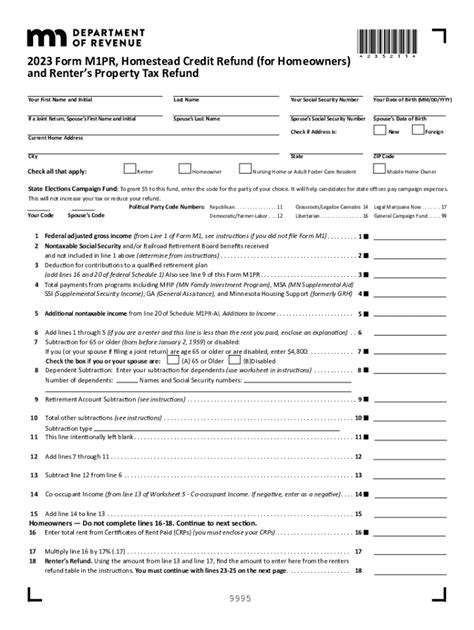

**Step 2: Fill Out the Form M1PR**

Once you have all the necessary documents and information, start filling out Form M1PR. The form is divided into several sections, including:

- Section 1: Property Information

- Section 2: Property Taxes Paid

- Section 3: Refund Information

- Section 4: Signature and Verification

Make sure to fill out each section accurately and completely.

**Tips for filling out the form:**

- Use black ink to fill out the form

- Print clearly and legibly

- Make sure to sign and date the form

**Step 3: Calculate Your Refund**

After filling out the form, calculate your refund amount using the Property Tax Refund Calculator or by using the worksheet provided in the instructions. Make sure to follow the instructions carefully to ensure accuracy.

**Why is calculating your refund important?**

Calculating your refund accurately will ensure that you receive the correct refund amount.

**Step 4: Review and Submit the Form**

Before submitting the form, review it carefully to ensure that all the information is accurate and complete. Make sure to sign and date the form.

**How to submit the form:**

You can submit the form online, by mail, or in person. Make sure to follow the instructions carefully to ensure that your form is processed correctly.

**Step 5: Follow Up on Your Refund**

After submitting the form, follow up on your refund to ensure that it is processed correctly. You can check the status of your refund online or by contacting the Minnesota Department of Revenue.

**Why is following up important?**

Following up on your refund will ensure that you receive the correct refund amount and that any issues are resolved promptly.

We hope this article has helped you understand the 5 steps to complete Minnesota Form M1PR. If you have any further questions or concerns, please don't hesitate to comment below. Don't forget to share this article with others who may find it helpful!

What is the deadline to file Form M1PR?

+The deadline to file Form M1PR is August 15th of each year.

Can I file Form M1PR electronically?

+Yes, you can file Form M1PR electronically through the Minnesota Department of Revenue's website.

How long does it take to receive my refund?

+The processing time for refunds can vary, but it typically takes 2-4 weeks to receive your refund.