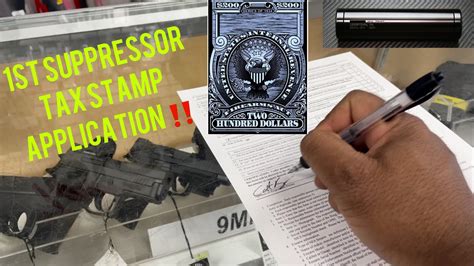

Owning a firearm suppressor, also known as a silencer, can be a significant investment for gun enthusiasts. However, the process of acquiring one can be complex and time-consuming, particularly when it comes to filling out the necessary paperwork. The suppressor tax stamp form, also known as Form 4, is a crucial document that must be completed and submitted to the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) to obtain approval for the transfer of a suppressor. In this article, we will guide you through the 5 steps to fill out a suppressor tax stamp form.

Step 1: Determine the Type of Transfer

Before filling out the suppressor tax stamp form, you need to determine the type of transfer you are making. There are two types of transfers: individual and business. If you are purchasing a suppressor as an individual, you will need to fill out Form 4. However, if you are purchasing a suppressor for a business or trust, you will need to fill out Form 4 with additional documentation.

Understanding the Difference Between Individual and Business Transfers

- Individual transfers are for personal use, and the suppressor will be registered in the individual's name.

- Business transfers are for commercial use, and the suppressor will be registered in the business's name.

Step 2: Gather Required Information and Documents

To complete the suppressor tax stamp form, you will need to gather the following information and documents:

- Your name, address, and date of birth

- The make, model, and serial number of the suppressor

- The name and address of the seller (if purchasing from a dealer)

- The name and address of the chief law enforcement officer (CLEO) in your area

- A copy of your driver's license or state-issued ID

- A copy of your passport or other government-issued ID

Understanding the Importance of Accurate Information

- Providing accurate information is crucial to avoid delays or rejection of your application.

- Double-check your information and ensure that it matches the documentation you provide.

Step 3: Fill Out the Form 4

Once you have gathered the required information and documents, you can begin filling out Form 4. The form is divided into several sections, each requiring specific information.

- Section 1: Transferor's Information

- Provide the name, address, and date of birth of the seller (if purchasing from a dealer)

- Section 2: Transferee's Information

- Provide your name, address, and date of birth

- Section 3: Article Information

- Provide the make, model, and serial number of the suppressor

- Section 4: Certification

- Sign and date the form

Tips for Filling Out the Form

- Use black ink to fill out the form

- Make sure to sign the form in the presence of a notary public

- Use a pen to sign the form, not a pencil

Step 4: Obtain the CLEO Signature

The CLEO signature is a critical component of the suppressor tax stamp form. The CLEO is responsible for verifying your identity and ensuring that you are eligible to possess a suppressor.

- Contact your local law enforcement agency to schedule an appointment with the CLEO

- Bring a copy of your driver's license or state-issued ID and a copy of your passport or other government-issued ID

- The CLEO will review your information and sign the form

Understanding the Role of the CLEO

- The CLEO is responsible for verifying your identity and ensuring that you are eligible to possess a suppressor

- The CLEO may request additional information or documentation

Step 5: Submit the Form and Supporting Documents

Once you have completed the form and obtained the CLEO signature, you can submit the form and supporting documents to the ATF.

- Make a copy of the form and supporting documents for your records

- Mail the original form and supporting documents to the ATF

- Pay the required tax stamp fee ($200 for individual transfers)

Understanding the Review Process

- The ATF will review your application and verify the information provided

- The review process typically takes several months

- You will receive a notification from the ATF once your application has been approved or denied

In conclusion, filling out a suppressor tax stamp form requires careful attention to detail and accurate information. By following these 5 steps, you can ensure that your application is complete and accurate, reducing the risk of delays or rejection.

What is the purpose of the suppressor tax stamp form?

+The suppressor tax stamp form, also known as Form 4, is required to obtain approval for the transfer of a suppressor. The form is used to verify the identity of the transferee and ensure that they are eligible to possess a suppressor.

How long does it take to process a suppressor tax stamp form?

+The review process typically takes several months. You will receive a notification from the ATF once your application has been approved or denied.

What is the tax stamp fee for a suppressor?

+The tax stamp fee for a suppressor is $200 for individual transfers.