Filling out tax forms can be a daunting task, especially for those who are new to the process. The Connecticut Withholding Certificate for Pension or Annuity Payments (Form CT-W4P) is a crucial document that ensures accurate tax withholding from pension or annuity payments. In this article, we will explore five ways to fill out Form CT-W4P, providing you with a comprehensive guide to make the process smoother.

Understanding Form CT-W4P

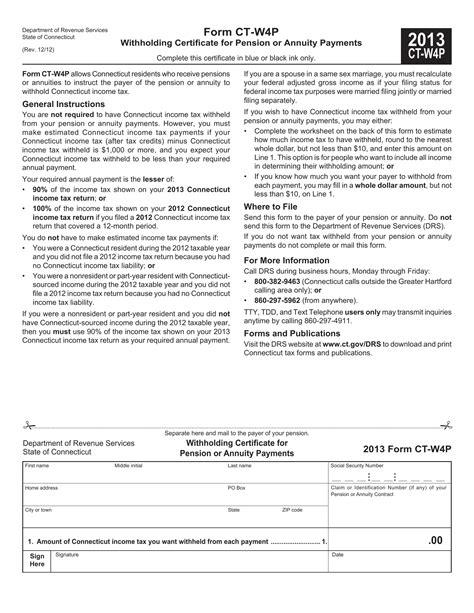

Before we dive into the ways to fill out Form CT-W4P, it's essential to understand what this form is and why it's necessary. Form CT-W4P is used by payers of pension or annuity payments to determine the amount of Connecticut state income tax to withhold from these payments. The form allows recipients to claim exemptions or specify the amount of tax to be withheld.

Why is Form CT-W4P Important?

Form CT-W4P is crucial for several reasons:

- It ensures accurate tax withholding, which helps avoid underpayment or overpayment of taxes.

- It provides recipients with control over their tax withholding, allowing them to claim exemptions or specify the amount of tax to be withheld.

- It helps payers comply with Connecticut state tax regulations.

5 Ways to Fill Out Form CT-W4P

Now that we understand the importance of Form CT-W4P, let's explore the five ways to fill it out:

1. Claim Exemption from Withholding

If you are exempt from Connecticut state income tax, you can claim exemption from withholding on Form CT-W4P. To do this:

- Check the box on Line 1, "Exempt from Connecticut state income tax withholding."

- Provide your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

2. Specify the Amount of Tax to be Withheld

If you want to specify the amount of tax to be withheld, you can do so on Form CT-W4P. To do this:

- Check the box on Line 2, "Specify the amount of Connecticut state income tax withholding."

- Enter the amount of tax you want to be withheld per payment on Line 3.

3. Claim a Reduced Rate of Withholding

If you want to claim a reduced rate of withholding, you can do so on Form CT-W4P. To do this:

- Check the box on Line 4, "Claim a reduced rate of Connecticut state income tax withholding."

- Enter the reduced rate percentage on Line 5.

4. Claim a Different Filing Status

If your filing status has changed, you can claim a different filing status on Form CT-W4P. To do this:

- Check the box on Line 6, "Claim a different filing status for Connecticut state income tax withholding."

- Enter your new filing status on Line 7.

5. Revise a Previous Form CT-W4P

If you need to revise a previous Form CT-W4P, you can do so by completing a new form and checking the box on Line 8, "Revised form." Make sure to provide your name, address, and Social Security number or ITIN.

Tips and Reminders

Here are some tips and reminders to keep in mind when filling out Form CT-W4P:

- Make sure to sign and date the form.

- Keep a copy of the completed form for your records.

- If you need help, consult the instructions or contact the Connecticut Department of Revenue Services.

- Submit the completed form to the payer of your pension or annuity payments.

Conclusion

Filling out Form CT-W4P can seem daunting, but by following these five ways, you can ensure accurate tax withholding from your pension or annuity payments. Remember to keep a copy of the completed form for your records and submit it to the payer of your payments. If you have any questions or need help, don't hesitate to consult the instructions or contact the Connecticut Department of Revenue Services.

Take Action

If you have any questions or need help filling out Form CT-W4P, share your concerns in the comments below. We'd be happy to help you navigate the process. Don't forget to share this article with friends and family who may need assistance with Form CT-W4P.

What is Form CT-W4P used for?

+Form CT-W4P is used by payers of pension or annuity payments to determine the amount of Connecticut state income tax to withhold from these payments.

Can I claim exemption from withholding on Form CT-W4P?

+Yes, if you are exempt from Connecticut state income tax, you can claim exemption from withholding on Form CT-W4P.

How do I specify the amount of tax to be withheld on Form CT-W4P?

+To specify the amount of tax to be withheld, check the box on Line 2 and enter the amount of tax you want to be withheld per payment on Line 3.