Filing a tax extension can be a daunting task, but it doesn't have to be. For California-based businesses, Form 568 is a crucial document that requires timely submission to avoid penalties. In this article, we'll break down the process of filing Form 568 extension in 5 easy steps. Whether you're a seasoned tax professional or a business owner looking to navigate the process yourself, this guide will walk you through the essential steps to ensure a smooth and hassle-free experience.

Understanding Form 568 and the Extension Process

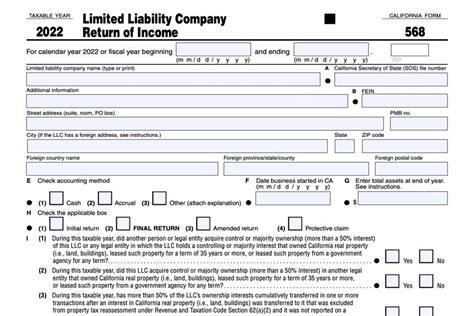

Before diving into the step-by-step guide, it's essential to understand the purpose of Form 568 and the extension process. Form 568 is the Limited Liability Company Return of Income, which California-based LLCs must file annually with the Franchise Tax Board (FTB). The form reports the LLC's income, deductions, and credits, as well as any taxes owed. If your business needs more time to file Form 568, you can request an automatic 7-month extension by filing Form 568 extension.

Step 1: Determine If You Need an Extension

Not all businesses need to file an extension, but if you're unsure, it's always better to err on the side of caution. If your business is facing any of the following situations, you may need to file an extension:

- Insufficient time to gather necessary documentation

- Complexity of tax returns requiring additional time

- Unexpected business or personal circumstances

- Previous years' tax liabilities that need to be addressed

Take a moment to assess your business's situation and determine if an extension is necessary. If you're still unsure, consult with a tax professional or accountant for guidance.

Step 2: Gather Required Information and Documentation

Before filing the extension, you'll need to gather essential information and documentation. This includes:

- Business name and address

- Federal Employer Identification Number (FEIN)

- LLC's tax year and accounting method

- Estimated tax liability (if any)

- Supporting documentation for estimated tax liability (if applicable)

Make sure to have all necessary documents and information readily available to avoid delays or errors in the filing process.

Step 3: File Form 568 Extension

Now it's time to file the extension. You can file Form 568 extension electronically or by mail. If you're filing electronically, you'll need to use the California FTB's online portal. If you're filing by mail, make sure to use the correct address and follow the FTB's guidelines for mail-in submissions.

When filing, ensure you provide accurate and complete information. Double-check your calculations and documentation to avoid errors or discrepancies.

Electronic Filing: Benefits and Requirements

Electronic filing offers several benefits, including:

- Faster processing times

- Reduced risk of errors

- Environmentally friendly

- Ability to track submission status

To file electronically, you'll need to:

- Create an account on the California FTB's online portal

- Complete the electronic version of Form 568 extension

- Submit the form and supporting documentation

- Receive confirmation of submission

**Step 4: Pay Estimated Tax Liability (If Applicable)**h2>

If you're required to pay estimated taxes, you'll need to submit payment with your extension. You can pay online, by phone, or by mail. Make sure to follow the FTB's guidelines for payment submission and keep records of your payment.

Step 5: File Form 568 by the Extended Deadline

Once you've filed the extension, you'll have an additional 7 months to file your Form 568. Use this time to gather any remaining documentation and complete your tax return. Submit Form 568 by the extended deadline to avoid penalties and interest.

By following these 5 easy steps, you can successfully file Form 568 extension and avoid any potential penalties or fines. Remember to stay organized, gather necessary documentation, and submit your extension on time. If you're unsure about any aspect of the process, consult with a tax professional or accountant for guidance.

Now it's your turn! Have you filed Form 568 extension before? Share your experiences or ask questions in the comments below. Don't forget to share this article with fellow business owners who may benefit from this information.

What is the deadline for filing Form 568 extension?

+The deadline for filing Form 568 extension is the 15th day of the 4th month after the close of the LLC's tax year.

Can I file Form 568 extension electronically?

+Yes, you can file Form 568 extension electronically through the California FTB's online portal.

What is the penalty for not filing Form 568 extension?

+The penalty for not filing Form 568 extension can range from $250 to $2,500, depending on the LLC's tax liability and the number of months the return is late.