The thrill of tax season! As individuals and businesses prepare to file their tax returns, two forms often come into play: Form 8879 and Form 1040. While they're both crucial in the tax filing process, they serve distinct purposes. Let's break down the differences and similarities between these two essential tax forms.

What is Form 1040?

Form 1040, also known as the U.S. Individual Income Tax Return, is the standard form used by individuals to file their personal income tax returns with the Internal Revenue Service (IRS). It's the main form used to report income, claim deductions and credits, and calculate tax liability. Form 1040 is typically filed annually by April 15th of each year.

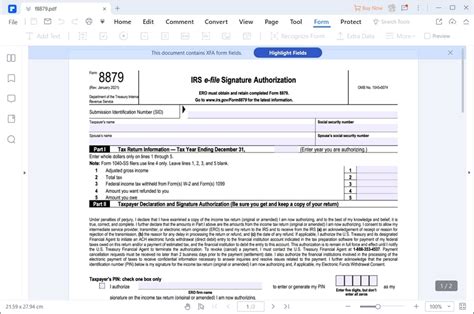

What is Form 8879?

Form 8879, also known as the IRS e-file Signature Authorization, is a supplemental form used to authenticate an individual's or business's identity when e-filing their tax return. This form is required when using tax software or a tax professional to e-file a tax return, as it ensures the return is submitted with the taxpayer's explicit consent.

Key differences between Form 8879 and Form 1040:

- Purpose: Form 1040 is used to report income and calculate tax liability, while Form 8879 is used to authorize and authenticate the e-filing of a tax return.

- Content: Form 1040 requires detailed information about income, deductions, credits, and tax liability, whereas Form 8879 only requests basic taxpayer information, such as name, Social Security number or Individual Taxpayer Identification Number (ITIN), and e-file PIN.

- Submission: Form 1040 is submitted directly to the IRS, either electronically or by mail, whereas Form 8879 is typically submitted through tax software or a tax professional's system, which then forwards the authorization to the IRS.

- Timing: Form 1040 is usually filed by April 15th of each year, while Form 8879 is typically submitted at the same time as the tax return, but it can also be submitted separately if needed.

Similarities between Form 8879 and Form 1040:

- Tax filing process: Both forms are integral to the tax filing process, as Form 1040 is the primary form for reporting income and tax liability, and Form 8879 authenticates the e-filing of that return.

- IRS requirements: Both forms are required by the IRS for tax compliance, and failure to submit either form may result in delays or penalties.

- Electronic submission: Both forms can be submitted electronically, which helps streamline the tax filing process and reduces errors.

In conclusion

While Form 8879 and Form 1040 are two distinct forms, they work together to facilitate the tax filing process. Form 1040 is the primary form for reporting income and tax liability, while Form 8879 authenticates the e-filing of that return. Understanding the differences and similarities between these forms can help individuals and businesses navigate the tax filing process more efficiently.

Do you have any questions about Form 8879 or Form 1040? Share them in the comments below!

How to Fill Out Form 8879

Filling out Form 8879 is a straightforward process that requires basic taxpayer information. Here's a step-by-step guide:

Step 1: Gather required information Collect your:

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- E-file PIN (if you have one)

- Name and address

Step 2: Complete Form 8879

- Enter your name and Social Security number or ITIN in the designated fields.

- Provide your e-file PIN, if you have one.

- Sign and date the form.

Step 3: Submit Form 8879

- Attach Form 8879 to your tax return (Form 1040) if you're filing electronically.

- If you're using tax software, follow the software's instructions to submit Form 8879.

- If you're filing by mail, include Form 8879 with your tax return.

Common Mistakes to Avoid When Filing Form 8879

To ensure a smooth tax filing process, avoid these common mistakes:

- Incorrect Social Security number or ITIN: Double-check your number to avoid errors.

- Incorrect e-file PIN: Verify your PIN to avoid delays.

- Unsigned or undated form: Make sure to sign and date the form to authenticate your submission.

- Incomplete information: Ensure all required fields are completed to avoid rejection.

By following these tips and understanding the purpose of Form 8879, you can ensure a successful tax filing experience.

FAQs

Q: Can I submit Form 8879 separately from my tax return? A: Yes, you can submit Form 8879 separately if needed, but it's recommended to submit it with your tax return to avoid delays.

Q: Do I need to complete Form 8879 if I'm filing by mail? A: No, Form 8879 is only required for e-filing. If you're filing by mail, you don't need to complete this form.

Q: Can I use Form 8879 for multiple tax returns? A: No, each tax return requires a separate Form 8879. You'll need to complete a new form for each return.

What is the purpose of Form 8879?

+Form 8879 is used to authenticate an individual's or business's identity when e-filing their tax return.

Can I submit Form 8879 electronically?

+Yes, Form 8879 can be submitted electronically through tax software or a tax professional's system.

Do I need to complete Form 8879 if I'm filing an amended return?

+No, Form 8879 is not required for amended returns.