If you're a self-employed individual or a small business owner, you're likely familiar with the IRS Form 3922, also known as the Exercise of an Incentive Stock Option Under Section 422(b). This form is used to report the exercise of incentive stock options, which can be a complex and time-consuming process. However, with TurboTax, completing and filing Form 3922 can be easy and accurate. In this article, we'll guide you through the process of completing Form 3922 with TurboTax, highlighting the benefits and steps involved.

Understanding Form 3922 and Its Importance

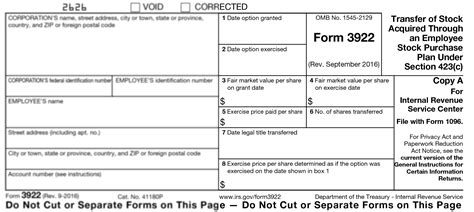

Form 3922 is used to report the exercise of incentive stock options, which are a type of employee benefit. When you exercise an incentive stock option, you're essentially buying company stock at a predetermined price, which can be lower than the current market value. The IRS requires employers to report this transaction on Form 3922, which must be filed with the IRS and a copy provided to the employee.

Benefits of Using TurboTax to Complete Form 3922

TurboTax is a popular tax preparation software that offers numerous benefits when completing Form 3922. Here are some of the advantages of using TurboTax:

- Accuracy and Compliance: TurboTax ensures that your Form 3922 is accurate and compliant with IRS regulations, reducing the risk of errors and potential penalties.

- Ease of Use: TurboTax guides you through the process of completing Form 3922, making it easy to understand and navigate, even for those with limited tax knowledge.

- Time-Saving: Completing Form 3922 with TurboTax saves you time and effort, allowing you to focus on other important aspects of your business.

- Expert Support: TurboTax offers expert support and guidance throughout the process, providing peace of mind and ensuring that your Form 3922 is completed correctly.

Steps to Complete Form 3922 with TurboTax

Completing Form 3922 with TurboTax involves the following steps:

- Gather Required Information: Before starting, gather all necessary information, including:

- Your employer's name and address

- Your name and address

- The date you exercised the incentive stock option

- The number of shares exercised

- The exercise price per share

- The fair market value per share on the exercise date

- Create a TurboTax Account: If you don't already have a TurboTax account, create one by visiting the TurboTax website and following the registration process.

- Select the Correct Form: Log in to your TurboTax account and select the correct form (Form 3922) from the TurboTax dashboard.

- Answer Guided Questions: TurboTax will guide you through a series of questions, which you'll need to answer to complete Form 3922.

- Review and Edit: Review your Form 3922 for accuracy and completeness. Edit any errors or omissions before proceeding.

- E-file with the IRS: Once you've completed and reviewed your Form 3922, TurboTax will allow you to e-file it with the IRS.

Common Mistakes to Avoid When Completing Form 3922

When completing Form 3922, it's essential to avoid common mistakes that can lead to errors and potential penalties. Here are some mistakes to avoid:

- Incorrect Employer Information: Ensure that your employer's name and address are accurate.

- Inaccurate Dates: Verify that the exercise date and other relevant dates are correct.

- Incorrect Share Information: Double-check the number of shares exercised, exercise price per share, and fair market value per share on the exercise date.

Conclusion and Next Steps

Completing Form 3922 with TurboTax is a straightforward and accurate process. By following the steps outlined above and avoiding common mistakes, you can ensure that your Form 3922 is completed correctly and filed with the IRS on time.

If you have any questions or need further assistance, don't hesitate to reach out to TurboTax support or consult with a tax professional.

Encouraging Engagement

Have you used TurboTax to complete Form 3922 in the past? Share your experiences and tips in the comments below! If you found this article helpful, be sure to share it with others who may benefit from it.

FAQ Section

What is Form 3922, and why do I need to complete it?

+Form 3922 is used to report the exercise of incentive stock options. You'll need to complete this form if you exercised an incentive stock option and your employer is required to report the transaction to the IRS.

Can I complete Form 3922 manually, or do I need to use TurboTax?

+While it's possible to complete Form 3922 manually, using TurboTax can ensure accuracy and compliance with IRS regulations. TurboTax guides you through the process, making it easier to complete the form correctly.

What if I make a mistake on Form 3922? Can I correct it?

+If you make a mistake on Form 3922, you can correct it by filing an amended return with the IRS. However, it's essential to avoid mistakes in the first place by using TurboTax and following the steps outlined above.