Arizona's Maricopa County is known for its scenic beauty, rich history, and unique laws governing property inheritance. One such law that stands out is the Arizona Beneficiary Deed, also known as the "Beneficiary Deed" or "Transfer on Death Deed." This type of deed allows property owners to transfer their real estate to designated beneficiaries upon their death, avoiding probate and ensuring a smoother inheritance process.

In Maricopa County, the Beneficiary Deed is a popular choice among property owners who want to plan for the future and ensure that their loved ones receive their assets without unnecessary hassle. In this article, we will explore five ways to use the Arizona Maricopa County Beneficiary Deed Form effectively.

Understanding the Arizona Beneficiary Deed

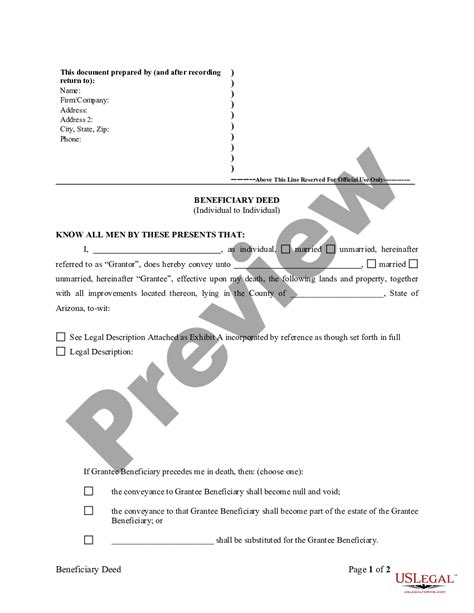

Before we dive into the uses of the Arizona Maricopa County Beneficiary Deed Form, it's essential to understand what it is and how it works. A Beneficiary Deed is a type of deed that allows a property owner to transfer their real estate to designated beneficiaries upon their death. This type of deed is also known as a "Transfer on Death Deed" or "TOD Deed."

The Arizona Beneficiary Deed Form is a simple and effective way to transfer property to beneficiaries without the need for probate. When a property owner records a Beneficiary Deed, they are essentially creating a contract that transfers their property to their designated beneficiaries upon their death.

Key Benefits of the Arizona Beneficiary Deed

The Arizona Beneficiary Deed offers several benefits to property owners, including:

• Avoiding probate: By using a Beneficiary Deed, property owners can avoid the costly and time-consuming probate process. • Ensuring a smooth inheritance process: Beneficiary Deeds ensure that property is transferred to beneficiaries quickly and efficiently. • Flexibility: Beneficiary Deeds can be revoked or changed at any time, giving property owners flexibility in their estate planning.

5 Ways to Use the Arizona Maricopa County Beneficiary Deed Form

Now that we understand the basics of the Arizona Beneficiary Deed, let's explore five ways to use the Arizona Maricopa County Beneficiary Deed Form effectively.

1. Transfer Property to Family Members

One of the most common uses of the Arizona Beneficiary Deed is to transfer property to family members. Property owners can use a Beneficiary Deed to transfer their real estate to their spouse, children, or other family members upon their death. This ensures that their loved ones receive their property without the need for probate.

For example, let's say John owns a home in Maricopa County and wants to transfer it to his daughter, Emily, upon his death. John can record a Beneficiary Deed naming Emily as the beneficiary. When John passes away, the property will automatically transfer to Emily, avoiding probate and ensuring a smooth inheritance process.

2. Transfer Property to Friends or Charities

Property owners can also use a Beneficiary Deed to transfer their real estate to friends or charities. This can be a great way to support a favorite charity or leave a legacy for a friend.

For example, let's say Sarah owns a vacation home in Maricopa County and wants to transfer it to her favorite charity upon her death. Sarah can record a Beneficiary Deed naming the charity as the beneficiary. When Sarah passes away, the property will automatically transfer to the charity, supporting their cause.

3. Plan for the Future of a Business

Business owners can also use a Beneficiary Deed to plan for the future of their business. By transferring ownership of business property to beneficiaries, business owners can ensure that their business continues to thrive even after they're gone.

For example, let's say Michael owns a small business in Maricopa County and wants to transfer ownership of the business property to his partner, David, upon his death. Michael can record a Beneficiary Deed naming David as the beneficiary. When Michael passes away, the property will automatically transfer to David, ensuring the business continues to operate smoothly.

4. Reduce Estate Taxes

Using a Beneficiary Deed can also help reduce estate taxes. By transferring property to beneficiaries upon death, property owners can avoid the need for probate and reduce the amount of taxes owed on their estate.

For example, let's say James owns a large estate in Maricopa County and wants to transfer it to his beneficiaries upon his death. By using a Beneficiary Deed, James can avoid the need for probate and reduce the amount of taxes owed on his estate.

5. Ensure a Smooth Inheritance Process for Out-of-State Beneficiaries

Finally, property owners can use a Beneficiary Deed to ensure a smooth inheritance process for out-of-state beneficiaries. By transferring property to beneficiaries upon death, property owners can avoid the need for probate and ensure that their out-of-state beneficiaries receive their inheritance quickly and efficiently.

For example, let's say Karen owns a home in Maricopa County and wants to transfer it to her niece, who lives in California, upon her death. By using a Beneficiary Deed, Karen can ensure that her niece receives the property quickly and efficiently, without the need for probate.

Conclusion

In conclusion, the Arizona Maricopa County Beneficiary Deed Form is a powerful tool for property owners who want to plan for the future and ensure a smooth inheritance process. By understanding the benefits and uses of the Beneficiary Deed, property owners can make informed decisions about their estate planning and ensure that their loved ones receive their assets without unnecessary hassle.

We hope this article has been informative and helpful. If you have any questions or would like to learn more about the Arizona Beneficiary Deed, please don't hesitate to comment below.

What is an Arizona Beneficiary Deed?

+An Arizona Beneficiary Deed is a type of deed that allows a property owner to transfer their real estate to designated beneficiaries upon their death.

How does a Beneficiary Deed work?

+A Beneficiary Deed works by creating a contract that transfers a property owner's real estate to their designated beneficiaries upon their death.

What are the benefits of using a Beneficiary Deed?

+The benefits of using a Beneficiary Deed include avoiding probate, ensuring a smooth inheritance process, and reducing estate taxes.