Filing taxes as a partnership can be a complex process, but understanding the requirements and instructions for Form IL 1065 can help make it more manageable. As a partnership, it's essential to comply with the Illinois state tax laws and file your annual return accurately to avoid any penalties or fines.

What is Form IL 1065?

Who Must File Form IL 1065?

All partnerships, including general partnerships, limited partnerships, and limited liability partnerships (LLPs), must file Form IL 1065 if they have Illinois-source income or have a partner who is an Illinois resident. This includes partnerships that have:- Illinois-source income, such as income from real estate, tangible personal property, or intangible personal property

- A partner who is an Illinois resident

- A business operation in Illinois

- Assets or property located in Illinois

Exceptions to Filing Form IL 1065

Some partnerships are exempt from filing Form IL 1065, including:- Single-member limited liability companies (LLCs) that are treated as disregarded entities for federal tax purposes

- Limited liability companies (LLCs) that are treated as S corporations for federal tax purposes

- Partnerships that have no Illinois-source income and no Illinois resident partners

Filing Requirements for Form IL 1065

Form IL 1065 must be filed by April 15th of each year, or the next business day if April 15th falls on a weekend or holiday. If the partnership is unable to file by the deadline, it can request an automatic six-month extension by filing Form IL 1065-EXT.Information Required for Form IL 1065

To complete Form IL 1065, the partnership will need to provide the following information:- Partnership name, address, and federal employer identification number (FEIN)

- List of partners, including their names, addresses, and Social Security numbers or FEINs

- Statement of income, deductions, and credits, including a detailed schedule of items such as:

- Gross income from sales, services, and other sources

- Cost of goods sold and operating expenses

- Depreciation and amortization

- Interest and dividends

- Capital gains and losses

- Tax credits and deductions

Instructions for Completing Form IL 1065

To complete Form IL 1065, follow these steps:- Gather all necessary information and documentation, including financial statements, schedules, and supporting documents.

- Complete the partnership information section, including the partnership name, address, and FEIN.

- List all partners, including their names, addresses, and Social Security numbers or FEINs.

- Complete the statement of income, deductions, and credits, including all required schedules and supporting documents.

- Calculate the partnership's Illinois-source income and credits, and complete the corresponding schedules.

- Sign and date the return, and include any required supporting documentation.

Supporting Documentation Required

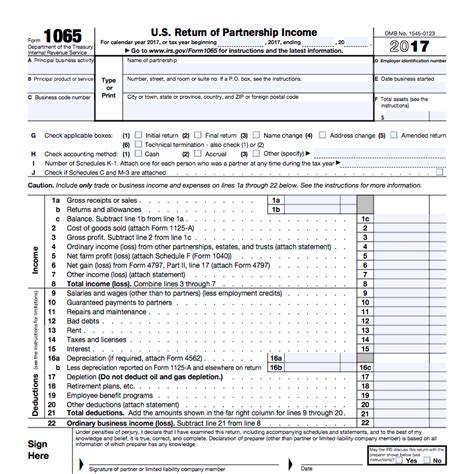

The partnership must include the following supporting documentation with Form IL 1065:- A copy of the partnership's federal return (Form 1065)

- A copy of the partnership's Schedule K-1 (Form 1065)

- A detailed schedule of income, deductions, and credits

- Supporting documentation for any claimed credits or deductions

Penalties for Failure to File Form IL 1065

Failure to file Form IL 1065 or failure to pay any tax due can result in penalties and fines, including:- A penalty of $100 per month or part of a month, up to a maximum of $500, for failure to file the return

- A penalty of 10% of the tax due, plus interest, for failure to pay the tax

- A penalty of $100 per partner, per month, or part of a month, up to a maximum of $500 per partner, for failure to provide a Schedule K-1 (Form 1065)

Conclusion

Filing Form IL 1065 is a critical step in complying with Illinois state tax laws. By understanding the requirements and instructions for completing the form, partnerships can ensure they meet the deadline and avoid any penalties or fines. If you have any questions or concerns about filing Form IL 1065, it's recommended that you consult with a tax professional or contact the Illinois Department of Revenue for guidance.What is the deadline for filing Form IL 1065?

+The deadline for filing Form IL 1065 is April 15th of each year, or the next business day if April 15th falls on a weekend or holiday.

Who must file Form IL 1065?

+All partnerships, including general partnerships, limited partnerships, and limited liability partnerships (LLPs), must file Form IL 1065 if they have Illinois-source income or have a partner who is an Illinois resident.

What is the penalty for failure to file Form IL 1065?

+The penalty for failure to file Form IL 1065 is $100 per month or part of a month, up to a maximum of $500, plus interest and any applicable penalties for failure to pay the tax due.