Navigating the complexities of small business administration (SBA) forms can be a daunting task, especially for entrepreneurs who are new to the world of business financing. One of the most crucial forms for small business owners seeking SBA loan guarantees is the SBA Form 1919. This form, also known as the "Borrower Information Form," plays a pivotal role in the loan application process, as it provides the SBA with essential information about the borrower and their business. In this article, we will break down the SBA Form 1919 into five easy steps, making it simpler for small business owners to fill out the form accurately and efficiently.

Understanding the Importance of SBA Form 1919

Before diving into the steps to fill out the SBA Form 1919, it's essential to understand the significance of this form in the SBA loan application process. The SBA Form 1919 is used by the SBA to gather critical information about the borrower, including their business and personal financial history, creditworthiness, and loan repayment capacity. This information helps the SBA determine whether the borrower qualifies for an SBA loan guarantee.

What Information Does SBA Form 1919 Require?

SBA Form 1919 requires a wide range of information, including:

- Business information (business name, address, tax ID number, etc.)

- Personal information (name, social security number, date of birth, etc.)

- Financial information (annual revenues, net income, etc.)

- Credit information (credit scores, outstanding debts, etc.)

- Loan information (loan amount, interest rate, repayment terms, etc.)

Step 1: Gather Required Documents and Information

Before starting to fill out the SBA Form 1919, it's crucial to gather all the required documents and information. This includes:

- Business license

- Tax returns (personal and business)

- Financial statements (balance sheet, income statement, etc.)

- Credit reports

- Loan documents (loan application, loan agreement, etc.)

Having all the necessary documents and information readily available will make the process of filling out the SBA Form 1919 much smoother and less time-consuming.

Tips for Gathering Documents and Information

- Make sure to gather all the required documents and information in advance to avoid delays in the loan application process.

- Verify the accuracy of all the documents and information to ensure that the SBA Form 1919 is filled out correctly.

- Keep all the documents and information organized and easily accessible.

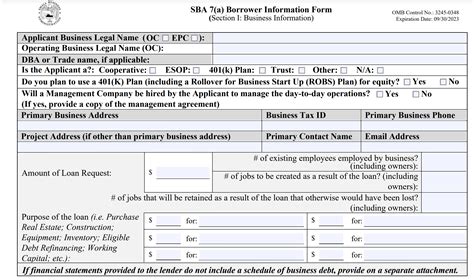

Step 2: Fill Out Section 1: Borrower Information

Section 1 of the SBA Form 1919 requires information about the borrower, including their name, social security number, date of birth, and address. This section also asks for information about the borrower's business, including the business name, address, and tax ID number.

Tips for Filling Out Section 1

- Make sure to fill out all the required fields in Section 1 accurately and completely.

- Verify the accuracy of all the information provided in Section 1 to ensure that the SBA Form 1919 is filled out correctly.

- Use the correct business name and tax ID number to avoid any confusion or delays in the loan application process.

Step 3: Fill Out Section 2: Business Information

Section 2 of the SBA Form 1919 requires information about the borrower's business, including the type of business, annual revenues, and net income. This section also asks for information about the business's ownership structure and management team.

Tips for Filling Out Section 2

- Make sure to fill out all the required fields in Section 2 accurately and completely.

- Verify the accuracy of all the information provided in Section 2 to ensure that the SBA Form 1919 is filled out correctly.

- Use the correct financial statements and tax returns to support the information provided in Section 2.

Step 4: Fill Out Section 3: Financial Information

Section 3 of the SBA Form 1919 requires information about the borrower's financial situation, including their credit score, outstanding debts, and loan repayment history. This section also asks for information about the borrower's collateral and other financial obligations.

Tips for Filling Out Section 3

- Make sure to fill out all the required fields in Section 3 accurately and completely.

- Verify the accuracy of all the information provided in Section 3 to ensure that the SBA Form 1919 is filled out correctly.

- Use the correct credit reports and financial statements to support the information provided in Section 3.

Step 5: Review and Sign the SBA Form 1919

Once all the sections of the SBA Form 1919 have been filled out, it's essential to review the form carefully to ensure that all the information is accurate and complete. The borrower must then sign the form, certifying that all the information provided is true and accurate.

Tips for Reviewing and Signing the SBA Form 1919

- Make sure to review the SBA Form 1919 carefully to ensure that all the information is accurate and complete.

- Verify the accuracy of all the information provided in the SBA Form 1919 to ensure that the loan application process is not delayed.

- Sign the SBA Form 1919, certifying that all the information provided is true and accurate.

Conclusion

Filling out the SBA Form 1919 can seem like a daunting task, but by breaking it down into five easy steps, small business owners can ensure that the form is filled out accurately and efficiently. Remember to gather all the required documents and information, fill out each section carefully, and review and sign the form before submitting it. By following these steps, small business owners can increase their chances of approval for an SBA loan guarantee.

What is the purpose of SBA Form 1919?

+The SBA Form 1919 is used by the SBA to gather critical information about the borrower, including their business and personal financial history, creditworthiness, and loan repayment capacity.

What documents are required to fill out SBA Form 1919?

+The required documents include business license, tax returns (personal and business), financial statements (balance sheet, income statement, etc.), credit reports, and loan documents (loan application, loan agreement, etc.).

How long does it take to fill out SBA Form 1919?

+The time it takes to fill out SBA Form 1919 can vary depending on the complexity of the borrower's financial situation and the availability of required documents. On average, it can take several hours to several days to complete the form.