As a homeowner in Montgomery County, Maryland, it's essential to understand the importance of filing the MCPS Form SR-8. This document is a critical component of the county's tax assessment process, and its accuracy can significantly impact your property's tax bill. In this comprehensive guide, we'll walk you through the step-by-step process of filing the MCPS Form SR-8, ensuring you're well-equipped to navigate this crucial aspect of homeownership.

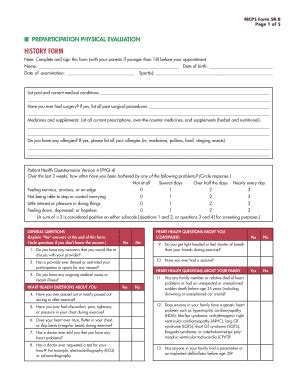

Understanding the MCPS Form SR-8

The MCPS Form SR-8, also known as the "Homeowners' Tax Credit Application," is a document used by the Montgomery County Government to determine eligibility for the Homestead Tax Credit. This credit can significantly reduce your property tax bill, making it an essential benefit for homeowners.

Benefits of Filing the MCPS Form SR-8

Filing the MCPS Form SR-8 can result in substantial savings on your property tax bill. By accurately completing and submitting the form, you can:

- Reduce your taxable assessment

- Lower your annual property tax bill

- Take advantage of the Homestead Tax Credit

Step-by-Step Filing Guide

To ensure a smooth and successful filing process, follow these steps:

- Gather Required Documents: Collect the necessary documents, including:

- Your property deed

- Proof of residency (driver's license, utility bills, etc.)

- Your most recent property tax bill

- Download and Complete the Form: Obtain the MCPS Form SR-8 from the Montgomery County Government website or pick one up at your local tax office. Complete the form accurately, ensuring all required information is provided.

- Determine Your Eligibility: Review the eligibility criteria for the Homestead Tax Credit, which includes:

- Owning and occupying the property as your primary residence

- Meeting the income limit (currently $60,000 or less)

- Not having previously applied for the credit

- Submit the Form: Return the completed form to the Montgomery County Government by the designated deadline (usually December 31st). You can submit the form by mail or in person.

- Review and Verify: The county will review and verify your application. If approved, you'll receive a confirmation letter and a revised tax bill reflecting the Homestead Tax Credit.

Common Mistakes to Avoid

When filing the MCPS Form SR-8, be mindful of the following common mistakes:

- Incomplete or inaccurate information: Double-check your application to ensure all required fields are complete and accurate.

- Missing deadlines: Submit your application by the designated deadline to avoid delays or rejection.

- Failure to provide required documents: Ensure you provide all necessary documentation to support your application.

Tips for a Smooth Filing Process

To ensure a hassle-free filing experience, consider the following tips:

- File electronically: If possible, submit your application electronically to reduce the risk of errors or lost documents.

- Keep records: Maintain a record of your application, including submission dates and correspondence with the county.

- Seek assistance: If you're unsure about any aspect of the filing process, don't hesitate to contact the Montgomery County Government or a tax professional for guidance.

Additional Resources

For more information on the MCPS Form SR-8 and the Homestead Tax Credit, visit the following resources:

- Montgomery County Government website:

- Maryland State Comptroller's Office:

Conclusion: Take Control of Your Property Taxes

Filing the MCPS Form SR-8 is a straightforward process that can result in significant savings on your property tax bill. By understanding the importance of this document and following the step-by-step filing guide, you can take control of your property taxes and enjoy the benefits of the Homestead Tax Credit. Remember to stay informed, seek assistance when needed, and submit your application accurately and on time.

We invite you to share your experiences and tips for filing the MCPS Form SR-8 in the comments below. Don't forget to share this article with fellow homeowners who may benefit from this valuable information.

What is the deadline for filing the MCPS Form SR-8?

+The deadline for filing the MCPS Form SR-8 is typically December 31st. However, it's essential to verify the deadline with the Montgomery County Government to ensure timely submission.

Can I file the MCPS Form SR-8 electronically?

+Yes, the Montgomery County Government offers electronic filing options for the MCPS Form SR-8. Check their website for more information and to submit your application online.

What documents do I need to provide with my MCPS Form SR-8 application?

+You'll need to provide proof of residency, your property deed, and your most recent property tax bill. Ensure you review the application instructions carefully to confirm all required documentation.