The use of promissory notes has become increasingly popular in recent years, particularly among individuals and small businesses. A promissory note is a written agreement where one party (the borrower) promises to pay a sum of money to another party (the lender) under specific terms. This document is a crucial tool for lenders, as it provides a legally binding agreement that ensures the borrower will repay the loan.

In this article, we will explore the concept of promissory notes, their benefits, and provide five free promissory note templates that you can use today.

What is a Promissory Note?

A promissory note is a written promise to pay a sum of money to another party. It is a legally binding document that outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral or security. Promissory notes can be used for a variety of purposes, such as personal loans, business loans, or mortgages.

Benefits of Using a Promissory Note

Using a promissory note provides several benefits to both lenders and borrowers. Some of the key benefits include:

- Provides a clear and concise agreement: A promissory note outlines the terms of the loan, ensuring that both parties understand their obligations.

- Legally binding: A promissory note is a legally binding document, providing a level of security for lenders.

- Flexibility: Promissory notes can be customized to meet the specific needs of the parties involved.

- Protects lenders: A promissory note provides lenders with a level of protection, as it outlines the terms of the loan and ensures that the borrower will repay the loan.

Types of Promissory Notes

There are several types of promissory notes, including:

- Secured promissory note: This type of note is secured by collateral, such as a mortgage or car loan.

- Unsecured promissory note: This type of note is not secured by collateral, such as a personal loan.

- Demand promissory note: This type of note allows the lender to demand repayment at any time.

- Installment promissory note: This type of note requires the borrower to make regular payments, such as a mortgage or car loan.

5 Free Promissory Note Templates

Here are five free promissory note templates that you can use today:

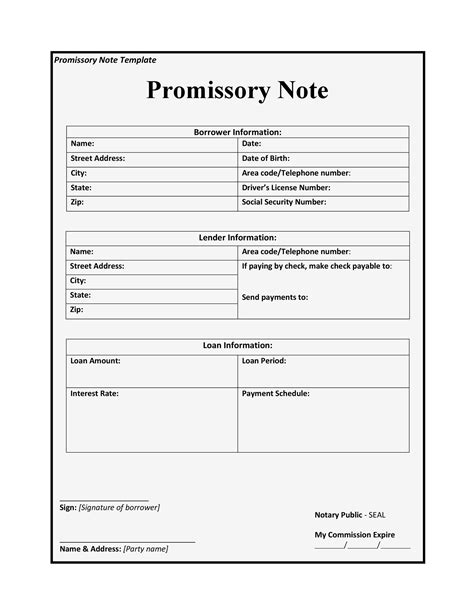

Template 1: Simple Promissory Note

This template provides a basic outline for a promissory note, including the borrower's and lender's information, the loan amount, interest rate, and repayment schedule.

Template 2: Secured Promissory Note

This template provides a more detailed outline for a secured promissory note, including the collateral and security information.

Template 3: Demand Promissory Note

This template provides a basic outline for a demand promissory note, including the lender's right to demand repayment at any time.

Template 4: Installment Promissory Note

This template provides a more detailed outline for an installment promissory note, including the regular payment schedule.

Template 5: Unsecured Promissory Note

This template provides a basic outline for an unsecured promissory note, including the borrower's and lender's information, the loan amount, and interest rate.

How to Use a Promissory Note Template

Using a promissory note template is a straightforward process. Here are the steps to follow:

- Choose a template: Select a template that meets your needs, such as a simple promissory note or a secured promissory note.

- Fill in the information: Fill in the borrower's and lender's information, the loan amount, interest rate, and repayment schedule.

- Customize the template: Customize the template to meet your specific needs.

- Sign the document: Sign the document and have the borrower sign it as well.

- Store the document: Store the document in a safe place, such as a file cabinet or safe.

Conclusion

A promissory note is a powerful tool for lenders and borrowers. It provides a clear and concise agreement, is legally binding, and offers flexibility. Using a promissory note template can help you create a customized document that meets your specific needs. By following the steps outlined in this article, you can use a promissory note template to create a binding agreement.

We encourage you to share your thoughts on promissory notes and how you have used them in your personal or professional life. Have you used a promissory note template before? What were your experiences? Share your comments below.

What is a promissory note?

+A promissory note is a written promise to pay a sum of money to another party.

What are the benefits of using a promissory note?

+Using a promissory note provides several benefits, including a clear and concise agreement, a legally binding document, flexibility, and protection for lenders.

How do I use a promissory note template?

+Using a promissory note template is a straightforward process. Choose a template, fill in the information, customize the template, sign the document, and store it in a safe place.