In the state of Pennsylvania, the Department of Transportation, also known as PennDOT, is responsible for handling vehicle-related transactions, including sales tax. The PA Form MV-4ST is a crucial document for vehicle buyers and sellers, as it pertains to the sales tax exemption or reduction for certain types of vehicle transactions. In this article, we will delve into the details of the PA Form MV-4ST, its purpose, and its application process.

What is the PA Form MV-4ST?

The PA Form MV-4ST is a document used to claim an exemption or reduction from the 6% sales tax on vehicle purchases in Pennsylvania. This form is typically used in situations where the vehicle is being transferred between family members, or when a vehicle is being sold to a non-resident of Pennsylvania.

Purpose of the PA Form MV-4ST

The primary purpose of the PA Form MV-4ST is to provide a mechanism for vehicle buyers and sellers to claim an exemption or reduction from the sales tax. This form helps to ensure that the correct amount of sales tax is paid on vehicle transactions, and it also helps to prevent fraud and abuse of the sales tax exemption.

Eligibility for Exemption or Reduction

To be eligible for an exemption or reduction from the sales tax, the vehicle transaction must meet certain criteria. Some of the common scenarios where an exemption or reduction may be applicable include:

- Transfer of a vehicle between family members, such as a parent to a child or a spouse to a spouse

- Sale of a vehicle to a non-resident of Pennsylvania

- Sale of a vehicle to a business or organization that is exempt from sales tax

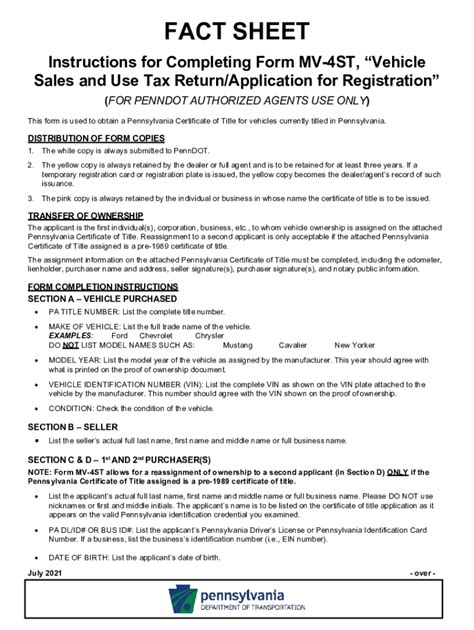

Application Process for PA Form MV-4ST

To apply for an exemption or reduction from the sales tax using the PA Form MV-4ST, the buyer and seller must follow these steps:

- Obtain the PA Form MV-4ST from the PennDOT website or from a local notary public

- Complete the form in its entirety, including the vehicle information, buyer and seller information, and the reason for the exemption or reduction

- Sign the form in the presence of a notary public

- Attach any required supporting documentation, such as proof of family relationship or business exemption

- Submit the form to the PennDOT along with the vehicle title and any other required documentation

Benefits of the PA Form MV-4ST

The PA Form MV-4ST provides several benefits to vehicle buyers and sellers, including:

- Exemption or reduction from the 6% sales tax on vehicle purchases

- Simplified application process for exempt or reduced sales tax

- Prevention of fraud and abuse of the sales tax exemption

- Clear documentation of the vehicle transaction and sales tax exemption or reduction

Common Mistakes to Avoid

When completing the PA Form MV-4ST, it's essential to avoid common mistakes that can lead to delays or rejection of the application. Some of the most common mistakes to avoid include:

- Incomplete or inaccurate information on the form

- Failure to sign the form in the presence of a notary public

- Failure to attach required supporting documentation

- Submission of the form with incorrect or incomplete vehicle information

Conclusion

In conclusion, the PA Form MV-4ST is a crucial document for vehicle buyers and sellers in Pennsylvania. By understanding the purpose, eligibility, and application process for this form, individuals can ensure a smooth and hassle-free vehicle transaction. Remember to avoid common mistakes and follow the guidelines outlined in this article to ensure a successful application.

Call to Action

If you have any questions or concerns about the PA Form MV-4ST or the vehicle sales tax exemption process, please don't hesitate to reach out to us. We're here to help you navigate the process and ensure a successful transaction.

What is the purpose of the PA Form MV-4ST?

+The PA Form MV-4ST is used to claim an exemption or reduction from the 6% sales tax on vehicle purchases in Pennsylvania.

Who is eligible for an exemption or reduction from the sales tax?

+Individuals who meet certain criteria, such as transfer of a vehicle between family members or sale of a vehicle to a non-resident of Pennsylvania, may be eligible for an exemption or reduction from the sales tax.

What documentation is required to support the PA Form MV-4ST application?

+Required documentation may include proof of family relationship, business exemption, or other supporting documentation as outlined in the application process.