The beautiful state of Hawaii, known for its stunning beaches, lush greenery, and active volcanoes. But, as a business owner or individual, you know that even in paradise, taxes are inevitable. One of the most important tax forms in Hawaii is the G-45, also known as the General Excise Tax Return. In this article, we'll delve into the world of the G-45, providing you with a free fillable template and a comprehensive guide to help you navigate this essential tax form.

Understanding the Hawaii G-45 Tax Form

The G-45 is a tax form used by businesses and individuals in Hawaii to report and pay General Excise Tax (GET). The GET is a tax on the gross income of businesses, including sales, services, and rentals. It's similar to a sales tax, but instead of being collected from customers, it's paid by the business itself.

Who Needs to File the G-45?

Not everyone in Hawaii needs to file the G-45. You'll need to file this tax form if you're a business or individual with a tax liability of $100 or more. This includes:

- Businesses with a gross income of $100,000 or more

- Individuals with a gross income of $100,000 or more

- Businesses and individuals with a tax liability of $100 or more

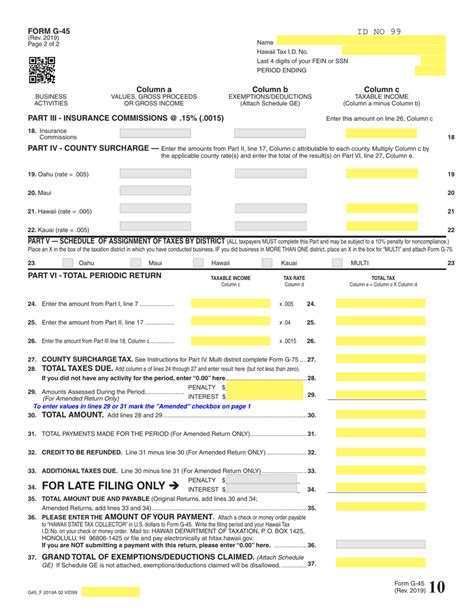

Filling Out the G-45 Tax Form

Filling out the G-45 tax form can be a bit daunting, but don't worry, we've got you covered. Here's a step-by-step guide to help you navigate the form:

- Identify Your Taxpayer Information: Enter your taxpayer identification number, name, and address.

- Report Your Gross Income: Report your total gross income from all sources, including sales, services, and rentals.

- Calculate Your Tax Liability: Calculate your tax liability based on your gross income and tax rate.

- Report Your Deductions and Credits: Report any deductions and credits you're eligible for.

- Sign and Date the Form: Sign and date the form, and don't forget to include your contact information.

G-45 Tax Form Schedules

The G-45 tax form has several schedules that you may need to complete, depending on your specific situation. These schedules include:

- Schedule A: Additional Taxes and Penalties

- Schedule B: Credits and Refunds

- Schedule C: Gross Income from Sales and Services

- Schedule D: Gross Income from Rentals

Free Fillable G-45 Tax Form Template

We've created a free fillable G-45 tax form template to help make the filing process easier for you. You can download the template below and fill it out electronically or print it out and fill it out by hand.

[Insert link to free fillable G-45 tax form template]

G-45 Tax Form Due Dates

The G-45 tax form is due on the 20th day of the month following the end of the tax period. For example, if you're filing for the first quarter of the year (January 1 - March 31), your G-45 tax form is due on April 20th.

Paying Your G-45 Tax Liability

You can pay your G-45 tax liability online, by phone, or by mail. Here are the payment options:

- Online: You can pay online through the Hawaii Department of Taxation's website.

- Phone: You can pay by phone by calling the Hawaii Department of Taxation at (808) 587-4242.

- Mail: You can pay by mail by sending a check or money order to the Hawaii Department of Taxation.

Penalties and Interest for Late Payment

If you fail to pay your G-45 tax liability on time, you may be subject to penalties and interest. The penalty for late payment is 10% of the unpaid tax liability, plus interest at a rate of 1% per month.

Conclusion

Filing the G-45 tax form can be a complex process, but with the right guidance, you can navigate it with ease. Remember to file your G-45 tax form on time, and pay your tax liability to avoid penalties and interest. If you have any questions or concerns, don't hesitate to reach out to the Hawaii Department of Taxation.

We hope this article has provided you with a comprehensive guide to the G-45 tax form. If you have any questions or comments, please leave them below.

What is the purpose of the G-45 tax form?

+The G-45 tax form is used to report and pay General Excise Tax (GET) in Hawaii.

Who needs to file the G-45 tax form?

+Businesses and individuals with a tax liability of $100 or more need to file the G-45 tax form.

What is the due date for the G-45 tax form?

+The G-45 tax form is due on the 20th day of the month following the end of the tax period.