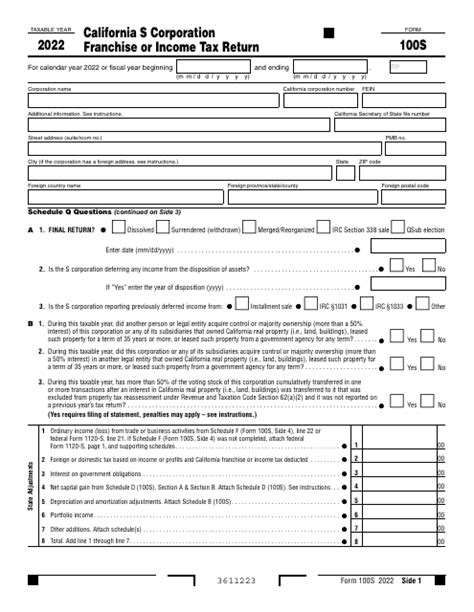

As a business owner in California, it's essential to understand the state's tax laws and filing requirements. One of the most critical tax forms for California businesses is the California Form 100, also known as the California Corporation Franchise or Income Tax Return. In this article, we'll delve into the world of California Form 100s, exploring the filing requirements, guidelines, and everything you need to know to stay compliant.

The California Form 100 is used by corporations, S corporations, and limited liability companies (LLCs) to report their income, deductions, and credits. It's crucial to file this form accurately and on time to avoid penalties and fines. In this article, we'll break down the filing requirements, guidelines, and provide valuable insights to help you navigate the complex world of California taxation.

Who Needs to File California Form 100?

The California Form 100 is required for:

- Corporations: All corporations, including C corporations and S corporations, must file Form 100.

- S Corporations: S corporations must file Form 100 and attach a copy of their federal Form 1120S.

- Limited Liability Companies (LLCs): LLCs must file Form 100 if they are classified as corporations for federal tax purposes.

- Partnerships: Partnerships are not required to file Form 100, but they must file Form 565, Partnership Return of Income.

Filing Requirements for California Form 100

To file California Form 100, you'll need to gather the following information:

- Federal Employer Identification Number (FEIN)

- California Corporation Number

- Business name and address

- Tax year ending date

- Gross income

- Deductions and credits

- Federal income tax return (Form 1120 or Form 1120S)

You can file California Form 100 electronically through the California Franchise Tax Board's (FTB) website or by mail. The FTB recommends e-filing, as it's faster and more secure.

Guidelines for Filing California Form 100

Here are some essential guidelines to keep in mind when filing California Form 100:

- Tax Year: The tax year for California Form 100 is the same as the federal tax year. For most businesses, this is a calendar year (January 1 to December 31).

- Filing Deadline: The filing deadline for California Form 100 is the 15th day of the 4th month after the tax year ends. For calendar-year filers, this is April 15th.

- Payment: You can pay your tax liability online, by phone, or by mail. The FTB accepts payment by credit card, debit card, or electronic funds transfer.

- Amended Returns: If you need to amend your California Form 100, you'll need to file Form 100X. You can file an amended return electronically or by mail.

Common Mistakes to Avoid When Filing California Form 100

When filing California Form 100, it's essential to avoid common mistakes that can lead to delays, penalties, or even audits. Here are some common mistakes to watch out for:

- Inaccurate or incomplete information: Make sure you provide accurate and complete information on your return.

- Missing or incorrect schedules: Ensure you attach all required schedules, such as Schedule K-1 or Schedule D.

- Incorrect tax year: Double-check that you're filing for the correct tax year.

- Late payment: Pay your tax liability on time to avoid penalties and interest.

Penalties and Fines for Late or Inaccurate Filings

If you fail to file California Form 100 or make an inaccurate filing, you may be subject to penalties and fines. The FTB imposes the following penalties:

- Late filing penalty: 5% of the unpaid tax liability for each month or part of a month, up to a maximum of 25%.

- Late payment penalty: 5% of the unpaid tax liability for each month or part of a month, up to a maximum of 25%.

- Accuracy-related penalty: 20% of the underpayment or understatement.

Conclusion and Next Steps

Filing California Form 100 is a critical requirement for California businesses. By understanding the filing requirements, guidelines, and common mistakes to avoid, you can ensure a smooth and accurate filing process. If you're unsure about any aspect of the filing process, consider consulting a tax professional or seeking guidance from the FTB.

Remember to file your California Form 100 on time and accurately to avoid penalties and fines. Stay compliant, and you'll be well on your way to navigating the complex world of California taxation.

What is the deadline for filing California Form 100?

+The filing deadline for California Form 100 is the 15th day of the 4th month after the tax year ends. For calendar-year filers, this is April 15th.

Can I file California Form 100 electronically?

+Yes, you can file California Form 100 electronically through the California Franchise Tax Board's (FTB) website.

What are the penalties for late or inaccurate filings?

+The FTB imposes penalties for late or inaccurate filings, including a late filing penalty, late payment penalty, and accuracy-related penalty.