Are you planning to start a business in Harris County, Texas? One of the essential steps to establish your business is to file a DBA (Doing Business As) form, also known as an Assumed Name Certificate. This form allows you to operate your business under a fictitious name, which is different from your personal name. In this article, we will guide you through the 5 steps to file a Harris County DBA form.

What is a DBA Form?

A DBA form is a legal document that allows you to conduct business under a name that is different from your personal name. It is also known as a fictitious business name or assumed name. Filing a DBA form is a requirement for sole proprietorships, partnerships, and LLCs (Limited Liability Companies) that want to operate under a name that is different from the owner's name.

Why Do You Need to File a DBA Form?

Filing a DBA form is essential for several reasons:

- It allows you to open a business bank account under your business name.

- It helps to establish your business identity and credibility.

- It enables you to file taxes and obtain necessary licenses and permits.

- It protects your personal name and assets from business liabilities.

5 Steps to File a Harris County DBA Form

Filing a DBA form in Harris County is a straightforward process that can be completed in a few steps. Here are the 5 steps to file a Harris County DBA form:

Step 1: Choose Your Business Name

The first step is to choose a unique and distinctive business name that complies with Texas state laws. Your business name should not be similar to an existing business name, and it should not contain certain words that are prohibited by law.

To ensure that your business name is available, you can search the Texas Secretary of State's database.

Step 2: Prepare Your DBA Form

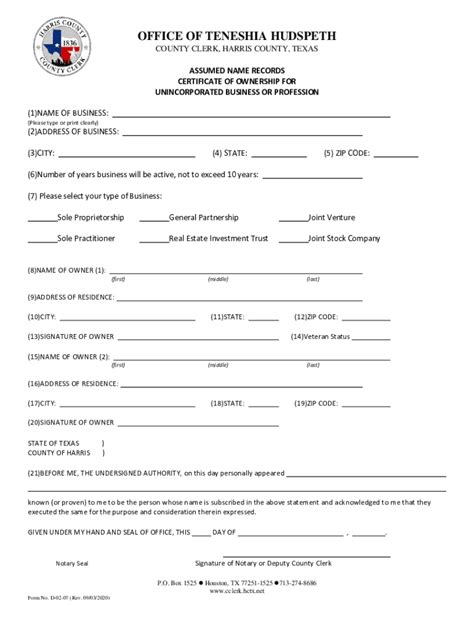

Once you have chosen your business name, you need to prepare your DBA form. You can download the Assumed Name Certificate form from the Harris County website or obtain it from the Harris County Clerk's office.

The form will require you to provide the following information:

- Your business name and address

- Your personal name and address

- The type of business you are operating (sole proprietorship, partnership, LLC, etc.)

- The duration of your business

Step 3: File Your DBA Form

After completing your DBA form, you need to file it with the Harris County Clerk's office. You can file the form in person or by mail.

The filing fee for a DBA form in Harris County is $27.50. You can pay the fee by cash, check, or credit card.

Step 4: Publish Your DBA Notice

After filing your DBA form, you need to publish a notice in a local newspaper. The notice should include your business name, address, and the fact that you have filed a DBA form.

The purpose of publishing a DBA notice is to inform the public that you are operating a business under a fictitious name.

Step 5: Obtain Any Necessary Licenses and Permits

Finally, you need to obtain any necessary licenses and permits to operate your business. These licenses and permits may include a sales tax permit, a food establishment permit, or a zoning permit.

You can obtain information about the necessary licenses and permits from the Harris County website or by contacting the Harris County Clerk's office.

What is the purpose of a DBA form?

+A DBA form allows you to operate your business under a fictitious name, which is different from your personal name.

How do I file a DBA form in Harris County?

+You can file a DBA form in person or by mail with the Harris County Clerk's office.

What is the filing fee for a DBA form in Harris County?

+The filing fee for a DBA form in Harris County is $27.50.

By following these 5 steps, you can file a Harris County DBA form and establish your business identity.