As the tax season approaches, many New Jersey residents are preparing to file their tax returns. One of the most important forms for New Jersey taxpayers is the NJ 1040 form. Filing this form accurately and on time is crucial to avoid penalties and ensure that you receive your refund quickly. In this article, we will provide you with 7 essential tips for NJ 1040 form filing to help you navigate the process with ease.

Understanding the NJ 1040 Form

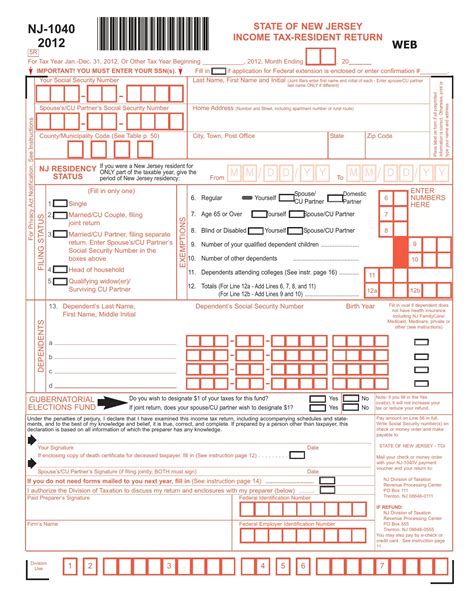

Before we dive into the tips, it's essential to understand what the NJ 1040 form is and what it's used for. The NJ 1040 form is the state income tax return form for New Jersey residents. It's used to report your income, deductions, and credits, and to calculate your state income tax liability. The form is typically filed annually, and the deadline is usually April 15th.

Tip 1: Gather All Necessary Documents

To ensure that you file your NJ 1040 form accurately, it's crucial to gather all necessary documents. These may include:

- Your W-2 forms from your employer(s)

- Your 1099 forms for freelance work or self-employment income

- Your interest and dividend statements (1099-INT and 1099-DIV)

- Your capital gains and losses statements (Schedule D)

- Your charitable donation receipts

- Your medical expense receipts

Having all these documents ready will make it easier to complete your tax return and avoid errors.

Tip 2: Choose the Correct Filing Status

Your filing status determines your tax rate and the deductions and credits you're eligible for. New Jersey offers several filing statuses, including:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the correct filing status to ensure you're paying the correct amount of tax.

Tip 3: Take Advantage of Tax Credits

New Jersey offers several tax credits that can reduce your tax liability. Some of the most common credits include:

- The Earned Income Tax Credit (EITC)

- The Child and Dependent Care Credit

- The Education Credits (American Opportunity and Lifetime Learning)

- The Retirement Savings Contribution Credit

Make sure to claim all the credits you're eligible for to reduce your tax bill.

Tip 4: Claim Your Deductions

New Jersey allows several deductions that can reduce your taxable income. Some of the most common deductions include:

- The standard deduction

- Itemized deductions (medical expenses, mortgage interest, charitable donations)

- Business expenses (for self-employed individuals)

Keep accurate records of your expenses to ensure you're claiming all the deductions you're eligible for.

Tip 5: File Electronically

Filing your NJ 1040 form electronically is the fastest and most convenient way to submit your tax return. The New Jersey Division of Taxation offers several e-file options, including:

- NJ WebFile

- Tax preparer e-file

- IRS Free File

E-filing reduces errors and ensures that your return is processed quickly.

Tip 6: Make Timely Payments

If you owe taxes, it's essential to make timely payments to avoid penalties and interest. You can pay online, by phone, or by mail. Make sure to keep records of your payment, including the payment date and amount.

Tip 7: Seek Professional Help

If you're unsure about any aspect of the NJ 1040 form filing process, consider seeking professional help. A tax professional can guide you through the process, ensure that you're taking advantage of all the credits and deductions you're eligible for, and help you avoid errors and penalties.

By following these 7 essential tips, you can ensure that you file your NJ 1040 form accurately and on time. Remember to gather all necessary documents, choose the correct filing status, take advantage of tax credits, claim your deductions, file electronically, make timely payments, and seek professional help if needed.

We hope this article has been informative and helpful. If you have any questions or need further guidance, please don't hesitate to ask.

What is the deadline for filing the NJ 1040 form?

+The deadline for filing the NJ 1040 form is typically April 15th.

Can I file my NJ 1040 form electronically?

+Yes, you can file your NJ 1040 form electronically through the New Jersey Division of Taxation's website or through a tax preparer.

What are the most common tax credits available in New Jersey?

+The most common tax credits available in New Jersey include the Earned Income Tax Credit (EITC), the Child and Dependent Care Credit, and the Education Credits (American Opportunity and Lifetime Learning).