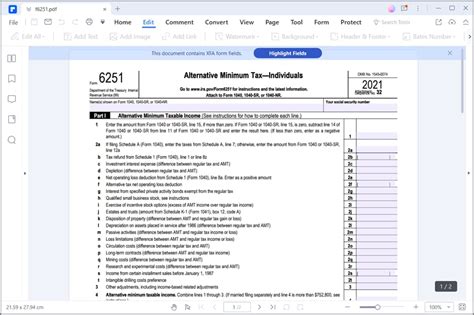

Federal Form 6251, also known as the Alternative Minimum Tax (AMT) form, can be a complex and intimidating document for many taxpayers. However, with the right guidance and understanding, completing this form can be a manageable task. In this article, we will provide six tips to help you navigate and complete Federal Form 6251 with ease.

Understanding the Alternative Minimum Tax

Before diving into the tips, it's essential to understand what the Alternative Minimum Tax (AMT) is and why it's necessary. The AMT is a separate tax system designed to ensure that high-income individuals and corporations pay a minimum amount of tax, regardless of the deductions and exemptions they claim. The AMT is calculated using a different set of rules and rates than the regular income tax.

Tip 1: Determine if You Need to File Form 6251

Not everyone needs to file Form 6251. To determine if you need to file, you'll need to complete the AMT Assistant, which is a worksheet provided by the IRS. The worksheet will guide you through a series of questions to determine if you owe the AMT. If you're unsure, it's always best to consult with a tax professional or the IRS directly.

Tip 2: Gather Required Documents and Information

To complete Form 6251, you'll need to gather several documents and pieces of information, including:

- Your tax return (Form 1040)

- Your W-2 forms

- Your 1099 forms

- Any other relevant tax documents

- Your income, deductions, and exemptions

Having all the necessary documents and information will make the process much smoother and less frustrating.

Tip 3: Understand the AMT Calculation

The AMT calculation can be complex, but it's essential to understand the basics. The AMT is calculated by adding back certain deductions and exemptions to your taxable income, then applying the AMT rates. The AMT rates are different from the regular income tax rates and range from 26% to 28%.

To calculate the AMT, you'll need to complete Form 6251, which will guide you through the process. You'll need to calculate your Alternative Minimum Taxable Income (AMTI), which is your taxable income plus any adjustments and preferences.

Tip 4: Identify and Claim Applicable Exemptions and Deductions

While the AMT limits certain deductions and exemptions, there are still some that you can claim. For example, you can claim the standard deduction, and certain itemized deductions, such as mortgage interest and charitable contributions.

It's essential to identify and claim all applicable exemptions and deductions to minimize your AMT liability.

Tip 5: Complete Form 6251 Accurately and Thoroughly

Completing Form 6251 requires attention to detail and accuracy. Make sure to read the instructions carefully and complete each section thoroughly. If you're unsure about any part of the form, don't hesitate to seek help from a tax professional or the IRS.

Tip 6: Seek Professional Help if Needed

If you're unsure about completing Form 6251 or have complex tax situations, it's always best to seek help from a tax professional. A tax professional can guide you through the process, ensure accuracy, and help you minimize your AMT liability.

By following these six tips, you'll be well on your way to completing Federal Form 6251 with ease and accuracy. Remember to take your time, gather all necessary documents and information, and seek help if needed.

Additional Tips and Reminders

- Make sure to file Form 6251 by the tax filing deadline to avoid penalties and interest.

- Keep accurate records and documentation to support your AMT calculation.

- Consider consulting with a tax professional if you have complex tax situations or are unsure about any part of the process.

Conclusion

Completing Federal Form 6251 requires attention to detail, accuracy, and a basic understanding of the Alternative Minimum Tax. By following the six tips outlined in this article, you'll be well-equipped to navigate the process and minimize your AMT liability. Remember to seek help if needed, and don't hesitate to reach out to a tax professional or the IRS if you have any questions or concerns.

What is the Alternative Minimum Tax (AMT)?

+The Alternative Minimum Tax (AMT) is a separate tax system designed to ensure that high-income individuals and corporations pay a minimum amount of tax, regardless of the deductions and exemptions they claim.

Who needs to file Form 6251?

+Not everyone needs to file Form 6251. To determine if you need to file, you'll need to complete the AMT Assistant, which is a worksheet provided by the IRS.

What is the AMT calculation?

+The AMT calculation is a complex process that involves adding back certain deductions and exemptions to your taxable income, then applying the AMT rates.