As a taxpayer, understanding the various forms and regulations set by the government is crucial for a smooth and hassle-free tax filing experience. One such form that has gained significant attention in recent years is the IT-204-LL form. If you're a limited liability company (LLC) owner or a business taxpayer, it's essential to grasp the intricacies of this form to ensure compliance with the tax laws. In this article, we'll delve into the six essential facts about the IT-204-LL form that you need to know.

What is the IT-204-LL Form?

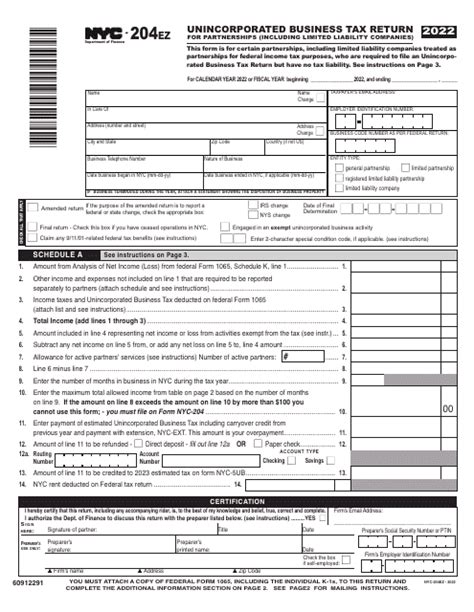

The IT-204-LL form is a tax form used by limited liability companies (LLCs) to report their business income and expenses to the New York State Department of Taxation and Finance. It's a crucial form for LLCs operating in New York, as it helps the state government to determine the tax liability of these businesses.

Who Needs to File the IT-204-LL Form?

Not all LLCs need to file the IT-204-LL form. According to the New York State Department of Taxation and Finance, only LLCs that are classified as partnerships or S corporations for federal income tax purposes need to file this form. If your LLC is classified as a sole proprietorship, you don't need to file the IT-204-LL form. However, it's essential to consult with a tax professional to determine the correct classification and filing requirements for your LLC.

What Information is Required on the IT-204-LL Form?

The IT-204-LL form requires LLCs to provide detailed information about their business income and expenses. Some of the key information required on the form includes:

- Business name and address

- Federal Employer Identification Number (FEIN)

- Business income and expenses

- Depreciation and amortization

- Tax credits and deductions

LLCs must also attach supporting schedules and statements to the form, including Schedule K-1 (Partner's Share of Income, Deductions, Credits, etc.) and Schedule D (Capital Gains and Losses).

How to File the IT-204-LL Form

The IT-204-LL form can be filed electronically or by mail. The New York State Department of Taxation and Finance recommends electronic filing, as it's faster and more convenient. LLCs can file the form through the department's website or through a tax professional. If filing by mail, the form should be sent to the address listed on the form.

When is the IT-204-LL Form Due?

The IT-204-LL form is due on the 15th day of the third month following the close of the LLC's tax year. For example, if the LLC's tax year ends on December 31st, the form is due on March 15th. If the LLC is unable to file by the deadline, it can request an automatic six-month extension by filing Form IT-204-LL-E.

Penalties for Not Filing the IT-204-LL Form

Failure to file the IT-204-LL form or filing it late can result in penalties and interest. The New York State Department of Taxation and Finance may impose a penalty of up to $100 per month, up to a maximum of $500, for failure to file the form. Additionally, interest may be charged on any unpaid tax liability.

Conclusion

The IT-204-LL form is a critical tax form for LLCs operating in New York. By understanding the requirements and deadlines for filing this form, LLCs can ensure compliance with the tax laws and avoid penalties. It's essential to consult with a tax professional to ensure accurate and timely filing of the IT-204-LL form.

We hope this article has provided you with a comprehensive understanding of the IT-204-LL form. If you have any questions or concerns, please don't hesitate to comment below. Share this article with your friends and colleagues who may benefit from this information.

What is the purpose of the IT-204-LL form?

+The IT-204-LL form is used by limited liability companies (LLCs) to report their business income and expenses to the New York State Department of Taxation and Finance.

Who needs to file the IT-204-LL form?

+Only LLCs that are classified as partnerships or S corporations for federal income tax purposes need to file the IT-204-LL form.

What is the deadline for filing the IT-204-LL form?

+The IT-204-LL form is due on the 15th day of the third month following the close of the LLC's tax year.